The bailout from the International Monetary Fund (IMF) is a big positive for growth and will likely help Pakistan avert a near-term default, reported Bloomberg.

South Asia Economist for Bloomberg Economics Ankur Shukla said in a note that the aid will take pressure off the State Bank of Pakistan (SBP) to raise rates further to keep the country’s FX reserves from running out.

The aid package, which still requires final sign-off from the IMF board, would boost growth by easing dollar shortages and allowing for the purchase of key imported supplies. The higher taxes and other concessions made to secure the aid will depress demand, but this will likely be outweighed by the benefits. Overall, the loans will likely be a big boost to growth.

“We expect GDP to expand 2.5% in fiscal 2024, up from just 0.3% in the year through June 2023,” he said, further estimating inflation to average 21 percent in the year started from July, down from 29 percent in fiscal 2023. “Lower commodity prices and softening demand will likely more than offset the upside price pressures arising from a weaker rupee and tax increases,” he added.

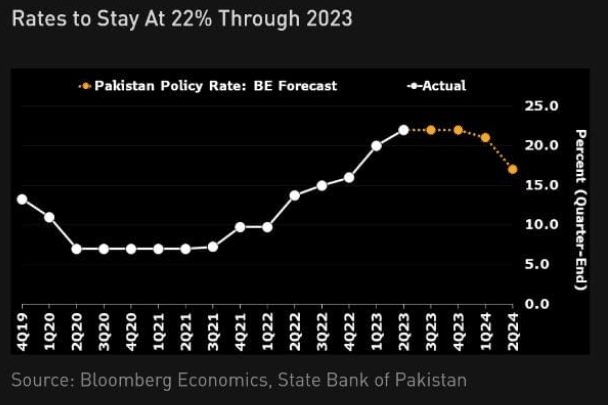

Shukla noted that the SBP might keep its key rate at 22 percent through the end of 2023 and start cutting in 1Q24. The new short-term IMF program will likely keep the government fiscally disciplined (in line with the approved fiscal 2024 budget) until elections in October.

The IMF would be likely to suspend the program if the government fails to deliver on its targets for generating a primary budget surplus. “We don’t expect this to happen, but it would raise the risk of default again,” the economist added.

Growth is expected to accelerate in fiscal 2024. Meanwhile, dollar inflows from friendly countries, following aid from the IMF, will shore up dollar reserves. This, along with the recent removal of import restrictions by the central bank, means more purchases of raw materials which should increase production.

The economist asserted that a lower year-earlier base will also help prop up growth. “Even so, headwinds will limit the pace of recovery. Higher-income taxes and elevated inflation will reduce consumer spending power. Record-high interest rates will likely dampen private credit and investment,” he noted.

“The SBP has raised rates by 600 basis points to 22% this year. We don’t think that the SBP will raise rates further, especially now that the IMF appears very likely to deliver aid,” Shukla opined.

The primary aim of the central bank’s hikes was to squeeze demand for imports and thereby protect scant dollar reserves. The IMF aid — along with assistance from friendly countries should boost the reserves. The urgent need to choke demand should be gone now, he explained.

Meanwhile, inflation is also set to cool ahead. The rates are already positive on a 12-month forward-looking basis.

The economist concluded by suggesting that further hikes will hit growth that’s already weak. “We think the SBP will start cutting rates in 1Q24 as inflation cools quickly,” he stated.