The Pakistani rupee reported big gains against the US Dollar during intraday trade today after opening trade at 271 in the interbank market.

At 10 AM, it gained over Rs. 11 or roughly 4 percent against the greenback, rising to 274.98.

At 10:12 AM, it was trading at 274.2 against the dollar after initially staying at 277.77 for the first 5 minutes of trade.

The rupee was bullish between 9:30 AM and 10:15 AM with the interbank rate rising by ~5 percent or Rs. 14.9 and staying on that level. This is the highest PKR recovery since 12 May 2023 when the local unit gained Rs. 13.85 or 4.87 percent against USD before intraday movement was suspended.

Rupee gains against the USD, up PKR 10.55 in the interbank

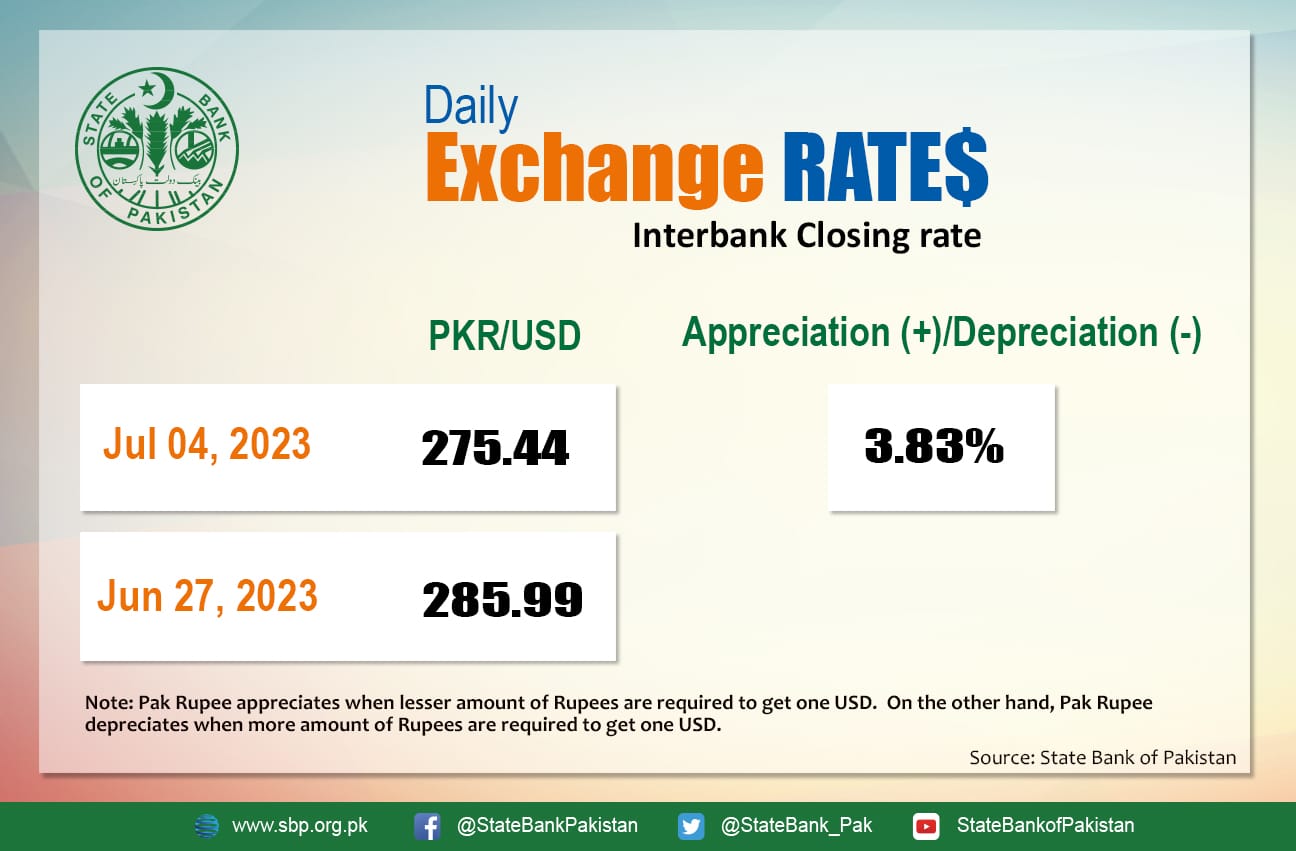

Rupee gains by PKR 10.55 (+3.83%) against the USD, closed at 275.44. This is the highest DoD recovery after 12 May 2023 (PKR 13.85 or 4.86%).@StateBank_Pak#SBP #Pakistan #Economy #AHL pic.twitter.com/WV0SYwEb2C

— Arif Habib Limited (@ArifHabibLtd) July 4, 2023

Open market rates across multiple currency counters gained over Rs. 15 to as high as 279 with further improvements expected before the day’s closing.

At close, the PKR appreciated by 3.83 percent to close at 275.44 after gaining Rs. 10.55 against the dollar today.

Dollar trade has turned a new leaf almost everywhere as traders reap a larger impact before close today. Indicators appear to be justified with further recovery expected in the days to come. Industry experts opine that the market remains volatile to IMF news and this feature may outlast July but with smaller gains than today’s showing.

The informal exchange rate has recovered massively and at 11:30 AM rose to the 281 level in response to the $3 billion bailout agreement with the IMF.

Today’s cash rate per dollar in Hundi fell below 285 to as low as 283, while many channels reported rates from 288 to as low as 295.

One trader told ProPakistani that the interbank volume will remain in the green for the current week as daily digital transactions average roughly above $3-5 million. For now, cash counters have normalized movement to surprisingly welcome sellers’ pressure but reports on Hundi/Hawala exchange margins in the next couple of hours could improve things substantially, he added.

According to a Bloomberg market snapshot, Pakistan’s growth is expected to accelerate in fiscal 2024. Meanwhile, dollar inflows from friendly countries, following aid from the IMF, will shore up dollar reserves. This, along with the recent removal of import restrictions by the central bank, means more purchases of raw materials which should increase production, and hence, revive the PKR to higher levels against the greenback.

The PKR was bullish against all of the other major currencies in the interbank market today. It gained Rs. 2.81 against the Saudi Riyal (SAR), Rs. 2.87 against the UAE Dirham (AED), and Rs. 14.4 against the Pound Sterling (GBP).

Moreover, it gained Rs. 7.79 against the Australian Dollar (AUD), Rs. 9.8 against the Canadian Dollar (CAD), and Rs. 12.78 against the Euro (EUR) in today’s interbank currency market.