Pakistan’s cotton crop has shown a remarkable start this year with a record arrival of 1.42 million bales as of July while the overall production is estimated to rise above 12 million bales.

It will be the first time since 2018-19 that the production will cross the 10 million mark after reducing 65 percent in 2022-23 since the high of 2014-15.

The positive recovery in production has been attributed to a 34 percent increase in sowing and favorable weather conditions that supported the growth instead of harming the crop. But at the same time, the growers and ginners are struggling to get the full benefit of the growth so far because of multiple reasons.

The government announced the support price of Rs. 8,500 per kg for seed cotton (phutti) in March but has failed to ensure compliance for multiple factors that we will get into later. However, last month, cotton spot prices dropped by nearly 20 percent in a matter of weeks while in scattered markets across Punjab and Sindh, it was selling at up to Rs. 2,000 less than the support price.

In order to address the growers’ woes, last month, the government decided to purchase one million bales through the Trading Corporation of Pakistan to provide support to farmers and largely stabilize the prices.

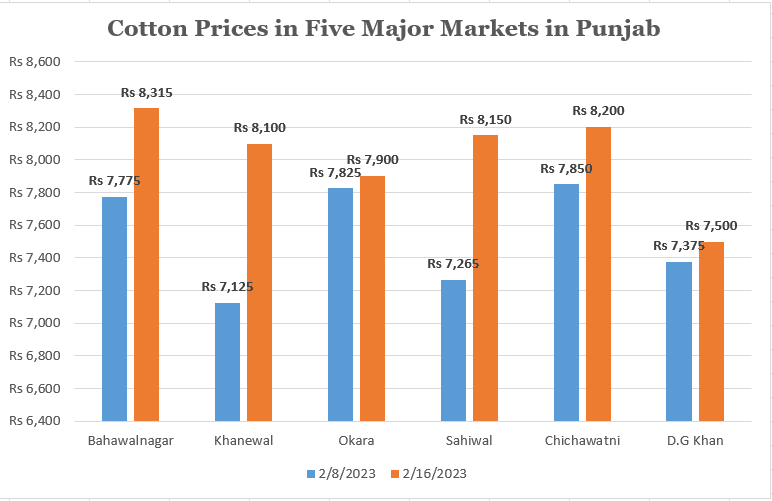

The move has apparently worked as prices in five major markets across Punjab have increased by up to 12 percent during the last two weeks due to the shifting market sentiment according to the data gathered by ProPakistani. Spot prices by Karachi Cotton Association (KCA) have also recovered and stabilized at Rs. 19,543 as of today from Rs. 17,683 during early July.

This is encouraging for the growers as high spot prices of cotton, nearing Rs. 22,000 per maund, during the past two years were the primary reason for farmers returning towards this legacy crop from alternatives like maize and sugarcane. That high demand was spurred by the record activity in the textile sector post-Covid as local industry resumed production earlier than regional competitors and received financial support from the State Bank of Pakistan as well.

The current positive outlook can also be attributed to the IMF stand-by agreement that also resulted in dollar inflows from friendly countries that raised both the stock market and hope of economic revival among the stakeholders.

But it also needs to be remembered that the factors that caused the last month’s crash in the cotton market are still there so despite the recent increase in prices, growers may not receive a substantial relief in the long run. That’s the reason the prices in major markets across Punjab are still lower than the support price promised by the government.

The prices fell as cotton ginners protested against the hefty sales tax notices served by the Federal Board of Revenue (FBR) by shutting down the factories due to which overall prices for seed cotton fell drastically. The ginners, ProPakistani talked to, claimed that notices in some circumstances were higher than the total worth of factories so they are unable to pay even if they sell the factories.

“The government imposed nearly 17 percent sales tax on cottonseed and cottonseed oil cake through Finance (Supplementary) Act 2022 and despite continuous promises over the last year and a half, the concerns of ginners are still unaddressed,” said Waheed Arshad, Chairman, Pakistan Cotton Ginners Association (PCGA) while talking to ProPakistani.

He added that they had conveyed the implications of this to the government including the fact that it will result in ginners either shutting down operations or operating without invoice. He also added that this whole supply chain contributes significantly to revenue generation which will be lost as a result of these measures.

On the other hand, textile exports shrunk by nearly 15 percent in FY23 and around 30 percent of textile mills have shut down according to media reports during the past year and a half. All due to a back-breaking balance of payment of crisis that resulted in import curbs on raw materials and machinery and has prevented the government from addressing the sector’s energy issues.

Another factor that indicates the potential shallow recovery of cotton prices is the economic conditions in the export markets, especially in China where the latest economic numbers released on Tuesday highlighted a slower-than-expected industrial output and post-Covid rebound of the economy rapidly losing steam.

Moreover, cotton from South Punjab and Balochistan has also already started to arrive in the markets and due to this increased supply, traders are also not expecting much of an increase in prices in upcoming weeks.

All in all, the current positive outlook of record production and a rise in cotton prices is promising but the underlying issues of ginners and textile millers are still there. Ginners argue that while APTMA and cotton growers are still sometimes heard by the government, their problems are mostly overlooked. Lastly, the structural economic reforms which were expected as the result of the IMF agreement are still nowhere to be seen so it may not be surprising if we end up at another crossroads in a few months.