Pakistan’s leading fintech and a prominent embedded finance platform, Neem has unveiled an all-encompassing payments infrastructure tailored to empower digital enterprises and brands in Pakistan.

This initiative aims to equip digital platforms with the tools to offer customized financial services to their clientele. The development comes on the heels of Neem’s recent announcement of a $1 million strategic investment partnership with South African enterprise DNI Group to promote comprehensive financial well-being among underserved communities and businesses across emerging markets.

“Our goal is to address the existing financial wellness gap in Pakistan, and we are doing so by enabling digital businesses to leverage the power of embedded finance. It’s all about banking with one platform,” stated Nadeem Shaikh and Naeem Zamindar, two of the co-founders of Neem talking to ProPakistani

He added that Neem’s payments infrastructure equips businesses and platforms to expand their reach into underserved communities, create novel revenue streams centered around financial services, and reduce their operational overheads.

“Developed in collaboration with financial services players such as BPC, Mastercard, Idemia, Unikrew, PayFast, and JS Bank, Neem’s embedded payments solution is now catering to a wide spectrum of sectors, including agriculture, utilities, e-commerce, MSMEs, and gaming. With the potential to enhance financial wellness for approximately 120 million underserved Pakistanis.” added the press release issued by Neem.

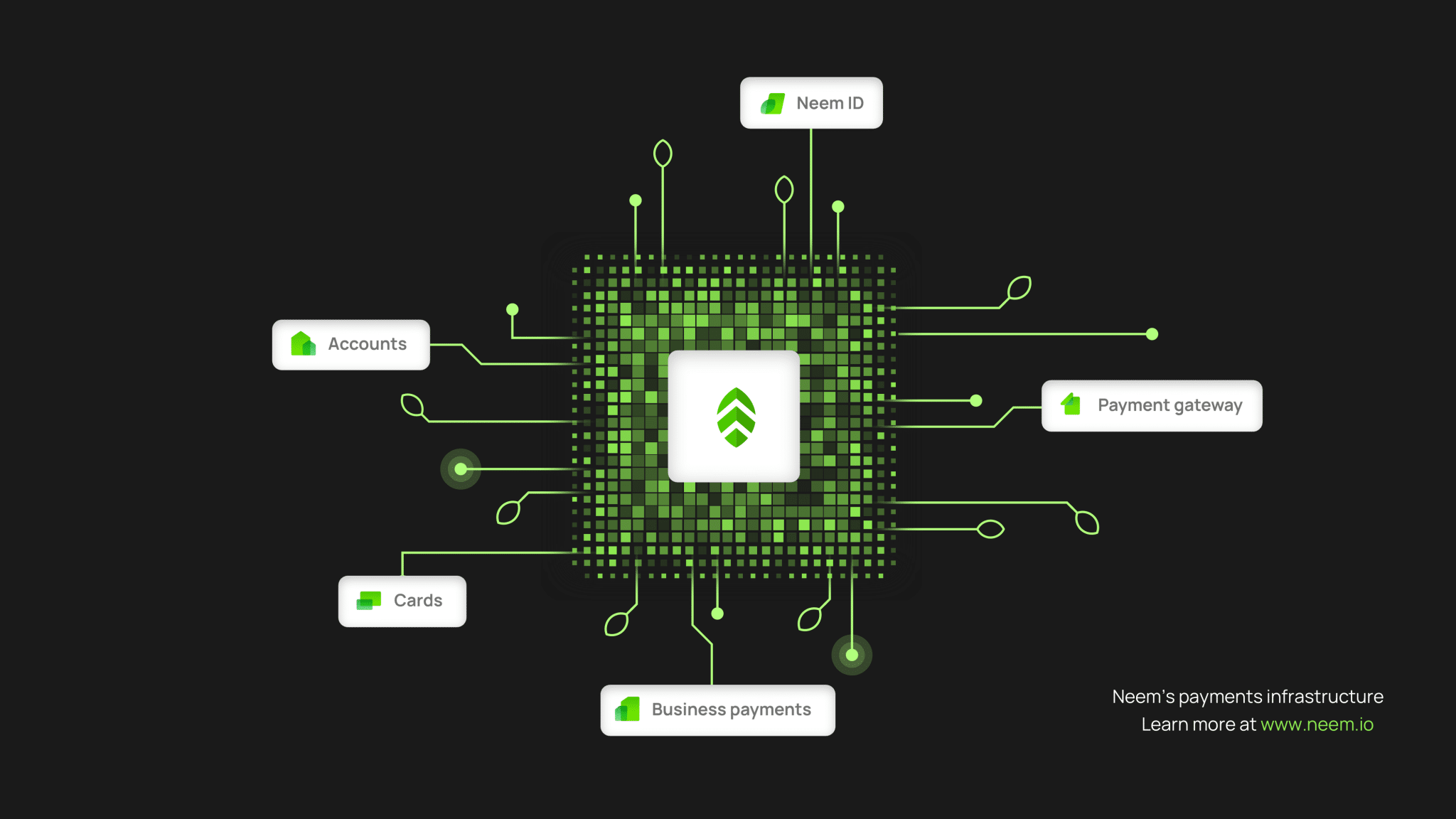

Neem’s Banking-as-a-Service (BaaS) solution will allow digital platforms to effortlessly integrate financial services like accounts, cards, payment gateways, and more using APIs and SDKs. While Neem will handle complex details like compliance and partnerships, enabling digital businesses to prioritize their customers.

Over the past decade, Pakistan has witnessed a significant digital transformation across various sectors, including retail, logistics, agriculture, mobility, and more. This digitization trend is gathering momentum, with new digital enterprises springing up daily. However, the fragmented payment landscape is still prevalent in Pakistan

Pakistan has been witnessing an increase digitization of businesses for the past few years driven primarily by technology penetration and the high cost of brick-and-mortar stores. However, despite this progress, digital businesses in Pakistan face substantial costs when it comes to providing financial services to their users, primarily due to the fragmented nature of the payment system, especially in the realm of revenue collection.

Founded in 2019 by Naeem Zamindar, Vladimira Briestenska and Nadeem Shaikh, Neem has raised commutatively raised $3.5 million since its inception.

“The current infrastructure available to digital businesses often requires that they become payment experts, diverting their focus from their core business and many digital businesses suffer from a lack of embedded solutions to collect and disburse payments” stated co-founder of Neem, Vladimira Briestenska talking to ProPakistani.

She added that often, the journey requires the end user to leave the platform and make the payment through a third party. This results in poor user experiences and abandoned journeys. It also leads to reconciliation issues across multiple payment methods, integration and maintenance costs across multiple solutions and generally higher business costs.

Digital businesses in Pakistan can expand their user base, reduce operational costs, and enhance their revenues by offering and monetizing financial services. To realize this potential, what is needed is a plug-and-play embedded payments solution, one that creates a win-win scenario benefiting both financially underserved communities and digital businesses in Pakistan.

As a part of its embedded payments offering, Neem has introduced a distinctive feature called Neem ID. This feature bestows upon users of any digital platform exclusive access to the Neem ecosystem, empowering them to establish or link bank accounts, wallets, and cards for a more streamlined payment experience across multiple digital businesses.

Once the customer creates a Neem ID with one digital platform, they will be able to leverage this ID with other digital businesses within the Neem ecosystem. Vladimira added that they are PCI DSS compliant and have multi-layer firewalls, Auth 2.0 tokenization and third-party pentest certification all of which ensure the protection of user data.

How It’s Responding to Global Fintech Downturn?

Fintechs have been at the forefront globally in suffering the brunt of global interest rate hikes and limited product offerings against legacy FIs who make money from deposits, insurance, credit cards and mortgages.

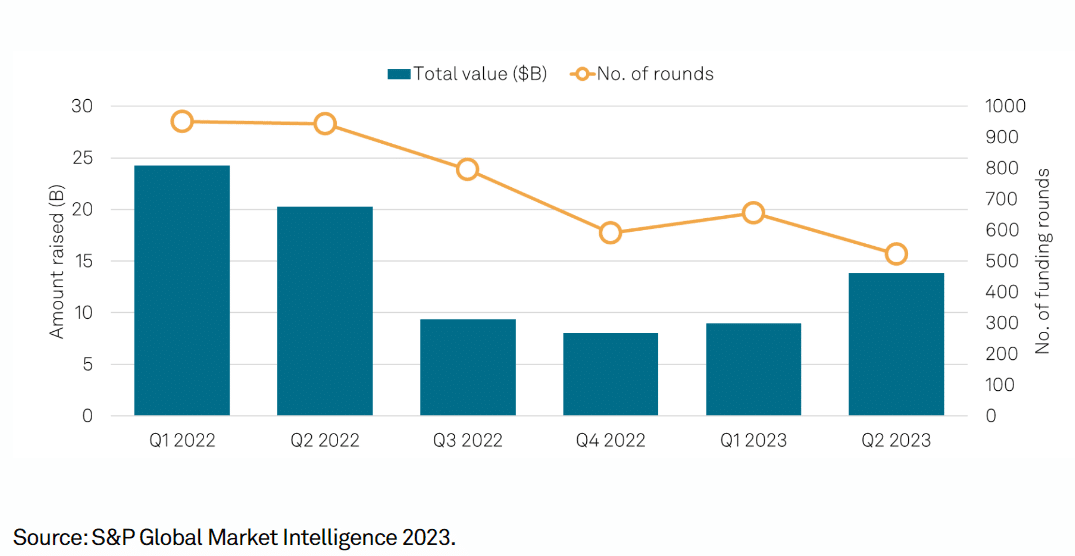

S&P Global Market Intelligence reported that global venture funding in fintechs shrunk by more than half to $23 billion during H12023 compared to $49 billion during H12022 with a more significant decline of 64% decrease in deal count. The mid-March collapse of Silicon Valley Bank exacerbated this decline, with only 522 rounds in Q2 2023, making it the slowest quarter in over 2.5 years.

While the deal count is still declining, the aggregate value has rebounded in Q2 2023 which can primarily be attributed to VCs showing extra faith in new technologies like Artificial Intelligence in adding more value to the overall ecosystem.

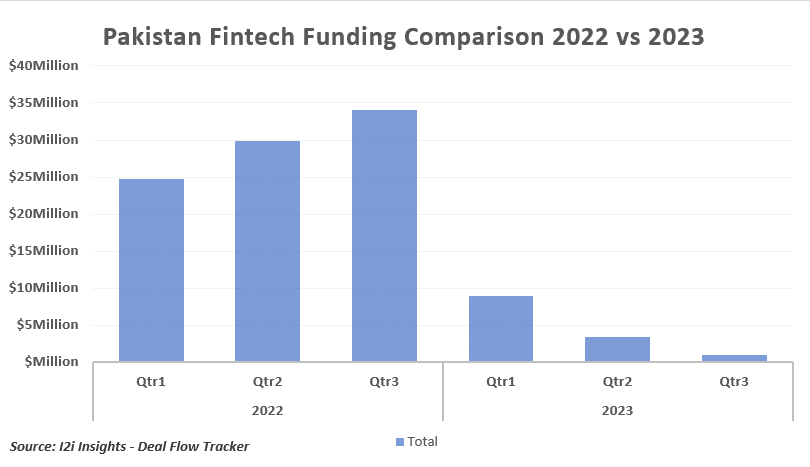

Pakistan’s Startup funding also witnessed its worst quarter from Apr-Jun 2023 since Q1 2020 with just $5.2 million raised while the Fintech funding has also reduced by nearly 90 percent from $89 million during Jan-Sep 2022 to a mere $13 million in the same period during 2023.

As the era of cheap money of last decade and the Pandemic Era has ended with record-high interest rates and with Federal Reserves’ recent hints to have it for longer than expected, experts have taken no time to highlight the limited offerings and more limited revenue streams as the more fundamental problem for fintechs to focus on than the actual lack of funding.

Fintechs both globally and locally will have to adapt to these evolving circumstances by putting technology back at their core and expanding their product portfolio in order to thrive. The good thing for fintechs is that their demand and value prepositions are not going anywhere. In fact, it can be considered one of the most fundamental verticals after artificial intelligence in terms of its broad applications in nearly all other sectors.

The future of fintech lies in more and more financial services being offered and integrated within websites and apps one does not usually use for financial activities and that’s what all-embedded finance is about. One can leverage their ride-sharing app not only to provide their service but also to have hassle-free in-app payment deposits and withdrawals of their earning.

E-learning platforms can extend their services to include convenient course payments, educational financing and child savings accounts. Similarly, marketplace apps can offer secure payment processing, escrow services, and seller financing, making them comprehensive platforms for buying and selling. It will not only provide fintechs with additional revenue streams but also more people will be able to access financial services tailored to their needs and that’s the road to financial inclusion.

“We’re developing Neem with a strong grasp of the financial services sector, considering the unique dynamics of emerging markets and their macroeconomics. As a result, our revenue model is multifaceted” added Vladimira.

When asked about Neem’s revenue sources, she said that they include interchange fees, float, and a percentage of payment transaction fees. She added that they also generate income through platform revenues, including subscription and integration fees and earn revenue shares through partnerships with specialized fintech players, particularly in lending, insurance, and other financial services.

Talking about expected use cases of Neem’s offerings in digital businesses, she said that they have completed their pilots and are in the final stages of going live with multiple businesses and all will be announced in due course.