Textile export subsidies are back on the debate table as the Ministry of Commerce presses the Special Investment Facilitation Council (SIFC) for fresh incentives amidst plummeting exports, surging interest rates, and soaring energy prices.

Led by a textile veteran, Gohar Ijaz, the ministry reportedly proposed some significant incentives for exporters last week including preferential cost-based electricity tariff, deferral of principal and interest payments on loans and restoration of a no-sales tax payment scheme.

It has also proposed priority allocation of gas to exporters, settlement of Rs. 24 billion duty drawback claims of exporters and instruction to banks to enhance financing credit limits for the export industry by 100 percent.

Critics argue and it’s pretty much a fact that the preferred financing for the textile sector has been misused and abused in the past for even buying real estate of all things. What is to say that nearly doubling the financing credit limits for the industry will not end up in the same place?

This is especially true since the industry is still dodging the recent debate about the alleged misuse of the $3 billion TERF disbursement. After PAC shelved the case in July, as per the last update, the NAB is still looking into it. But putting that aside, we all like all that. Make someone a devil, put everything on them and be done with it. That’s easy.

But what’s a little hard is to weigh the pros and cons of all the policies, find where they went wrong and improve on them for the long term.

Did Export Subsidies Work?

World Bank 2022 Country Economic Memorandum noted that distortions in export subsidies contributed to the misallocation of resources, reflecting a political economy dynamic favoring what the World Bank called ‘insiders.’ Design flaws in export subsidies, like DDT and DLTL, reflect lobbying dynamics, discouraging diversification and favoring existing exporters.

The Duty Drawbacks on Taxes or DDT is an active export promotion policy applying to 54 percent of textile products, accounting for 78 percent of textile exports in terms of value.

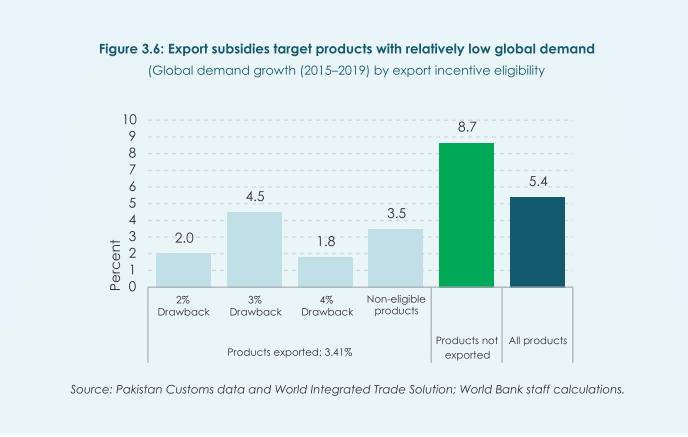

The scheme was found not cost-effective, lacking consistency in product eligibility criteria concerning export growth and having a low impact in boosting textile exports by only 1.8 percent but costing taxpayers between 46 and 76 cents for each additional US dollar exported.

“It’s true that schemes like DDT are not effective, but the whole narrative is shaped as if the export sector is in cahoots with the government to get these incentives—this is not the case” stated Syed Absar Ali, International Trade and Finance Economist while talking to ProPakistani.

He clarified that DDT is not effective because of the poor policy design as it’s an ex-post measure and exporters don’t know how much they will get back. He also noted that high inflation and interest rates coupled with delays in refunds can lead to a 55 percent loss in purchasing power.

He also revealed that 50 percent of the refund is unconditional but the rest is contingent on export performance which has been a tough gig given the incredibly volatile macroeconomy and general bias against open and free market policies.

“Schemes like LTFF and EFS have facilitated a lot of investment in export sectors, but this investment is rendered useless by poor policies in other sectors that prevent the investment from generating returns” added Ali.

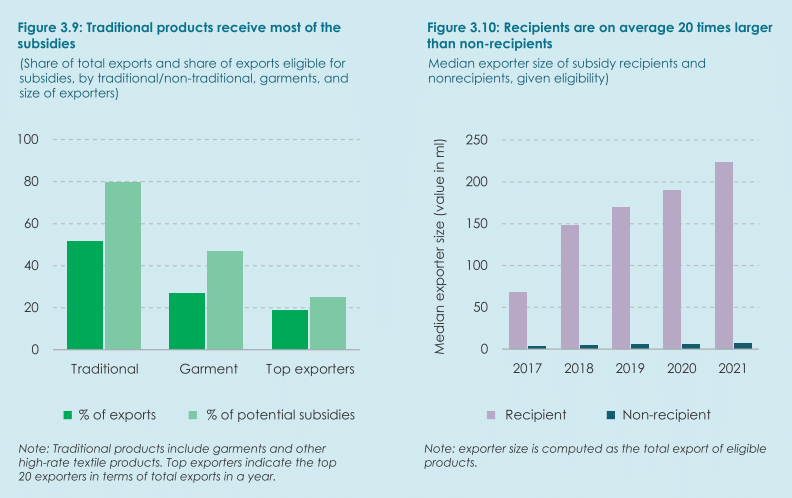

World Bank report noted that export promotion subsidies (EFS, LTFF, DLTL etc.) disproportionately reward traditional over new products, limiting the entry of exporters focused on product innovation. Traditional products contributed 50 percent to total exports and received 80 percent of export subsidies, indicating a bias against diversification.

A traditional and well-established exporter was found 80 percent more likely to be eligible for an export subsidy than someone trying to innovate and trying to export something new because these policies prefer those other unsophisticated products that can provide a 30-35 percent boost in profits in some sectors.

The report highlighted that subsidies favored products with low global demand, especially those with higher rebate rates. These rates often apply to less-sophisticated and well-established products, discouraging entry into new export markets.

This limits innovation for exporters and creates barriers, including registration costs and access challenges to essential inputs like a stable electricity supply. Consequently, it reduces the number of new firms, concentrating production among larger entities and allowing less productive businesses to survive, ultimately leading to a shrinkage of the production possibilities frontier and a higher prevalence of larger firms.

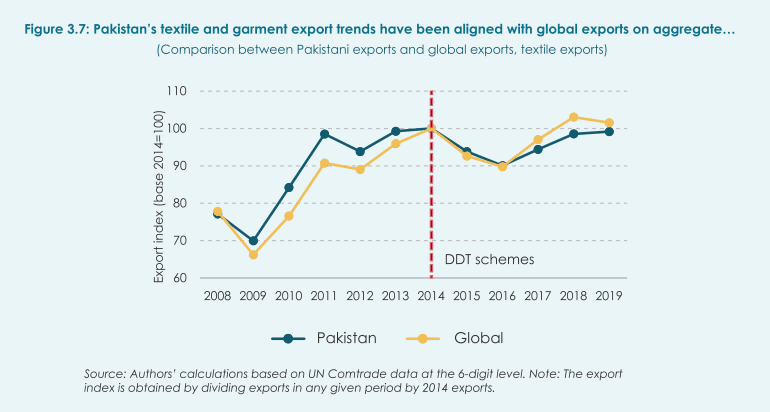

It also stated that despite these subsidies, Pakistan’s exports have remained aligned with global export trends on aggregate. The take-up of subsidies benefits larger insiders with the average recipient being 20 times larger than the non-recipient at the expense of smaller outsiders. Firms eligible for subsidies and receiving them are significantly larger than those eligible but not receiving them.

Ali said that duty drawbacks and financing alone cannot achieve diversification as it also needs better macroeconomics, investments in infrastructure, human capital, conducive trade policy and long-term vision and while LTFF did achieve investments in value addition and diversification, the business environment to yield returns is not available.

He also referred to Bangladesh’s export incentives stating how established sectors and diversifications both need investments and added that larger firms are supposed to take up more share of the loans given how banks evaluate the borrower’s ability to pay it back.

Did Textile Exports Increase Or Not?

Pakistan’s Textile Exports hit an all-time high of $19.32 billion in FY22, reporting a nearly 54 percent increase in dollar terms within two years but dropped 15 percent next year when a multitude of economic crises took away the momentum. The increase was largely attributed to the Temporary Economic Refinance Facility introduced during COVID-19 and the effects of other export incentives kicking in but data tells a different story.

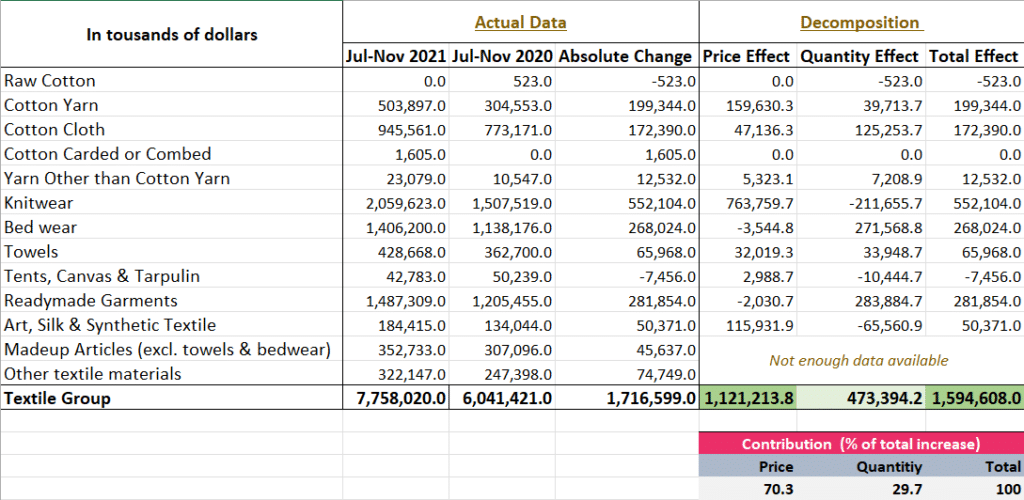

Economic Advisory Group, an independent think tank, noted in its December 2021 report that nearly 70 percent of the increase in dollar value of exports at that time was contributed by the rise in international prices that more than doubled during that time. “The analysis showed that, out of the $1.7 billion increase in textile exports during July-Nov 2021, more than two-thirds is simply due to an increase in international prices.” noted the report.

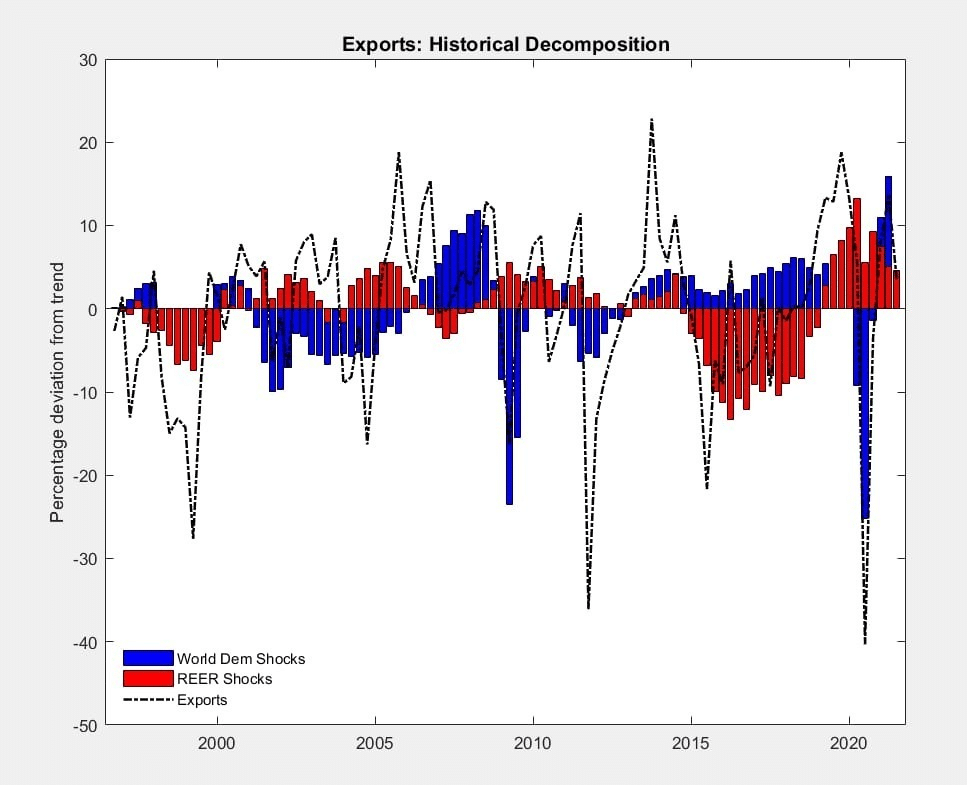

Factors driving the quantity of exports can be seen in the below table. The black line is actual data on the number of exports plotted in terms of percentage deviation from the trend. For example, a value of minus 10 means that exports are 10% below their trend level. The color bars plot the effect of the real exchange rate (red) and world demand (blue). The last period in the sample is Q4FY21.

In other words, had international prices remained the same as last year, the dollar value of textile exports would have increased by only 7.8 percent. The report also claimed that most of the slowdown in the number of exports between 2015-18 and the subsequent increase since 2018 is explained by changes in the Real Effective Exchange Rate (REER) (red bars in the figure above).

Subsequently, if we take that as a valid reason then the recent decline in exports can also be attributed to the nearly 40 percent drop in US Cotton Futures since Jan 2022. This would have meant that the whole talk about subsidies finally yielding their positive effect and being a primary contributor to the increase would not make any sense.

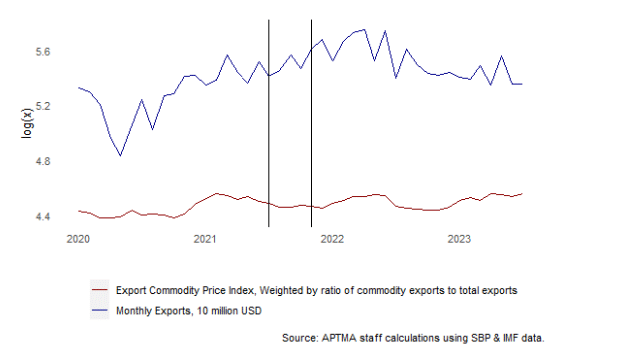

“This is simply not true. Between July and November 2021, the prices of Pakistani exports fell (explained in the figure below). REER is a real indicator and can’t be used to support nominal (i.e., price-related) inferences.” Ali disagreed saying that the graphs show an improvement on the real side of the economy, which improved the REAL effective exchange rate, which drove an increase in exports (again, a real indicator).

In the below chart shared by Ali, two vertical lines are July and November 2021 in which export prices can be seen to go down, but exports are still going up.

Moving along, the demand for increasing credit limits can be understood given that the industry is under a severe liquidity crisis with 50 percent of capacity sitting idle since February, persistent delays of over Rs. 300 billion in tax refunds, high interest rates and investments under TERF rendered stagnant due to lack of infrastructure even electricity connections in some cases.

“The industry is not asking for a bailout—even though this would be very much warranted. It’s only asking for credit limits to be increased so factories can at least get running, and the money will be paid back,” added Ali.

Energy Subsidies Are Not Subsidies?

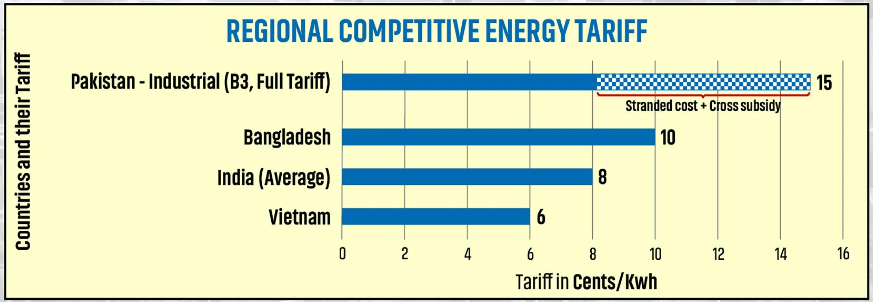

Exporters argued they are paying far more in tariffs against their Indian and Bangladeshi competitors. As per APTMA, electricity tariffs include Rs. 16 per unit of cross-subsidy and while the cost of Regionally Competitive Energy Tariffs is only 3 percent, taking dollar loans costs nearly 10 percent.

APTMA is demanding the removal of cross-subsidies and B2B power contracts at 1.5 cents/kWh wheeling charges. Though media reports also cited the demand for a separate 1,200MW power plant, however, that could not be verified by independent sources.

According to the Pakistan Credit Rating Agency, energy accounts for 8 percent to 13 percent of the total input costs but recent hikes must have increased that share. The power tariff structure reveals a substantial gap between generation and transmission costs and what the government charges the industry.

This extends to a significant disparity between charges for industrial/commercial and residential/agricultural consumers. The government’s imposition of high power tariffs extracts funds from export sectors, acting as a subsidy for non-productive sectors and covering inefficiencies in DISCOs.

Why the government thinks the industry is supposed to pay for the inefficiency of the DISCOs and dinged-up policymaking is beyond the scope of this discussion. Exporters only urge the government to exclude these extraneous charges from export-oriented power tariffs, emphasizing the adverse impact on international trade dynamics.

“We are certain that the proposed incentives do not violate the IMF Stand-by Agreement as stated in the 2023 APTMA Knowledge Brief that the provision of regionally competitive energy tariffs (RCET) for exporters, though labelled an ‘unbudgeted subsidy’ in the SBA, doesn’t inherently violate IMF SBA commitments. If the revenue differential is budgeted, possibly by distributing it across other consumer categories, it aligns with the SBA but may incur significant political and other costs,” added Ali.

In Pakistan, some industries have received strong protectionist policies i.e., cement, fertilizers, sugar, steel, and automobiles with import restrictions while some others have never been touched i.e., real estate. That has created a kind of negative incentive for textiles. We as a country need a larger reality check in terms of policymaking of what industries we like to have as our strengths.

Now I wish I had the space to talk about Bangladesh’s model and the need for organic cotton and traceability but that’s the story of another day. But the point is, that industry can not be blamed alone if the government makes a policy and regulators are found sleeping on the wheels. It’s not the exporters’ job alone to come up with a policy but since I don’t think the government has any better plans, it can at least discuss the policies in the open domain so the mistakes of the past may not be repeated.

The purpose of the present proposals should not be to introduce incentives for the sake of incentives without any long-term policy-making or ensuring the issues highlighted above, at least to make it worthy of all the economic pain that the country and its people are going through.