The Pakistani rupee (PKR) has been one of the hardest-hit currencies globally.

From a low of 105.18 in 2018, it crashed below 300 in 2023 before drawing back a few gains to the current level of 279. The USD/PKR exchange rate has shifted above all moving averages and is likely to shed another 10 percent in the next three months as trends look set for the next threshold at 300, maybe worse.

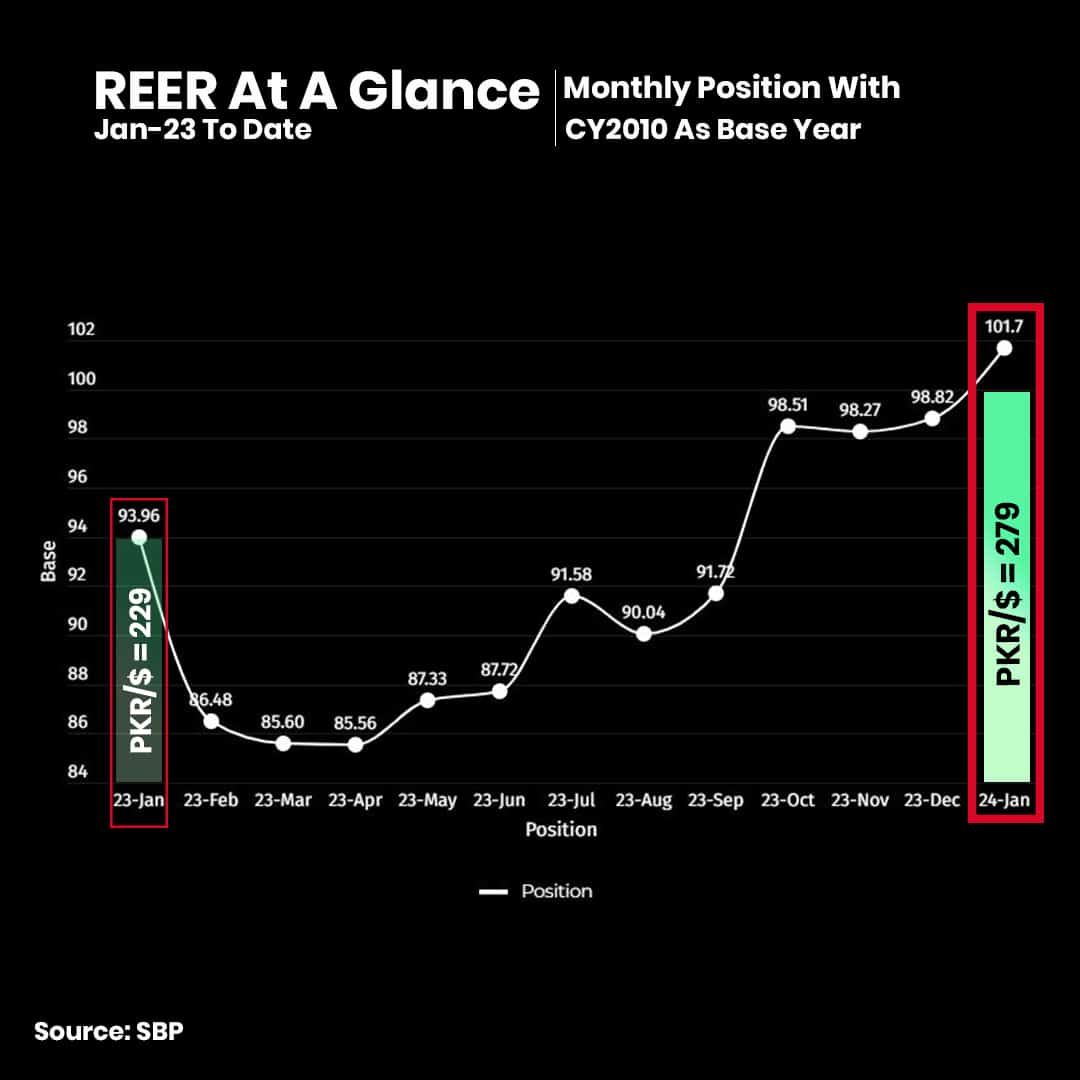

As per SBP’s Real Effective Exchange Rate (REER) index, PKR is now officially overvalued. The latest January 2024 REER index published by the SBP stands at 101.7 vs 98.8 in December 2023, down by roughly 3 percent. Is it significant?

From 105 to 330

In the first 6 months of 2023, before the IMF’s Stand By Agreement (SBA), PKR fell by 21 percent from Rs. 226 to Rs. 286 against the dollar. In the open market, it declined by 19 percent from Rs. 236 to Rs. 290.

When the caretaker government took charge on August 14, 2023, the PKR came further under pressure, falling further by 6 percent from Rs. 288 to Rs. 307 in the interbank market and by 10 percent from Rs. 296 to Rs. 330 against the dollar in the open market by September 04, 2023.

Since then, the rupee has somehow managed to climb back above 280 in the 279 territory, but uncertainty due to election results and no IMF agreement post-SBA expiry next month spells doom.

The REER Science

The rationale behind the REER approach lies in its potential to enhance the competitiveness of Pakistani exports in the global market, at least in theory. By devaluing the currency to a certain extent, Pakistani goods become relatively cheaper for foreign buyers, thereby stimulating demand and increasing export revenues.

While currency devaluation may offer short-term advantages, it also presents challenges, particularly in managing inflation and servicing foreign debt. The risk of exacerbating the debt problem is a concern, especially if monthly fiscal deficits continue to widen and export earnings plummet due to PKR depreciation.

Controlled devaluations for a short period of time could have positive effects on the economy as the market would prefer. By reallocating resources effectively and encouraging growth in export-oriented industries like manufacturing, previous rounds of devaluation have demonstrated the potential for this strategy to yield small benefit. But this doesn’t last long, as history has taught us.

In considering the broader economic strategy, Pakistan needs to weigh the short-term challenges against the long-term gains. While currency devaluation and austerity hurt, enduring these challenges is necessary to safeguard Pakistan’s economic future. It’s a matter of prioritizing the second-round benefits of short-term sacrifices for sustainable growth.

The perspective that leaving economic decisions to the market tends to allow market forces to play a role in shaping Pakistan’s economic policies, is a bit disturbing and has faulty science behind it. This viewpoint suggests that the market is inherently more adept at allocating resources efficiently compared to government intervention. Both have failed so far.

Currency devaluation in Pakistan is a bad recipe for solving economic imbalances and enhancing export competitiveness. A devalued currency is subject to inflationary pressures, which can reduce the purchasing power of the currency very quickly. This can make it more expensive for people/government to buy goods and services and can erode savings, investments, and remittances.

Policymakers must adopt a new and innovative approach that complements PKR stability and encourages monetary reforms to maximize the benefits while mitigating risks. Balancing short-term challenges with long-term objectives will be critical in navigating the economy.

Get a currency board, dear State Bank of Pakistan. You’ve experimented enough.

Note: 165% drop simply shows loss of PKR in percentage. A Rupee decline in dollar terms is different.