Two years ago, journalists exposed betting websites for using surrogate advertising during the 7th and 8th seasons of Pakistan Super League (PSL) teams. One year later, an investigation by the Ministry of Information and Broadcasting (MoIB) verified the claims as valid.

This was followed by a letter addressed to the high-ups of the Pakistan Cricket Board, the Pakistan Electronic Media Regulatory Authority, the PTV Corporation, the Pakistan Business Council, the Pakistan Telecommunications Authority, and the Securities and Exchange Commission of Pakistan.

The letter advised all the stakeholders to avoid doing business with betting companies and immediately terminate their existing agreements with such surrogate companies. In the aftermath, the media industry circulated a narrative that Pakistani advertisers lacked the advertising expenditure (AdEx) to justify investment in the PSL, whether linear or streaming.

“The reality is that the companies that won the linear and streaming rights both failed to transparently provide advertisers with the data that would justify allocation of AdEx,” said Muhammad Ali Rehman, a real estate investor. “The exact opposite is happening this year, which is why even conventional advertisers are flocking to PSL streaming for reach.”

The ROI of data hoarding

In its bid for the 2024-2025 streaming rights, Daraz reported over 368 million views for PSL streaming in 2022, though the average view time was just over a minute. The number indicates that people tuned in large numbers to watch the matches.

“It has been over a year and we have not received a report from Daraz on the effectiveness of our client’s digital AdEx on their streaming service,” said Mikail Alvi, chief media officer of Team Reactivation. “Clients that allocate AdEx to digital expect data and this behavior is discouraging.”

While advertisers can access reach and ratings data from MediaLogic for TV, there is no 3rd party measurement business for measuring, reporting, and verifying (MRV) the reach of streaming services. In that scenario, streaming services that want to attract advertisers are beholden to provide that real-time information themselves, with a transparent dashboard.

“Unilever created SuperSauda in 2020 because Daraz refused to share data and insights on CPG shoppers,” said Rehman. “Daraz applied the same SOP when selling digital ad space for PSL streaming on its app. Unsurprisingly, advertisers that need data to determine such investments, did not go for their pitch.”

Transparency of 2024

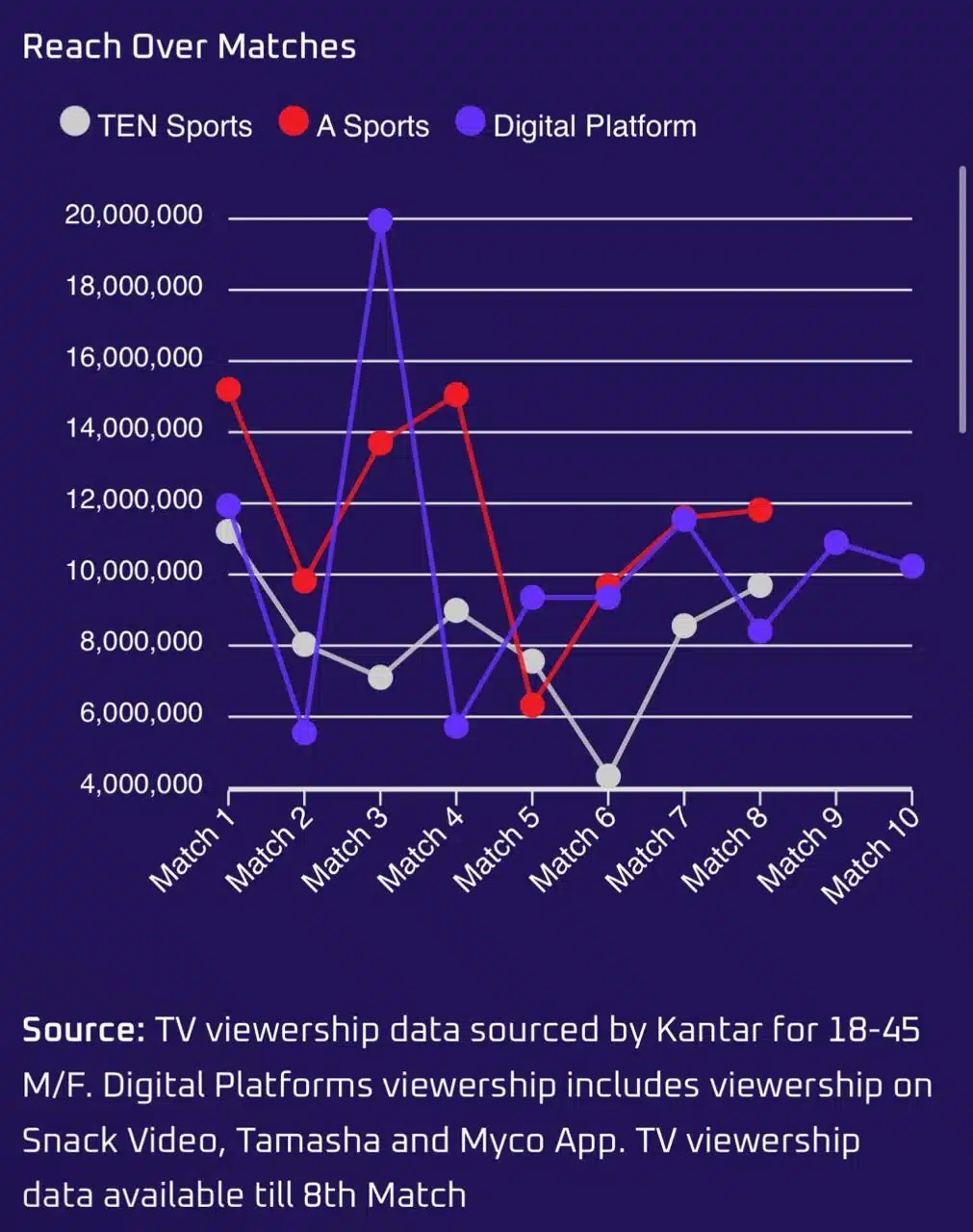

Shortly after Walee Technologies won streaming rights for seasons 9 and 10 of PSL, they secured distribution deals with ad-supported platforms that agreed to be transparent with viewership data. While Tapmad and MHL’s Begin are subscriber-supported for PSL streaming, SnackVideo, Jazz Tamasha, and MyCo are open to advertisers.

Since PSL season 9 started in mid-February, a Walee-vetted data dashboard has been published for public consumption, not just for advertisers.

“Unsurprisingly, this transparency – which is an SOP of companies such as Google and Meta – has flocked advertisers across the spectrum to Walee,” said Alvi. “As the streaming rights winner and the most trusted source of streaming data, Walee has become the principal focus for data-driven advertisers seeking AdEx placement deals across streaming platforms.”

Across SnackVideo, Jazz Tamasha, and MyCo, the streaming advertisers include Spotify, Jazz, Zong, Telenor Pakistan, Coca-Cola, PepsiCo, National Foods, Philip Morris, and many more that target the digital native psychographic or the Generation Z demographic.

Oddly enough, advertisers that feature Gen Z in their advertising and are directed at emerging youth are going for linear and conventional media. These include Unilever, Tapal, Foodpanda, Nestle, Samsung, and Colgate Palmolive to name a few.

“Instead of directing clients to streaming to better reach their actual target audience, media buyers directed them to linear TV where the youth penetration is at an all-time low. Coupling this with the opaque pricing of linear TV helps line the pockets of buyers, whereas digital is inherently transparent.”

Not their first (data) rodeo

As the broker between content creators and advertisers since 2019, Walee has been measuring, reporting, and verifying digital reach numbers for some years now. It is among a handful of start-ups that raised millions during the fundraising boom and has managed to survive amid the funding crunch while scaling up.

While it is unclear if Walee intends to be the MediaLogic of the streaming space, the choice to publicly publish a streaming dashboard has solidified that data transparency can be done, which will be expected as the status quo going forward.

The downside of these developments is they give the PCB room to jack up the price of PSL streaming even further in the next bid cycle. The bid price of PSL streaming rights increased by 175% in 2021 and 113% this year. The latter was won in the first round, with a whopping $7 million bid from Walee, which had only raised $2.7 million three years prior.

“Walee’s overwhelming financial muscle comes from customer success teams across the MENAPT region, including partnerships with agencies such as Havas Red, including closing powerhouses GCC advertisers such as Aston Martin, MBC Group, and STC,” said Alvi. “This is thanks in part to having six ISO certifications, opening doors to a multitude of regional partners and clients.”

This means it is prepared for the PCB to raise the price of PSL’s streaming rights to a number worthy of global recognition. As Pakistan’s national asset, thanks in large part to HBL, the PSL is a point of pride that has a long way to go before it can match its Indian counterpart.

In the last bidding cycle, the Indian Premier League media rights sold for $6 billion, with the lion’s share going for streaming. Advertisers expect that streaming will overtake linear due to trends on both the user behavior side and the advertiser experience side with data transparency.

“We’re putting all our AdEx eggs in the streaming offering because we want to be where the hockey puck will be,” said Rubab Rizvi, chief data scientist at Brainchild. “In the last five years, data consumption has increased five times while broadband subscribers have doubled in the same period, indicating higher accessibility to digital streaming platforms.”

The Big Change in 2024

For fans, 2024 will be remembered as the first time PSL was available ad-free, with Tapmad and Begin. Watch leading the pack. For advertisers, 2024 will be remembered as the beginning of data transparency. At the time of writing this, the Walee PSL streaming dashboard shows

- An average engagement of over 100,000 views on every match

- An average viewing time of more than 19 minutes

With over 140 million views in the first ten matches, this data reflects that this year, viewers’ consumption behavior indicates easy accessibility to streaming content.

Stream comments across AdEx-supported platforms show a positive sentiment for the interactive experience to users allowing users to communicate with each other during the match. This has opened up new opportunities for fans to flex their skills in providing match commentary and post-game analysis.

These changes indicate the status quo for user experience and advertiser experience has been drastically altered, forcing incumbents to adopt these principles of delight.