Are you looking to register your mobile device with PTA and pay the due taxes? If yes, then you have come to the right place. In this article, you’ll learn how to pay your PTA mobile registration tax. So, just stick with us for a few minutes.

First off, a little ‘recent history lesson’. In 2018, PTA launched the DIRBS (Device Identification, Registration and Blocking System) to curb all the risks associated with the illegal use of mobile devices in the country. In order to do so, PTA started blocking the unregistered devices. With that said, if you have a mobile device that is non-compliant with PTA and want to pay the mobile registration tax from the comfort of your home, then read the following instructions and find out how it can be done.

How to Pay Mobile Registration Tax

Before paying the tax, you should check the status of the device with PTA. How to do it? Just send your IMEI number to 8484 and find the status of your device. If your device is compliant with PTA then you don’t have to pay the tax for it.

However, if you want to know more about the mobile registration stuff, then you can check out the article on our website about how to register mobile in PTA (LINK: https://propakistani.pk/how-to/how-to-register-mobile-in-pta/). In that article, you will find all the necessary details you need to know for mobile registration with PTA.

Procedure

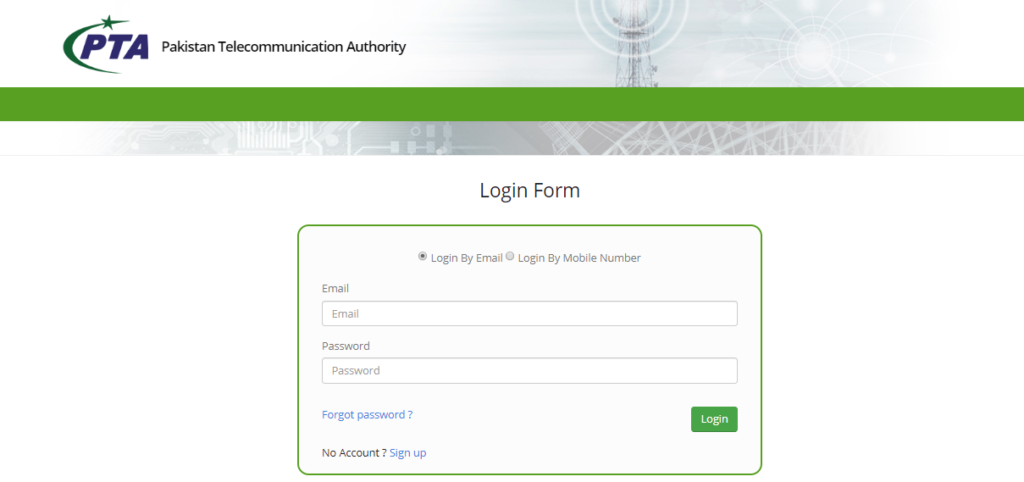

- To pay a mobile registration tax, you have to access this link (https://dirbs.pta.gov.pk/drs/auth/login).

- After opening the link, click on Sign up.

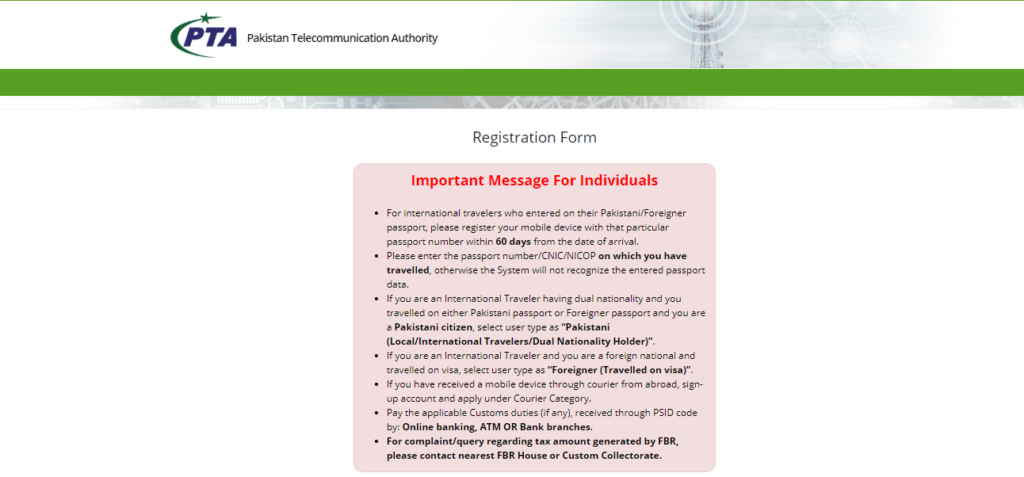

- On the next screen, you will see the important message for individuals notice. Read all the instructions carefully given in the message.

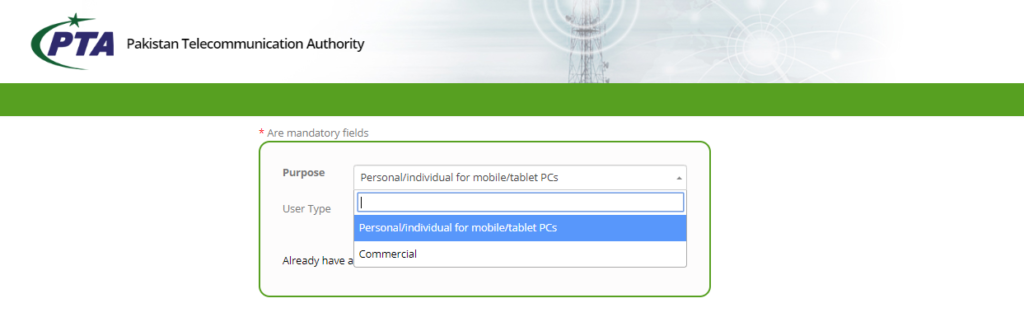

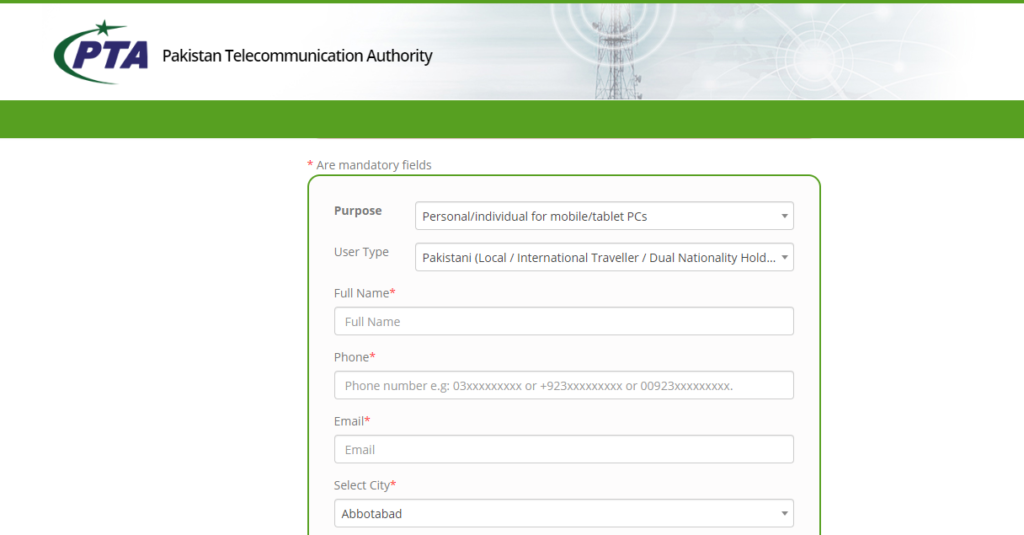

- Right after the message, you will see two mandatory fields, namely, ‘purpose’ and ‘user type.’

- When you click on purpose, you will see two options “personal” and “commercial”.

Note: The commercial option is only for the importers or companies that are registered with FBR.

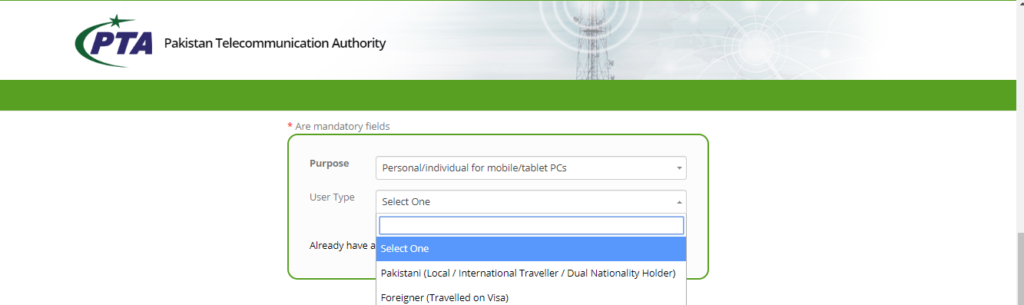

- After selecting the “personal” option, you have to choose the user type as well.

- Again, two options will be given to you, namely, ‘Pakistani’ (local, international traveller, dual national) and ‘Foreigner’. Click on the option of your choosing.

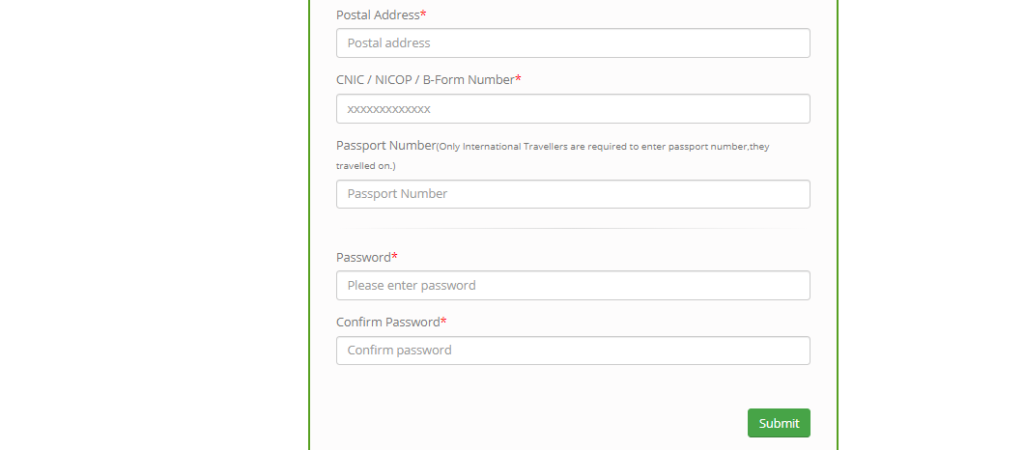

- After that, you have to fill out the form and provide all the details such as your full name, email address, phone number etc.

- Once you’re done with entering the information, click on “Submit”.

- A confirmation, an email will be sent by PTA on your email address.

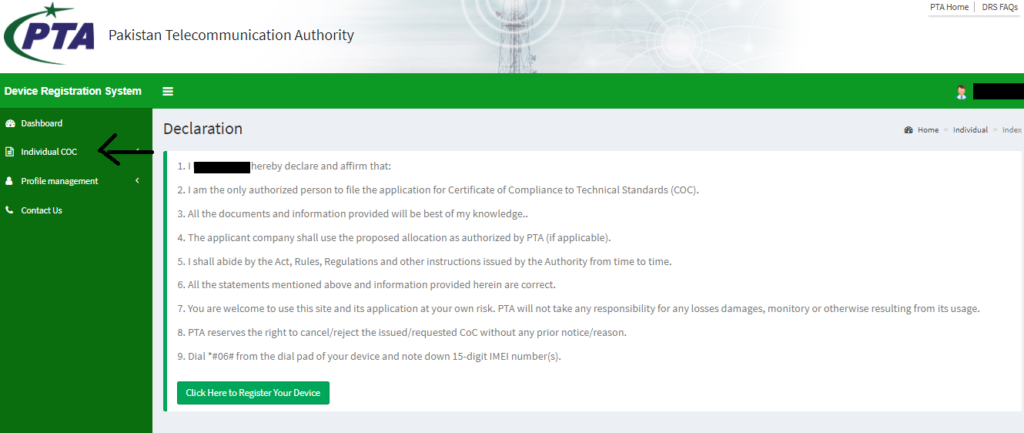

- After confirming your account, you have to type your email address and password to log in.

- When you log in to your account, you will see the individual COC option on the left side of your screen. Click on it.

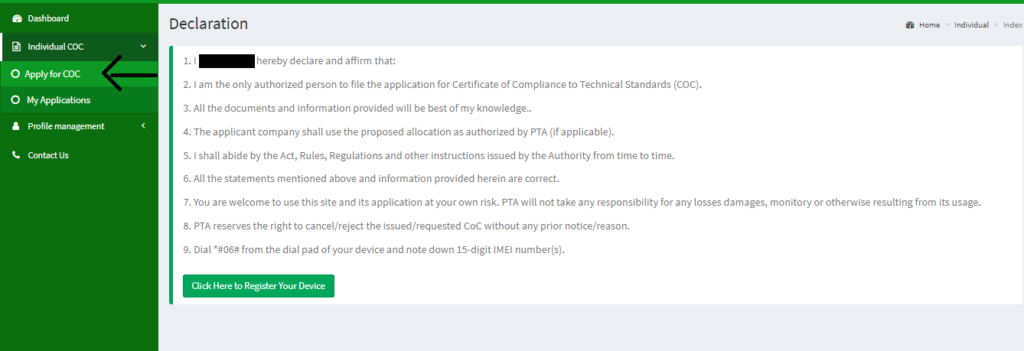

- Now click on Apply for COC.

- Once you click on it, you will see different option given on your screen.

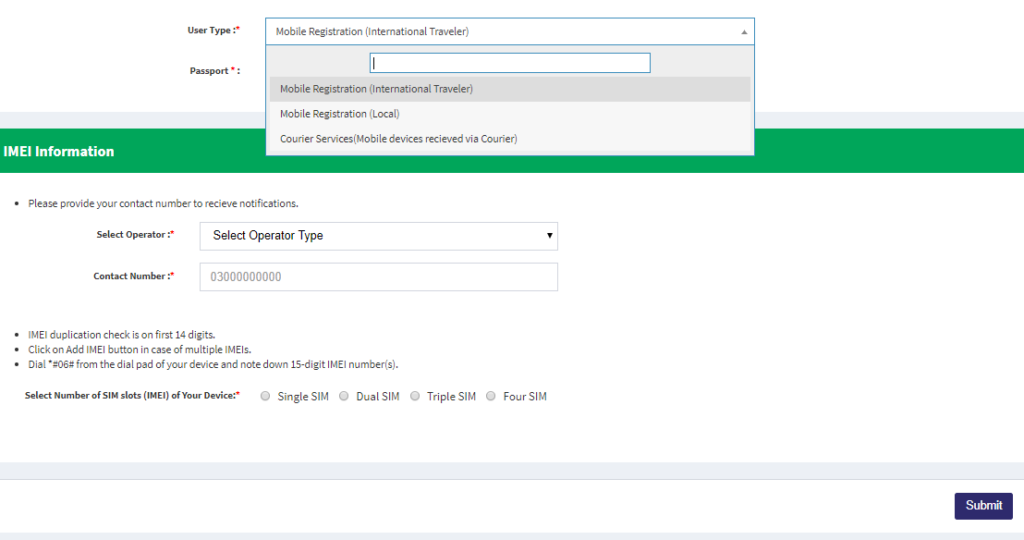

- Select the option that indicates whether you are a local or an international traveller or if you received the mobile phone through a courier service.

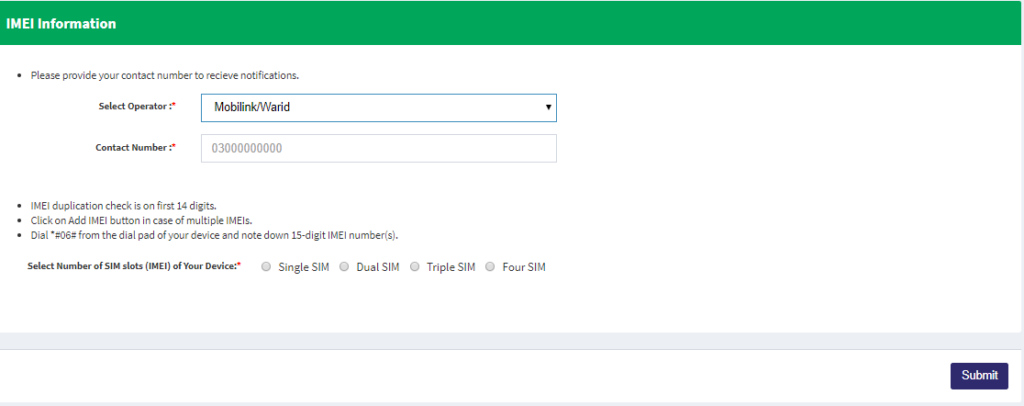

- We assume that you have chosen the local option. In which case, you just need to select your network operator and write your contact number.

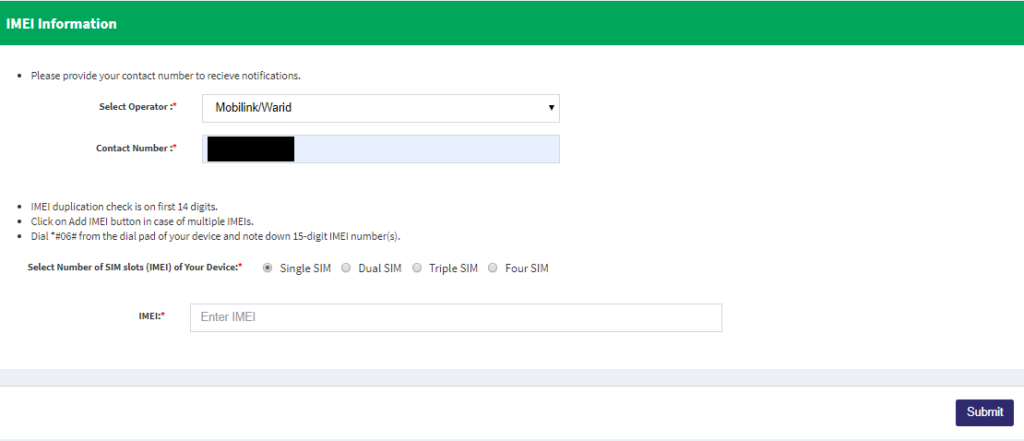

- After that, select the number of slots of your device.

- After selecting mobile slots, you have to write the IMEI of your device. If you have more than one slot, than you have to write IMEI’s for all of them.

Note: You can check your device’s IMEI by dialling *#06#.

- Once you’re done with entering the IMEI, click on “submit”.

- Upon verification of the details, the system will automatically generate the payment Slip ID (PSID) code along with duties and taxes.

- Once that’s done, you can use the PSID code and pay the tax through online banking, mobile wallets, ATM or in the branch of all the major banks like National Bank of Pakistan (NBP), Muslim Commercial Bank (MCB), Allied Bank Limited (ABL) etc.

Note: The Payment slip ID (PSID) is valid for only seven days. After that, the PSID code will expire and you’ll have to apply again for mobile registration.

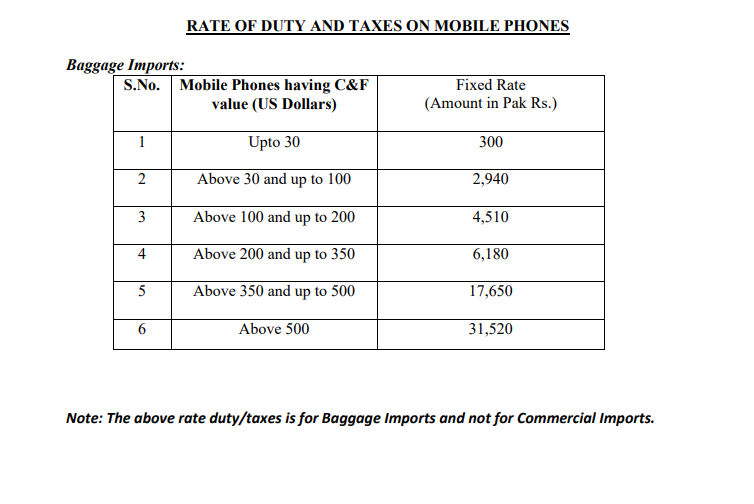

For your convenience, we have attached the image of the tax rate on various mobile phones. See the image given below.

This is the complete procedure of how to pay PTA mobile registration tax. If you have any questions regarding the procedure, feel free to ask in the comments section.