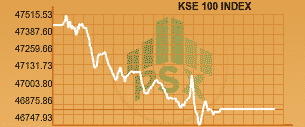

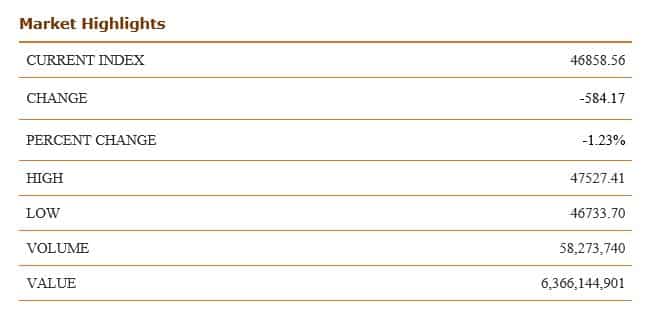

KSE-100 index fell by 584.17 points (1.23%) by the close of Friday’s trading session to reach 46858.56 points.

The 100 Index witnessed profit taking today as well as sharp volatility in the previous sessions.

Oil sector was down by 3.11% which drove the market in negative direction, according to the experts.

The day’s high was reported at 47527.41 points. The day’s lowest of 46733.70 came towards market close.

Overall, 129 million shares were traded. KSE 100 index volumes surged down to 58.27 million shares with a total worth of nearly Rs. 6.36 billion. In short, the volumes were very low today.

Top laggers of the market were HBL, OGDC, PPL, FFC and UBL.

Commercial Banks was the top traded sector with total traded volume of 34,897,800 shares. It was followed by Technology and Communication with a total traded volume of 21,295,000 shares and Power Generation sector with a total traded volume of 12,181,300.

Shares of 320 companies were traded today. At the end of the day, 103 Stocks closed higher, 195 declined while 22 remained unchanged.

Bank of Punjab (R) was the volume leader with 18.60 million shares, losing Rs 0.09 to close at Rs 0.20. It was followed by World Call Telecom with 12.29 million shares, gaining Rs 0.33 to close at Rs 3.55, K-Electric Ltd with 10.14 million shares, gaining Rs 0.11 to close at Rs 7.05 and OGDC with 5.57 million shares, losing Rs 4.96 to close at Rs 140.78.

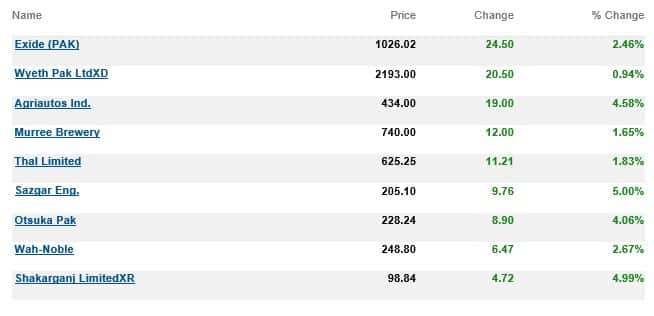

The top advancers of the market were:

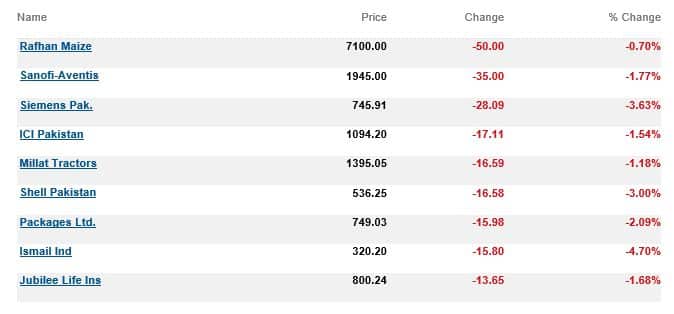

Top decliners of the market were:

Oil prices extended losses after settling lower for a second straight session. Crude oil has been under pressure lately from high global inventories and doubts about OPEC’s ability to implement agreed production cuts. The rise in dollar Index to its highest in more than two weeks also added further pressure on oil prices. It is currently being traded at $44.74 per barrel.