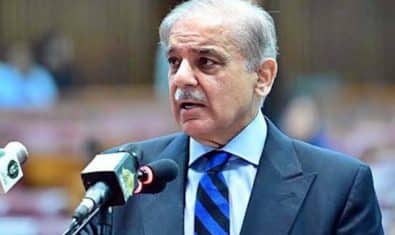

The government has announced several steps that will increase ease of doing business for the taxpayers and curtail the discretionary powers of the tax collectors.

Tax audit of a business involves considerable hassle and cost for the taxpayer, said Finance Minister. There are instances of taxpayers being subjected to multiple audits in successive years.

In order to encourage compliant tax payers, selection for audit in respect of all three taxes; Income Tax, Sales Tax and Federal Excise Duty, has been made risk based and a case shall not be audited more than once in three years for each tax. This limitation will apply to selection of audit by the commissioner as well as FBR.

He further said that the concept of composite audit will also be introduced to ensure that audit of tax affairs under all tax laws is undertaken simultaneously to avoid inconvenience to the tax payers. This approach shall serve as an encouragement for compliant taxpayers, and decrease the cost of compliance with tax laws.

Previously grant of stay by the Commissioner (Appeals) was subject to payment of 25% of tax liability. The condition has now been relaxed, and the payment is proposed to be reduced to 10%. It is expected that this will provide substantial relief to taxpayers who are sometimes burdened with unrealistic tax demands.

Under the current law, the decision of the ADRC is neither binding upon the FBR nor upon the taxpayer. It is proposed that composition of the members of ADRC may be changed so that retired judge of a High Court and tax professionals may be included in the Committee in addition to representatives from FBR.

As per the Sales Tax Act, any commissioner or chief commission has authority to appoint staff at the premises of taxpayer, and monitor sales and production.

Complaints have been received on the misusage of this authority. Therefore, this authority is being withdrawn from commissioners and chief commissioners. Now only FBR will use this authority based on evidence of variations in sectoral averages.