State Bank of Pakistan (SBP) has imposed 100% cash margins on more than 130 items being imported from various countries on a immediate basis.

According to the notification issued:

“State Bank of Pakistan Act, 1956 and other enabling laws, it has been decided that banks, with immediate effect, shall obtain 100 percent cash margin on the import of items.”

The step was taken to control rising imports of these items having undue weightage on the import bills, translating into a high trade deficit and loss of precious foreign exchange.

These items include:

- motorcycles,

- CNG Kits,

- Tyres of different vehicles,

- cylinder,

- specific spare parts,

- accessories and other items related to the automobile sector.

Cash margins have been imposed on heavily used items such as:

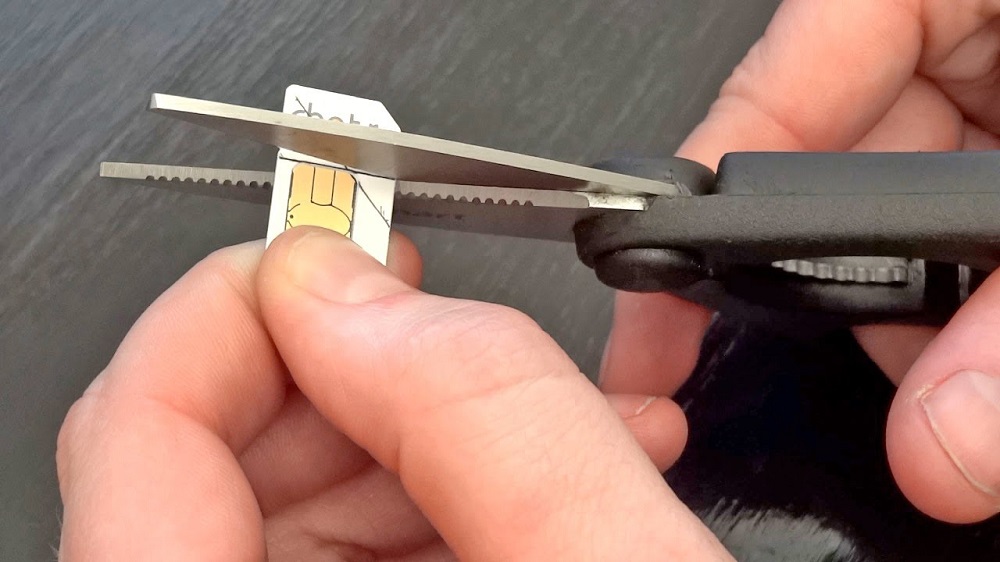

- SIM Cards,

- data processing equipment,

- air conditioning machines,

- remote controls,

- laser jet printers,

- and more.

Certain consumer items will be also subjected to this step including mosquito coils and instant gas water heater as well.

For edible items, a 100 percent cash margin has been imposed on:

- instant green tea,

- rice in husk,

- vegetable oil,

- almond,

- coconut oil,

- vegetable oils and its fraction,

- instant coffee

- and more.

Interestingly, cash margins have been imposed on imports of horse, sanitary towel and diapers for infants and babies.

The details of the items can be viewed here.

SBP Takes Measures To Contain PKR-US$ Exchange Rates

On the unabated depreciation of Rupee against the US Dollar, State Bank of Pakistan issued its statement saying that the banking regulator has taken administrative measures and increased policy rates that will adjust the parity between the two currencies.

“SBP is of the view that this adjustment in the exchange rate along with the increased policy rate and other administrative measures, would help contain domestic demand in general, and reduce the imbalances in the country’s external accounts in particular.”

The PKR-US$ exchange rate in the interbank market closed at PKR 128.0 per US$ today as against the closing level of PKR 121.55 per US$ of the previous day. This movement in the exchange rates reflects the demand-supply gap of the foreign exchange in the interbank market.

ALSO READ

Rupee Hits an All Time Low Against Dollar at Rs 128 [Updated]

As noted in the recent monetary policy statement, FY18 ended with real GDP growth at a thirteen-year high level. However, this high growth has been accompanied with a notable deterioration in the country’s balance of payments. Despite a double-digit growth in exports (YoY 13.2 percent in Jul-May FY18) and a moderate increase in remittances, strong demand for imports (YoY growth of 16.4 percent in Jul-May FY18) have pushed the country’s current account deficit to the levels not sustainable beyond the short run.

SBP says it will continue to closely monitor the evolving fundamentals of the economy, and stand ready to ensure stability in the financial markets.

looks like they are freaking out. emergency measures to contain the trade deficit!

looks like? obviously they’re peeing in their pants.

What does cash margin mean? What will it’s impact be on public?

Yes i would also like to know what does this mean for the end consumer? will the cost of these items rise by a 100%? How will this impact us?

BC i am looking for the same and read this full article but still dont know WTF is this cash margin.

I think what “CASH MARGIN” means is that now traders have to deposit full amount in their security institute (banks etc) if they are going to import stuff from outside of the country, before it used to work on the guarantee given by the banks to the seller so FOR EXAMPLE if a tyre importer from Pakistan wanted to get some tyres from China worth 100000 $ he would would only had to pay 50% ie; 50,000$ and the rest would be guaranteed by the bank from which the amount is being transferred to the seller in China. But now that tyre importer have to deposit full amount in the bank before the trade took place.

Right said. It’s a measure to reduce the imports

Correct.

I learnt that the 50% was even 0% in many cases

yes they recently sent message to all importers to openLC with 100% deposit before they used 50% or less deposits.

Millions of SIM cards are issued every year. Why does not an entrepreneur takes a step to produce SIM cards within the country?

Kwick is already doing it.

Nobody in their right mind should tax any consumable items, this severely hampers the health of the whole nation. I wonder which idot came up with this suggestion.