There has been a lot of discussion on the internet and mainstream media regarding the new mobile registration system. And yet, people are still nervous and unclear about how they can get their mobile phone registered and whether they have to pay taxes on their new phone or not.

The new mobile phone registration came into effect on December 1, 2018. While it was assumed that now all the disarray will fade off, that is far from what’s happening right now.

Those planning on bringing mobile phones from abroad are now clueless as to what will happen when they come to Pakistan. Some of you may think that once you land here, all the confusion will go away, as going to the customs office will answer most of the queries.

That too is far from happening.

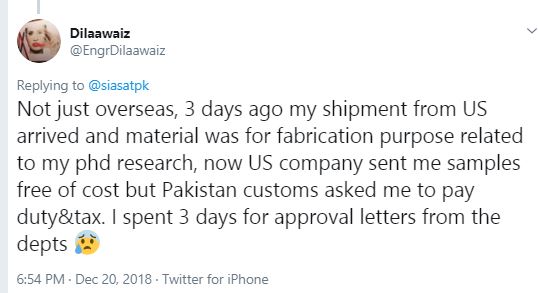

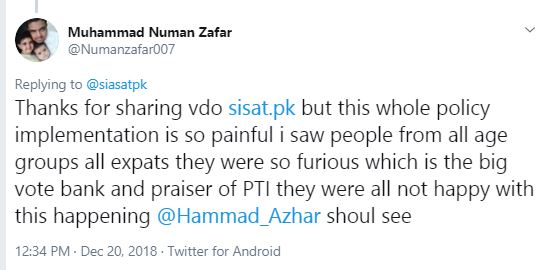

Overseas Pakistanis have been complaining of mismanagement and having to bribe to get their job done.

They resent that even approaching the concerned departments has not helped them, as they are told to go to another department, which then sends them to some other one.

ALSO READ

Here’s Why Govt’s Decision to Tax Mobile Phone Imports is Absurd

Here is the video of the aggrieved individuals, and there are many of them.

بیرون ملک سے آنے والے پاکستانی ائیرپورٹ پر موبائل فون رجسٹر کروانے کے لیے خوار ہو گئے، انہیں موبائل فون رجسٹر کروانے کے لیے کن مشکلات کا سامنا کرناپڑا اور ان سے رشوت کون مانگ رہا ہے ؟ جانیے pic.twitter.com/qoeVorFfD7

— Siasat.pk (@siasatpk) December 20, 2018

According to one person, when he went to the customs office, they sent him to the airport office. Airport office told them they do not deal with the registration and told him to go to the cargo office.

At the cargo office, neither the system is functioning properly nor are they able to log in. People are standing there with the issued tokens for hours.

Another person says that he has been asked to pay money while the tax will become operational after Jan 1. Moreover, he has been asked to pay money on one mobile, which according to the new system is admissible without any taxes.

The government is dubbing its new policy as an attempt to foil smuggling of mobile phones. However, since the announcement, if anyone is facing trouble due to this policy, that is the common man, not the smuggler.

In Pakistan : We Pay Custom Duty And Taxes For FOC Consignment / Under Warranty Consignment :

SAMPLE Ho Gift Ho Ya Kuch Bhi Sub Payable Taxes hai In Pakistan.

PTA chairman and the cabinet who passed this are a bunch of fools

Happened to my family member as well. The custom officer at the Lahore airport bluntly denied registration on an iPhone XS Max with the the reason that this phone is not present in our system and we are allowed only to register iPhone X. They went on saying that if we register this phone PTA will block it none the less. They referred us to airport 4th floor to custom office. We went there and the custom officer gave us another story. We used some reference and talked to DC customs, and he told us directly that the custom staff is misleading you entirely. And he narrated a totally different version of this law. We left the airport because they told us we can register till 15 days of flight landing and then we went back to them a few days later and they said “the phone has been taken out of the airport and now we have no way of knowing how many phones you brought to Pakistan and hence we cannot register and asked us to pay 63000 for registering.

This is a black law a.k.a kala kanoon. The people of Pakistan should reject these type of decisions by government who try to impose taxes on gifts.

Did You record all of these interactions? Post them on Facebook, Youtube etc. Let the government know what’s happening in those departments. Corrupt will at last be rooted out. For now, we have to be patient. Pakistani Departments are addicted to bribes and delaying the work for more than 30 years. Ending this addiction will take time.

Always record everything and then let the world know how corrupt and incompetent they are.

I haven’t recorded this on social media so far. I am just wondering if filing a complaint on the new PM’s citizen’s portal will do any justice.

Please don’t waste any more time and immediately file a report on that portal. You have to do your part and leave the rest to the departments. I use DU Recorder on mobile to record mobile screens and Cube ACR for call recordings. If You are using the portal app on Your mobile. Record all that with DU Recorder (its very easy) and post that too on the social media as well and then hope for the best.

These things take time. Pakistan’s economy is the major concern so most of the good big names are busy worrying about that and they don’t pay too much attention to other smaller details which by no means matter a lot for laymen. I still expect better from this Government.

My family bought iPhone XS Max, and they are out of airport now. Did you go through the custom verification process? if yes then do let me know also.

Thankyou

As per my knowledge dealing with this so far, unfortunately, you will have to pay duty on the phone in order to get it registered in Pakistan. If your family member’s visit is less than 30 days then there is no need to declare and get it registered. Same applies to the case if your family member is roaming.

Ro Imran Ro

I imported an electric wheel chair from China for my mother-in-law (who suffers from 3rd stage Arthritis) last year which landed at Gerry’s shed at “Islamabad International Airport” in Ramadan last year and even though it is duty-free tax-free item, I still had to pay several thousand Rs in terms of clearance papers etc on top of 20+ round trips for stupid signatures and approvals to and fro between many floors of the two customs buildings (as well as Gerry’s shed ) with fasting! Had the wheelchair not duty free or if I were not aware that it is duty free, they staff were willing to loot me and apply the wrong custom duty and taxes. They even did so but I had the prior knowledge from FBR that wheelchair is tax-free and duty free and had them corrected. Still I had to pay upto 4000Rs in terms of challan fees, approval fees and some stupid clearance fee. On top of that I have to pay Gerry’s shed fee and the fee to the person who carrys the luggage from within the shed to out at the door of the shed – as if he is not a paid employee! During the whole process, I was chased by commission agents asking between 10-15thousand Rs to getting this done on top of an other fees I was supposed to pay!

The people executing the policy are corrupt in all departments whether it is Custom Office, Property Tax Office, Airport, PIA, Hospitals, Traffic Police, License Office you name it and corrupt people are there – because the criteria for selection into these is bribe and corruption. There is no strict merit. Therefore, their food does not get digested unless they take bribe. The customs’ people put you through misery intentionally so that you say yourslef “Hey man take this money and get this done for me” even though you want absoluely legal and lawful thing to be done.

*Moral*

The people itself are corrupt. To get into customs department as an employee or officer, you have to pay bribe. Highly education people and strict merit is NOT applied when hiring people to these departments. There is a chain of corruption from the bottom to the top level. That’s why they ask for bribes at all times an all cases.

Land of impure mafia