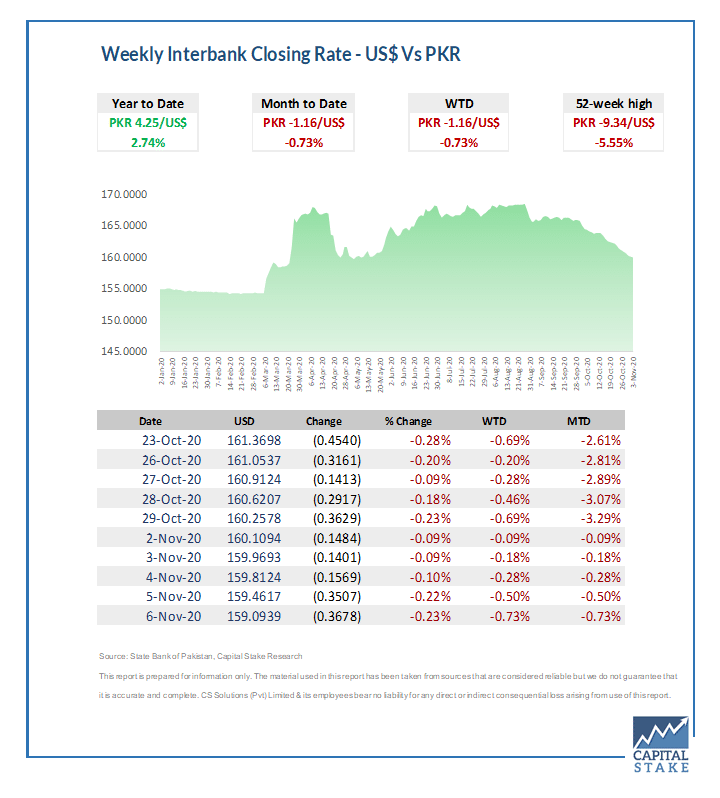

Pakistani rupee continued to recover losses against the US Dollar in the interbank market as it regained Rs. 1.16 during the current week.

According to Capital Stake, this was the highest level since March 24th.

The rupee closed at 159.09 against the US Dollar in the interbank market, compared with the previous closing of 159.46 as it appreciated by 37 paisas during the session.

Yaqoob Abubakar from Tresmark, an application that tracks financial markets said,

USD/PKR parity gained 37 paisas against the dollar on Friday and closed at Rs 159.09. As dealers lower imports, higher inflows of export receipts and workers remittances are the key reasons of Rupee appreciation. The market is expecting the rupee will appreciate further in the coming week due to better inflows.

A.A.H Soomro, managing director at Khadim Ali Shah Bukhari Securities told ProPakistani,

External accounts are well under control. Thanks to low oil prices and orders filled to capacity, exports are nudging upwards. Joe Biden’s victory would be China’ Yuan friendly, which is keeping the Dollar Index down. Expect Current Account & Remittances to surprise positively. However, further appreciation would undo export competitiveness.

The currency which was down by Rs. 13.5877/US$ in August as compared to the beginning of the year has regained its value and is now lower by only 4.25/US$ year to date. The Rupee has made an improvement of Rs. 9.34/US$ or 5.5% from its 52-weeks low of Rs. 168.4353/US$ that was seen on August 26, 2020.

The increase in the foreign exchange reserves has boosted the local currency against the greenback. According to the data released by the State Bank of Pakistan, the foreign currency reserves held by the State Bank of Pakistan (SBP) on October 29 were recorded at $12,182.6 million, which is up by $61 million as compared with $12,121.5 million in the previous week.

This was further aided by the news reports of Pakistan getting the rollover facility for $4 billion deposit loans. Pakistan obtained these loans from Saudi Arabia and the United Arab Emirates, and now their repayment has been delayed for another year to avoid a decline in foreign exchange reserves.

Furthermore, the reports of more aid potentially coming from the Asian Development Bank (ADB) to Pakistan built a positive sentiment in the market. The Asian Development Bank (ADB) has planned to provide Pakistan with approximately $10 billion in fresh assistance for various development projects and policy-based programs over the next five years under its new Country Partnership Strategy (CPS-2021-25).

roz woi khabar.. bhai dollar wesay hi kamzor hoa hai, against any other currency check kar lo.. Pakistan ne koi 5th state of matter nhi deryaaft kar li

All currencies have appreciated against the buck in last week due to uncertainty regarding the possible change of personnel at the oval office in Washington.

یہ وہ وقت ہے جب ہر اچھی سمت الٹی لگتی ہے کیوںکہ ایسی ڈویلپمنٹ سے شائد گورنمنٹ کو کریڈٹ نہ چلا جائے۔

جناب اب ان جائیں کہا اورآل ٹرنڈ بہتری کی طرف جا رہا ہے۔

uae and ksa will create trouble later,,, not so nice arabs

Yeah not so cool. Don’t know how could they swallow a heavy bitter stone of fully developed and operational Gwadar port down their throats. Dubai port would immediately loose its charm in global sea trade routes. Even Jeddah and Dammam ports would be of more significance than Dubai port then.