The current week brought consistent improvements for the Pakistani Rupee (PKR) against the US Dollar (USD).

After touching its highest value on 17 November 2020, at Rs. 158.31 to the USD, the PKR today crossed even that limit by jumping 36 paisas to the USD in the interbank market today, closing at Rs. 158.10 to the greenback.

Part of this consistent improvement is due to the inflow of foreign exchange through the Roshan Digital Accounts (RDAs).

According to the latest figures released by the State Bank of Pakistan (SBP), Pakistan has received $554 million over five months from the RDAs, with 57 percent of the remittances ($316 million) from Saudi Arabia and the UAE.

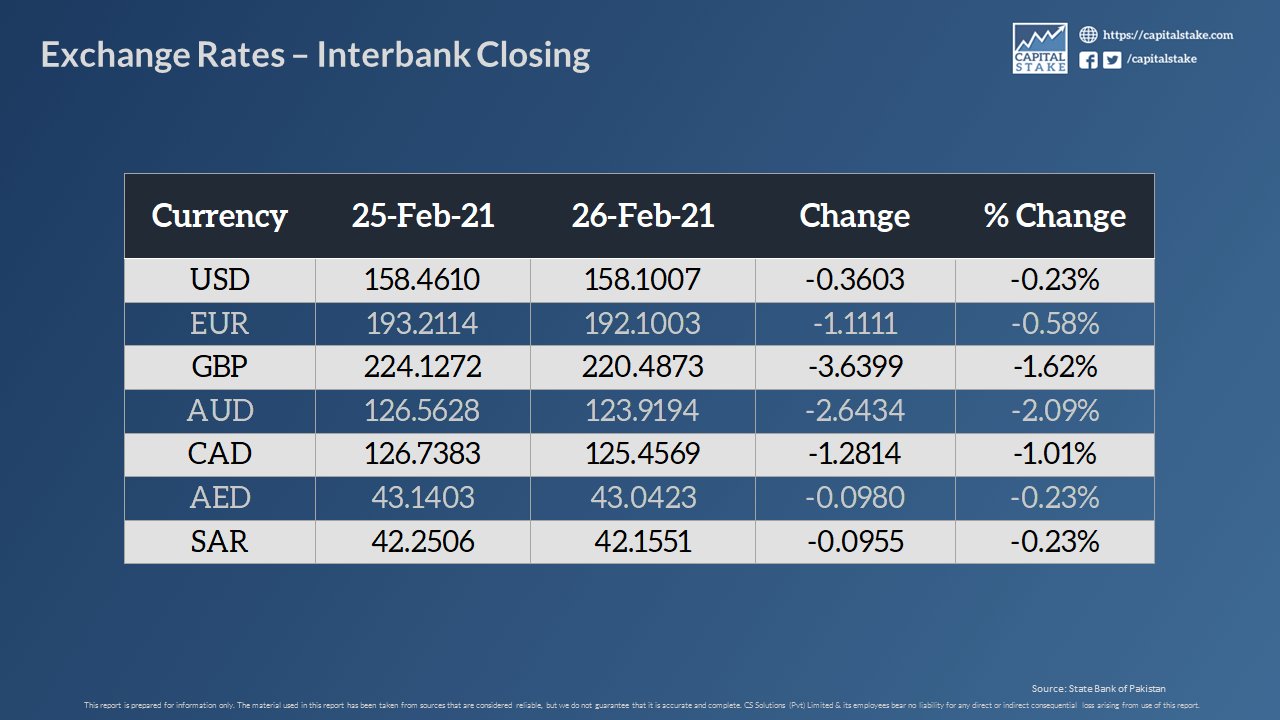

Yesterday (25 February), the PKR closed at 158.46 to the USD, up from Wednesday’s Rs. 158.76 to the USD, which was up 12 paisas from Rs. 158.86 to the USD on Tuesday, which had been up from Rs. 159.06 to the USD on Monday. Today (26 February), PKR has posted an improvement of 36 paisas, closing at Rs. 158.10 to the USD.

ALSO READ

Pakistani Rupee Reaches Another High Against the US Dollar

During the previous week, the PKR had deteriorated on the first two days and had posted blanket gains on the next two days before closing with blanket losses once again on Friday.

This Monday had brought an improvement for the PKR against the USD, the Euro, the UAE Dirham (AED), and the Saudi Riyal (SAR), in addition to erosion for the PKR against the Great British Pound (GBP), the Australian Dollar (AUD), and the Canadian Dollar (CAD).

Tuesday had almost the same results except for a downwards movement against the Euro. Wednesday had brought more improvement than erosion for the PKR, with losses only against the Pound Sterling and the CAD. Thursday had a continuation of the trend of mixed results, with the PKR posting losses against the Euro, the AUD, and the CAD. Friday, however, brought blanket gains for the PKR against all major currencies.

The PKR had gained 52 paisas to the Euro on Monday and lost 74 paisas on Tuesday. Wednesday had brought gains again, and the PKR had improved by 10 paisas against the Euro. Thursday turned the tide once again, and the PKR had closed with a loss of 13 paisas to the Euro. Friday closed the week for PKR with significant Rs. 1.11 gain against the Euro.

Against the GBP, the PKR had constantly been declining since the beginning of the current week. Wednesday’s loss for the PKR had been a substantial Rs. 1.4, adding to the loss of almost a rupee on Tuesday when it had deteriorated by 98 paisas. This had come after a loss of 14 paisas on Monday. On Thursday, however, the PKR has improved substantially against the GBP by 93 paisas, and Friday added to those gains massively by Rs. 3.63.

On Monday and Tuesday, the PKR had eroded against the AUD, posting losses of 81 paisas and 54 paisas, respectively. On Wednesday, the deterioration had reversed slightly with a gain of less than a paisa for the PKR against the AUD, following which Thursday once again brought erosion for the PKR against the AUD by 94 paisas. Friday’s gains were notable against AUD as well by Rs. 2.64.

ALSO READ

Pakistani Rupee Rises to Its Highest in 3 Months Against the US Dollar

The PKR was constantly losing against the CAD since Monday. The consecutive daily losses of the PKR against the CAD until Thursday this week were 28 paisas, 16 paisas, 25 paisas, and 52 paisas, respectively. Today, however, PKR improved by Rs. 1.2 against the CAD as well.

The movement of the PKR against the AED and the SAR has been positive throughout this week with a minimal gain of less than a paisa on Monday, a gain of 4 paisas on Tuesday, and an improvement of 3 paisas on Wednesday against both these currencies in the interbank currency market. Yesterday, the PKR improved by 8 paisas against the AED and by 7.9 paisas against the SAR. On Friday, PKR posted gains of 9 paisas against both currencies.