The report released by the IMF over the completion of the second through fifth reviews of the Extended Arrangement under the Extended Fund Facility (EFF) for Pakistan also discusses Pakistan’s response to the COVID-19 pandemic.

Background

COVID-19 was reported for the first time on February 26, 2020. Starting on March 23, both the federal and provincial governments implemented containment and mitigation measures.

These included selective quarantines, border closures, and international and domestic travel restrictions, closure of educational institutions, banning of public events, social distancing, and varying levels of lockdown.

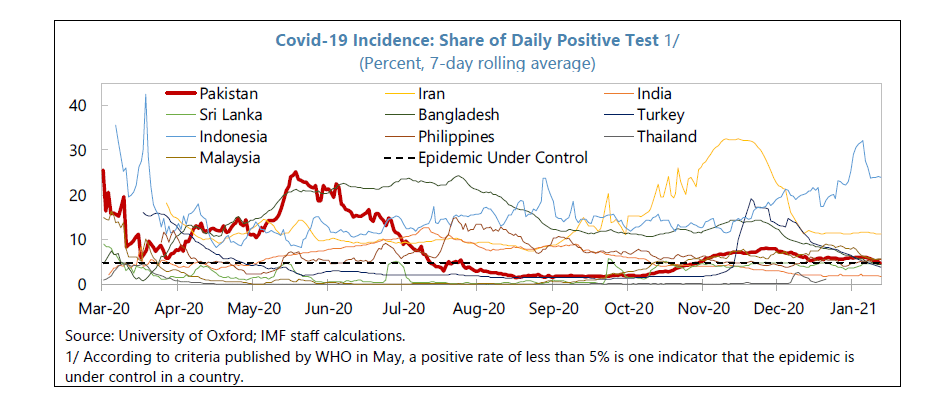

Despite these measures, the number of new daily cases increased rapidly, hitting the peak of 6,000 in mid-June, before slowing down in July. Between August and October, the number of daily new cases was consistently below 1,000 (reaching a low of 300 cases in early September).

The second wave of infections emerged starting in November as the positivity rate had been on an upward trend before moderating in mid-December and decreasing to less than the 5 percent mark in end-January.

Reopening of the economy and additional containment efforts

Since mid-April 2020, the Federal Government, in coordination with provinces, started to gradually ease lockdown arrangements. By the end of summer, further lockdown restrictions were lifted as educational institutions, recreational places, restaurants, malls, and retail outlets could reopen.

This trend was partially reversed in the last months of CY 2020 by better enforcing Standard Operating Procedures (SOPs) and mandating the use of face masks.

To mitigate the second wave, smart lockdown measures have been re-imposed, along with a general ban on public meetings and rallies and the closure of educational institutions and venues such as cinemas, theaters, and wedding halls. Educational institutions have started to reopen in phases from January 18.

In early December, the government applied to the UN’s COVAX Facility, which will cover priority groups—around 20 percent of the population. It has given emergency use approval for three vaccines—the Oxford-AstraZeneca vaccine, Sinopharm, and Sputnik V.

Pakistan is also in discussions with other vaccine manufacturers and with donors (notably the World Bank and Asian Development Bank) for the procurement of extra vaccines, which will be funded with a $250 million budget allocation.

The launch of the vaccination drive is expected in the second quarter of CY 2021.

Key policy responses:

The authorities took measures in three areas – fiscal, monetary and macro-financial, and exchange rate and balance of payments.

On the fiscal side, a relief package worth Rs. 1,200 billion (2.9 percent of GDP) was announced by the Federal Government on March 24, 2020, of which Rs. 715 billion (1.7 percent of GDP) was executed in FY 2020.

Key measures taken in this area include the elimination of import duties on emergency health equipment (recently extended until December 2020); cash transfers to 6.2 million daily wage workers (Rs. 75 billion); cash transfers to more than 12 million low-income families (Rs. 50 billion); accelerated tax refunds to exporters (Rs. 100 billion); and support to SMEs and the agriculture sector (Rs. 100 billion) in the form of power bill deferment, bank lending, as well as subsidies and tax incentives.

The economic package also earmarked resources for accelerated procurement of wheat, financial support to utility stores, a reduction in regulated fuel prices – with a benefit for end consumers, support for health and food supplies, electricity bill payments relief, an emergency contingency fund, and a transfer to the National Disaster Management Authority (NDMA) for the purchase of COVID-19 related equipment.

In addition, the FY 2021 budget includes further increases in health and social spending, tariff and custom duty reductions on food items, an allocation for ‘COVID-19 Responsive and Other Natural Calamities Control Program’ (Rs. 70 billion), a housing package to subsidize mortgages, as well as the provision of tax incentives to the construction sector (retail and cement companies), which got extended in the context of the second wave until the end of December 2021.

Provincial governments also implemented supportive fiscal measures from the onset of the shock, including cash grants to low-income households, tax relief, and additional health spending (including a salary increase for healthcare workers). The government of Punjab implemented an Rs. 18 billion worth tax relief package and a cash grants program worth Rs. 10 billion.

The government of Sindh’s measures included a cash grant and ration distribution program of Rs. 1.5 billion for low-income households. The FY 2021 provincial budgets also provide tax relaxations and sizeable increases in expenditure allocations, especially on health services.

On the front of the monetary and macro-financial area, the State Bank of Pakistan (SBP) has responded to the crisis by cutting the policy rate by a cumulative 625 basis points to 7 percent since March 17, 2020.

The SBP has expanded the scope of existing refinancing facilities and introduced three new ones to:

- Support hospitals and medical centers to purchase COVID-19-related equipment (39 hospitals, Rs. 8.36 billion, to date).

- Stimulate investment in new manufacturing plants and machinery, as well as modernization and expansion of existing projects (346 new projects, Rs. 278 billion, until end-CY 2020).

- Incentivize businesses to avoid laying off their workers during the pandemic (2,958 firms, Rs. 238 billion, to date).

These facilities have been extended beyond their original deadline of June 2021 to September or December 2021.

Moreover, the SBP introduced temporary regulatory measures to maintain the banking system’s soundness and sustain economic activity. These include:

- Reducing the capital conservation buffer by 100 basis points to 1.5 percent.

- Increasing the regulatory limit on the extension of credit to SMEs by 44 percent to Rs. 180 million from Rs. 120 million.

- Relaxing the debt burden ratio for consumer loans from 50 percent to 60 percent.

- Allowing banks to defer clients’ payment of principal on loan obligations by one year.

- Relaxing regulatory criteria for restructured/rescheduled loans for borrowers who require relief beyond the extension of principal repayment for one year.

- Reducing margin call requirements of 30 percent vis-à-vis banks’ financing against listed shares to 10 percent and banks are allowed to take exposure on borrowers against the shares of their group companies.

As of January 22, 2021, almost 1.7 million applications for principle deferral and loan restructuring under the debt relief scheme were received, of which more than 96 percent of applications were approved, covering Rs. 884 billion.

As part of the housing program, the SBP has also introduced mandatory targets for banks to ensure loans to construction activities account for at least 5 percent of the private sector portfolios by December 2021.

Finally, in the area of exchange rate and balance of payments, the IMF applauded and mentioned in the report that the SBP introduced further regulatory measures to facilitate the import of COVID-19-related medical equipment and medicine. These include:

- Lifting the limit on import advance payments and import on the open account.

- Allowing banks to approve an Electronic Import Form (EIF) for the import of equipment donated by international donor agencies and foreign governments.

The SBP has also relaxed the condition of the 100 percent cash margin requirement on the import of certain raw materials to support the manufacturing and industrial sectors.