Pakistan’s tax budget was revised recently, which resulted in increased income taxes, sales taxes, regulatory duties, and more. This caused a surge in prices for imported mobile phones.

Unfortunately, the increase in prices is quite significant as the new sales tax on smartphones costing above $200 is a staggering 17%. Pakistan Telecommunication Authority (PTA) has officially revealed the taxes you will have to pay for smartphones at different prices. The list includes smartphones of all price categories with entry-level phones all the way up to premium handsets like the Galaxy S21/iPhone 13 etc.

The fixed tax on smartphones priced between $201 – $350 has increased from Rs. 1,750 to a whopping Rs. 14,661. Handsets costing $351 to $500 will now be taxed Rs. 23,420 and phones going above $500 will tax you Rs. 37,000 and above. Here is the full list:

- $1 to $30 = Rs. 430

- $31 to $100 = Rs. 3,200

- $101 to $200 = Rs. 9,580

- $201 to $350 = Rs. 12,200 + 17% Sales Tax

- $351 to $500 = Rs. 17,800 + 17% Sales Tax

- $501 and above = Rs. 36,870 + 17% Sales Tax

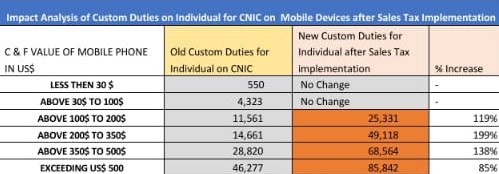

This applies to smartphones imported through your Passport ID. The taxes imposed on CNIC imports are even worse. Here is the list:

- $1 to $30 = Rs. 550

- $31 to $100 = Rs. 4,323

- $101 to $200 = Rs. 11,561

- $201 to $350 = Rs. 14,661 + 17% Sales Tax

- $351 to $500 = Rs. 23,420 + 17% Sales Tax

- $501 and above = Rs. 37,007 + 17% Sales Tax

The Federal Bureau of Revenue (FBR) has shared a screenshot of the new taxes as well, comparing the value of old taxes with the new ones.

If you are wondering why the taxes have increased so much, Prime Minister Imran Khan has recently explained it in an interview. He says that he wants to encourage local smartphone production in Pakistan and also wants to reduce billions of dollars of imports since it can damage PKR’s value. Check out the full interview below.

This is the kind of garbage that keeps expatriates out of Pakistan

it isn’t for expats, it is for locals. There is about 2 months of use before they block the phone, so, it makes no difference for expats. And, why shouldn’t the local ppl buy local and encourage local production of goods, India has been doing this for decades.

do you have any policy about secondhand or old cell phone

doesn’t matter if it is new or 2nd hand, even if it 2nd hand tax will be calculated on the price of the new phone.

This government has gone mad… instead of creating ease for expats they creating only difficulties…. Shame on them

Speeches mein tooooooo doodh kee nahren beh rahi hain naaaa

Instead of increasing tax base and reducing corruption the govt is focused on petty issues. Second those paying taxes what advantage in terms of facility are they getting. Karachi the largest tax paying city in Pakistan has no sewage system, public transport or proper traffic system or policing system. Simply put this is like a bone between two dogs

The current change in taxes are so huge and crazy. I am sure that Government functionaries are also not aware of the huge impact on general public by the change in calculation of sales tax and hopefully they will re-visit it.

Government paagal ho gai hai……..

Bht bari galti kee jo unki support mein thy start mein………..

her shobaa barbaad kar rahy hain yeee

feel so bad k in k supporter rhy