The Pakistani Rupee (PKR) resumed its historic drop against the US Dollar (USD) and reported losses in the interbank market today. The local currency lost five paisas against the greenback despite hitting an intra-day low of Rs. 182.15 against the USD during today’s open market session.

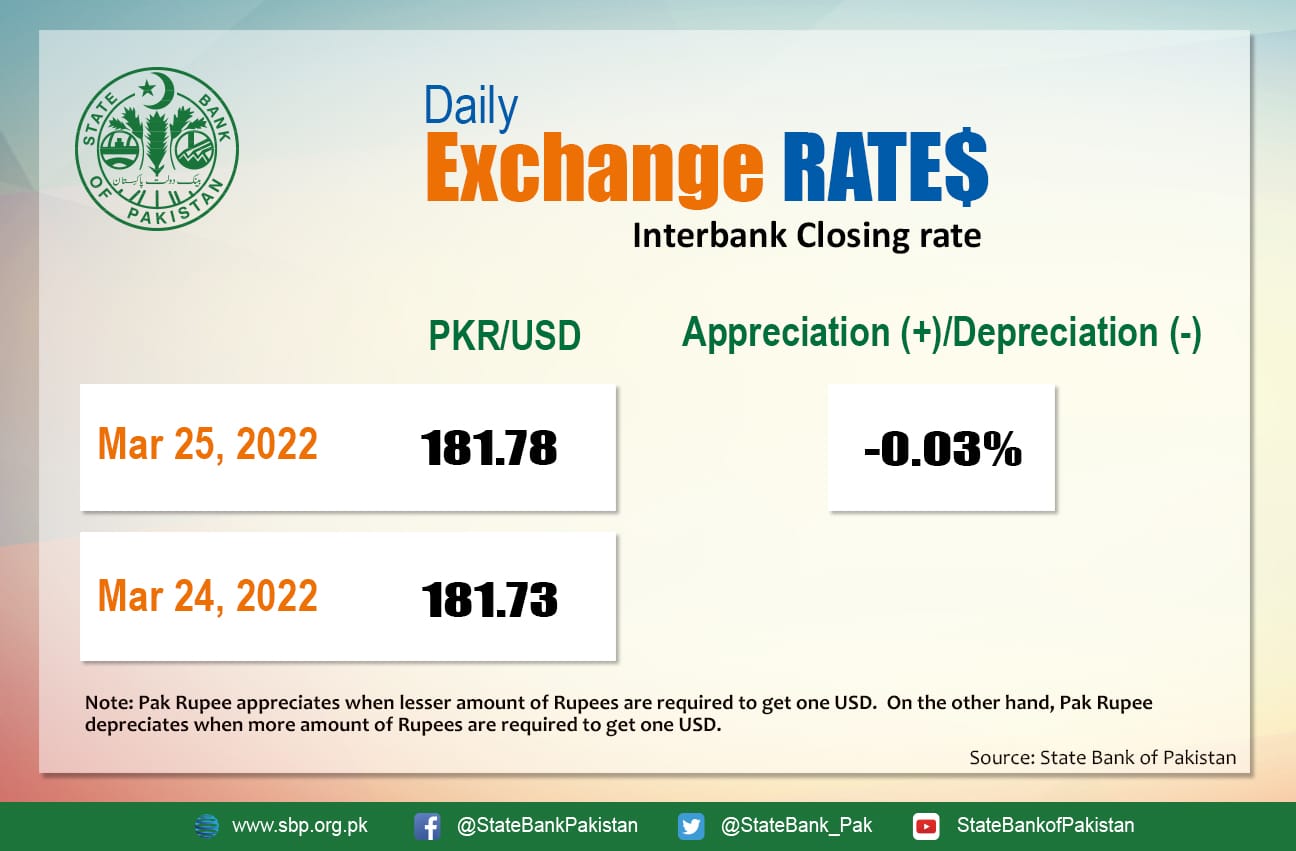

It depreciated by 0.03 percent against the USD and closed at Rs. 181.78 today after halting losses and closing at Rs. 181.73 in the interbank market on Thursday, 24 March.

The rupee’s hopeless plunge against the dollar resumed today despite a drop in global oil prices, which calmed amid anticipation that crude shipments from Kazakhstan’s CPC terminal will restart, but the European Union remained divided on whether to slap an oil embargo on Russia.

At the time of press, Brent futures stood at $118.4 a barrel, and U.S. West Texas Intermediate (WTI) crude fell to $111.4 a barrel.

At home, foreign reserves held by the State Bank of Pakistan (SBP) witnessed substantial outflows of $869 million in the week that ended on March 18, 2022, depicting a 5.49 percent decline on a week-on-week basis.

The SBP weekly report released on Thursday revealed that the country’s total liquid foreign exchange reserves went down by $843.7 million (-3.78%) on March 18, 2022, to $21.44 billion, compared to $22.28 billion in the previous week. The SBP reserves decreased by $869.2 million to $14.96 billion, compared to $15.83 billion a week earlier.

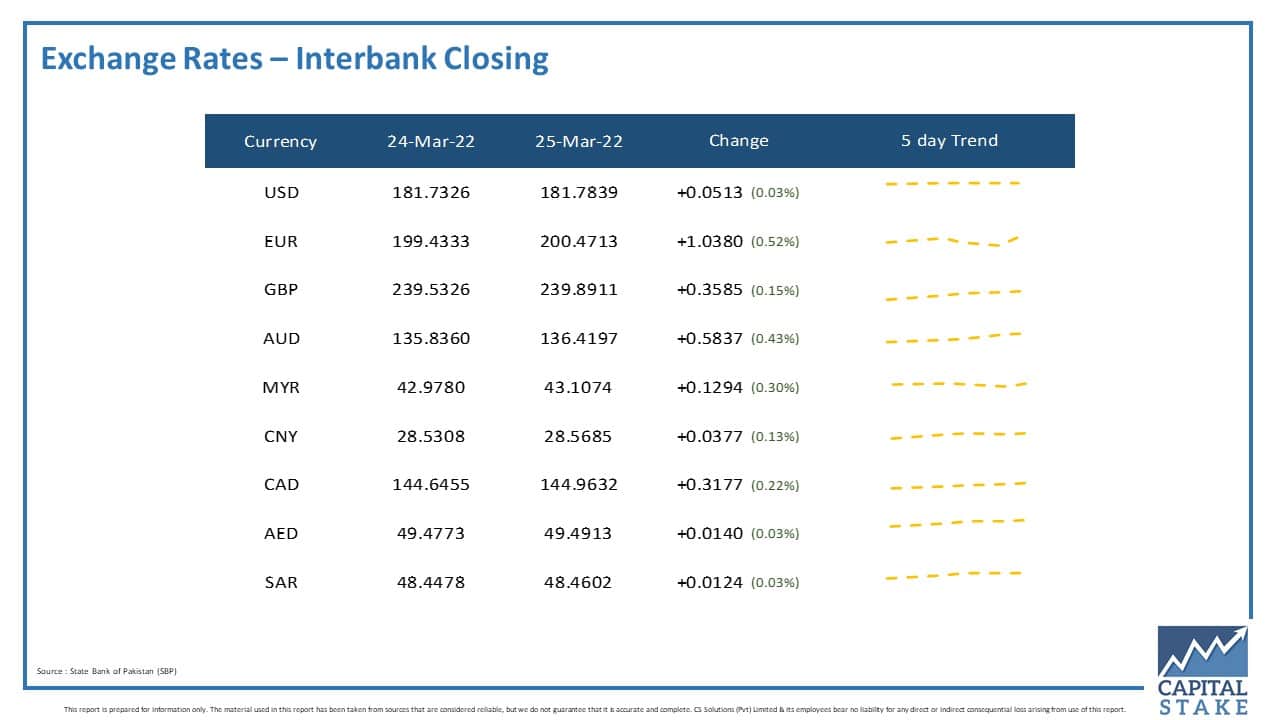

The PKR struggled against other major currencies and reported losses in the interbank currency market today. It lost 31 paisas against the Canadian Dollar (CAD), 35 paisas against the Pound Sterling (GBP), and 58 paisas against the Australian Dollar (AUD).

Moreover, it lost one paisa against both the Saudi Riyal (SAR) and the UAE Dirham (AED), and Rs. 1.03 against the Euro (EUR) in today’s interbank currency market.