Fitch Ratings and Moody’s Investor Service have tipped Pakistan to successfully receive $1.2 billion from the International Monetary Fund (IMF), as reported by Bloomberg.

The top rating agencies expect the funds to be released in the third quarter (current) of this year, which may potentially reduce pressure on the country’s currency and bonds.

Krisjanis Krustins, a Hong Kong-based director at Fitch, said, “We assume IMF board approval of Pakistan’s new staff-level agreement. This will unlock significant additional financing from the IMF and other multilateral and bilateral sources and may well provide a significant confidence boost to the markets”.

Similarly, Grace Lim, who works as a sovereign analyst with Moody’s in Singapore, remarked that the rating agency expects the IMF to release funds during July-September. She said that there is a possibility that Pakistan may not complete its IMF bailout program because the government could struggle to implement revenue-raising initiatives.

“Pakistan’s ability to complete the current program and maintain a credible policy path that supports further financing remains highly uncertain, while elevated inflation and a higher cost of living are adding to social and political risks,” Lim remarked.

It is noteworthy that Fitch Ratings cut Pakistan’s credit rating outlook to negative last week while Moody’s did the same in June.

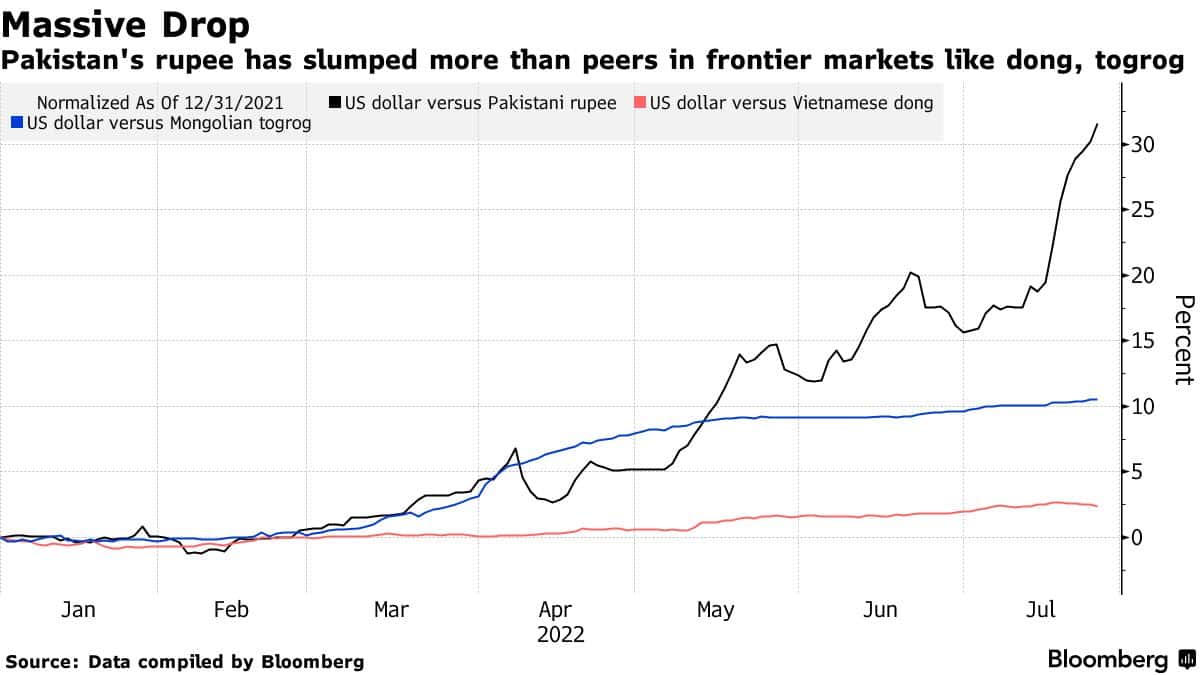

So far, Pakistan’s currency and bonds have taken a beating this month as investors are concerned that political instability could stall the IMF funding for the country. The South Asian nation is attempting to allay concerns that it will follow Sri Lanka into default this year, with the government seeking billions of dollars from the Washington DC-based lender, besides nations such as China and Saudi Arabia.

Persons familiar with the internal deliberations said that the IMF is seeking assurances from Saudi Arabia and other countries that they will follow through on their financial obligations before authorizing the loan to Pakistan under its Extended Fund Facility (EFF).

Pakistan and the IMF managed to make headway on budget measures for 2022-23 in June, with Islamabad committing to more policy initiatives to revive the stalled EFF. The agreement resulted in the introduction of a 10 percent poverty alleviation tax (super tax) on 13 industries, including cement, steel, sugar, oil and gas, fertilizer, LNG, textile, banking, automotive, drinks, chemicals, and tobacco.

Pakistan began the 39-month, $6 billion IMF program in 2019, but less than half of the funds have been released so far due to the former’s inability to meet benchmarks.