The Pakistani Rupee (PKR) dropped further against the US Dollar (USD) and posted losses during intraday trade today.

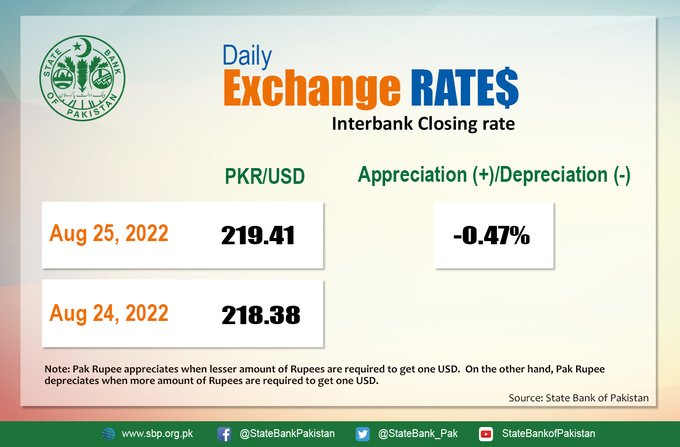

It depreciated by 0.47 percent against the USD and closed at Rs. 219.41 after losing Rs. 1.03 in the interbank market today. The local unit quoted an intra-day high of Rs. 214.50 against the USD during today’s open market session.

The local unit was stable when trade resumed early in the morning against the greenback and traded at yesterday’s 217-219 level in the open market at 10:12 AM. By midday, the greenback went as low as 214.50 against the rupee. After 2 PM, the local unit was trading at the 219 level against the top foreign currency before the interbank close.

The rupee slid against the US dollar for the fourth consecutive day today despite promising news that the Qatar Investment Authority, one of the world’s biggest and most prominent sovereign funds, is considering pouring $3 billion into Pakistan.

Economic analyst, A. H. H. Soomro, told ProPakistani,

The situation is correcting after a sharp appreciation from Rs. 240 to Rs. 210 interbank. The one-way trajectory had to rationalize as speculators started betting for unrealistic below-200 levels. Similarly, the government has removed the ban on imports – albeit with higher duties – coupled with the requirement from UAE to bring 5,000 dirhams on arrival is creating demand again.

He further added, “The situation does seem under control and would normalize from next week onwards as the IMF deal paves way for UAE, Saudi, and Qatari economic assistance”.

Markets were bearish throughout the day as money changers observed another dry outpour of dollar sellers. Experts maintain that traders are once again hoarding the top currency in the expectation of another increase as markets struggle with near-term uncertainty.

The imposition of a massive regulatory duty on 700 luxury items has compelled Pakistani traders to import products via Afghan Transit Trade, increasing demand for the dollar in Khyber Pakhtunkhwa, where the rupee was trading between 230 and 235 per dollar.

Additionally, the local unit maintained its fourth successive fall after the International Monetary Fund (IMF) confirmed with the Finance Ministry that Pakistan’s economy will slow to around 3.5 percent due to deteriorating economic conditions, with average inflation reaching nearly 20 percent by the end of the current fiscal year due to currency depreciation and higher commodity prices.

It is expected that the updated projections will be shared with the IMF board, which will meet next week to discuss Pakistan’s request for a $1.17 billion bailout and an extension of the program until June 2023. After approval, the lender will share macroeconomic framework projections for the coming few months.

In terms of global factors impacting growth at home, oil prices rose on Thursday on growing supply crunch concerns amid imminent blockades to Russian exports, the potential for major producers to cut output, and the partial shutdown of a US refinery.

Both crude oil benchmark contracts hit multi-week highs after Saudi Arabia’s energy minister hinted that the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, may reduce output to support prices.

Brent crude was up by 0.40 percent at $101.6 per barrel, while the US West Texas Intermediate (WTI) went beyond $94 and went up by 0.13 percent to settle at $95.01 per barrel.

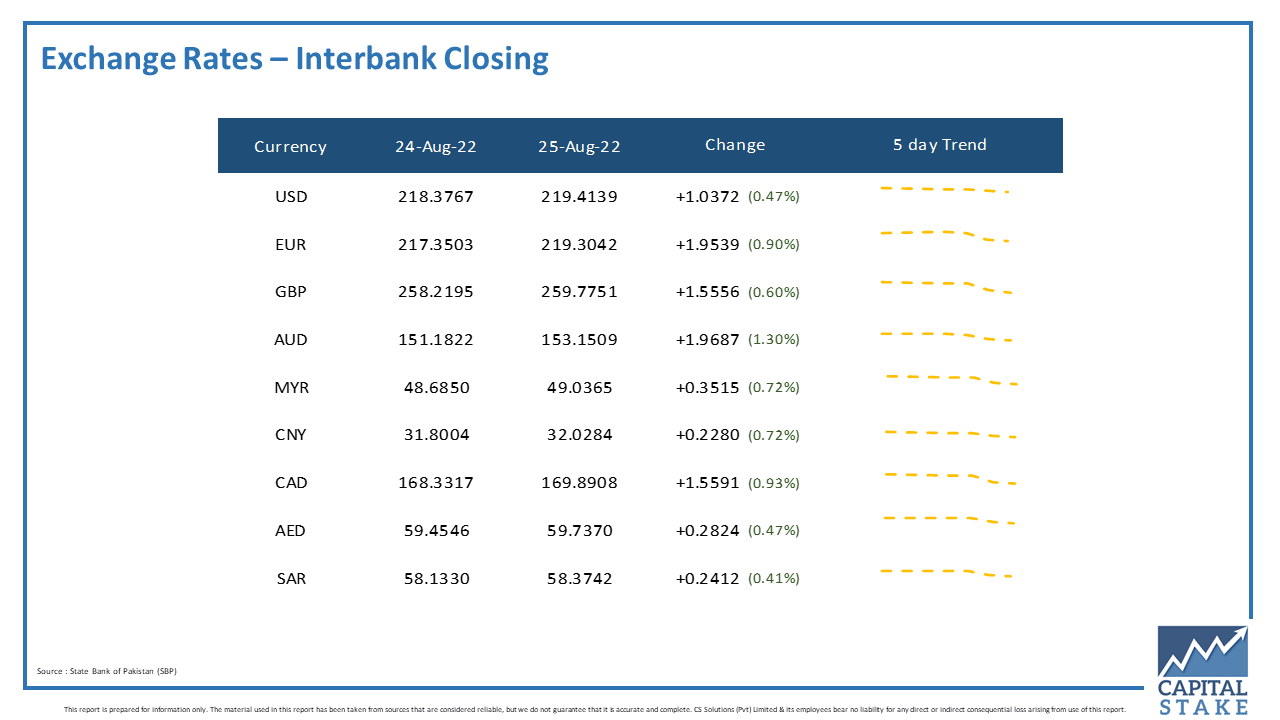

The PKR slid further against the other major currencies in the interbank market today. It lost 24 paisas against the Saudi Riyal (SAR), 28 paisas against UAE Dirham (AED), Rs. 1.55 against the Pound Sterling (GBP), Rs. 1.55 against the Canadian Dollar (CAD), and Rs. 1.96 against the Australian Dollar (AUD).

Moreover, it lost Rs. 1.95 against the Euro (EUR) in today’s interbank currency market.