The Pakistani Rupee (PKR) continued to outperform the US Dollar (USD) and posted big gains today.

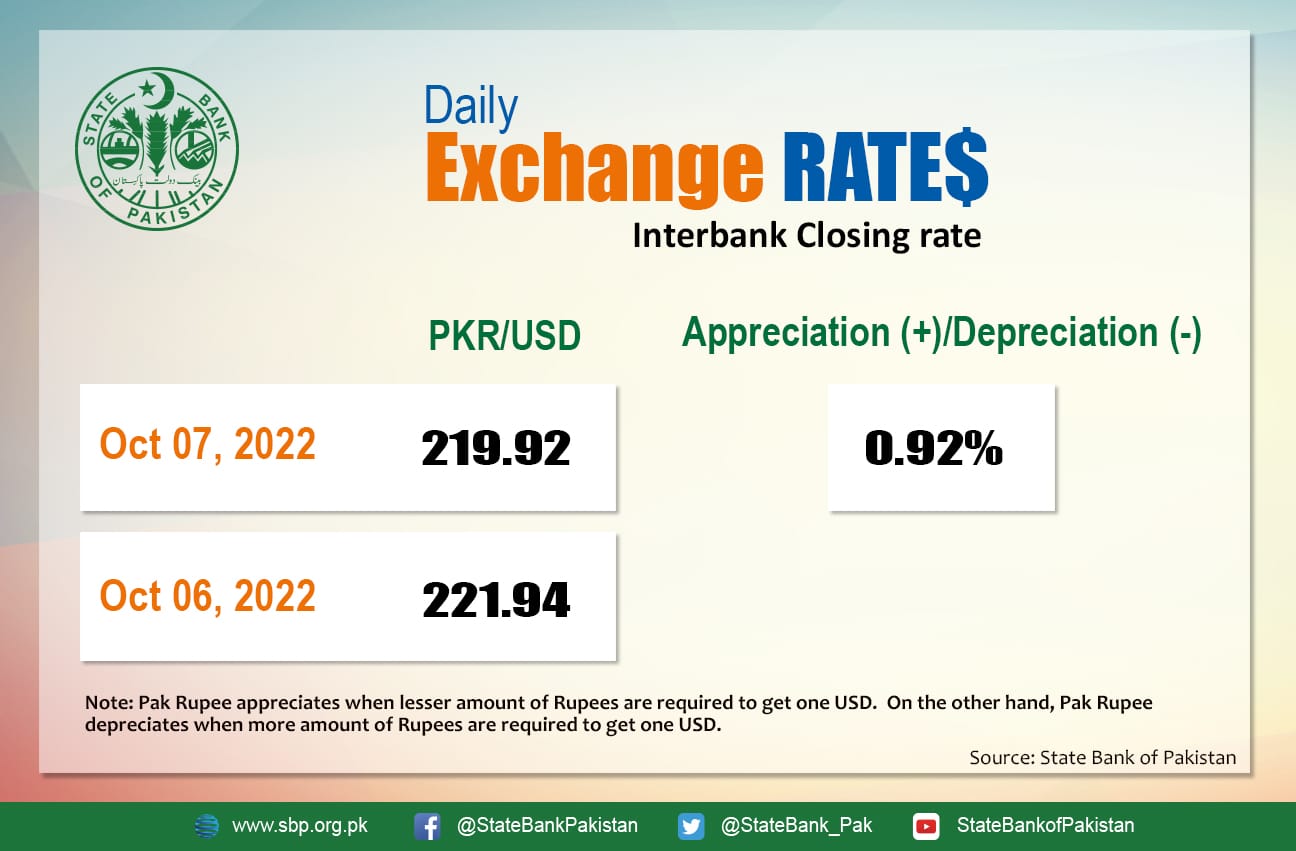

It appreciated by 0.92 percent against the USD and closed at Rs. 219.92 after gaining Rs. 2.01 in the interbank market today. The local unit quoted an intra-day low of Rs. 221.90 against the USD during today’s open market session.

The local unit was all green when trading resumed against the greenback and opened trade at 221.40 in the open market. By 10:15 AM, the greenback went as low as 219.50 against the rupee. By midday, the greenback went as high as 221.89 against the rupee. After 2 PM, the local unit rose and stayed at the 219-220 level against the top foreign currency before the interbank close.

The rupee continued its good run against the dollar for the eleventh consecutive day today despite Moody’s Investors Service downgrading Pakistan’s local and foreign currency issuer and senior unsecured debt ratings.

In a statement, the rating agency said the downgrade is driven by increased government liquidity and external vulnerability risks, and higher debt sustainability risks, in the aftermath of devastating floods that hit the country since June 2022.

Despite expectations on Moody’s report, the rupee’s value is still improving. Money changers are of the view this is a result of regulators’ strict monitoring and action against speculators.

Exporters who had kept their profits abroad were now bringing them back in fear of a further decline in the value of the dollar, which was improving supply. The market expects the State Bank of Pakistan’s Monetary Policy Committee to either maintain or reduce interest rates at its meeting on Monday, which would strengthen the rupee even further.

Globally, oil rose on Friday and was on track for a second consecutive weekly gain, boosted by OPEC+’s decision to cut supply by the most since 2020, despite concerns about a recession and rising interest rates. One of the most significant consequences of OPEC’s latest cut is the likely return of $100 oil.

Brent crude was up by 0.98 percent at $95.35 per barrel, while the US West Texas Intermediate (WTI) soared by 1.03 percent to settle at $89.36 per barrel.

Both benchmarks were on track for another weekly gain, with Brent approaching 8 percent this week. The global benchmark is still falling sharply after approaching an all-time high of $147 per barrel in March following Russia’s invasion of Ukraine.

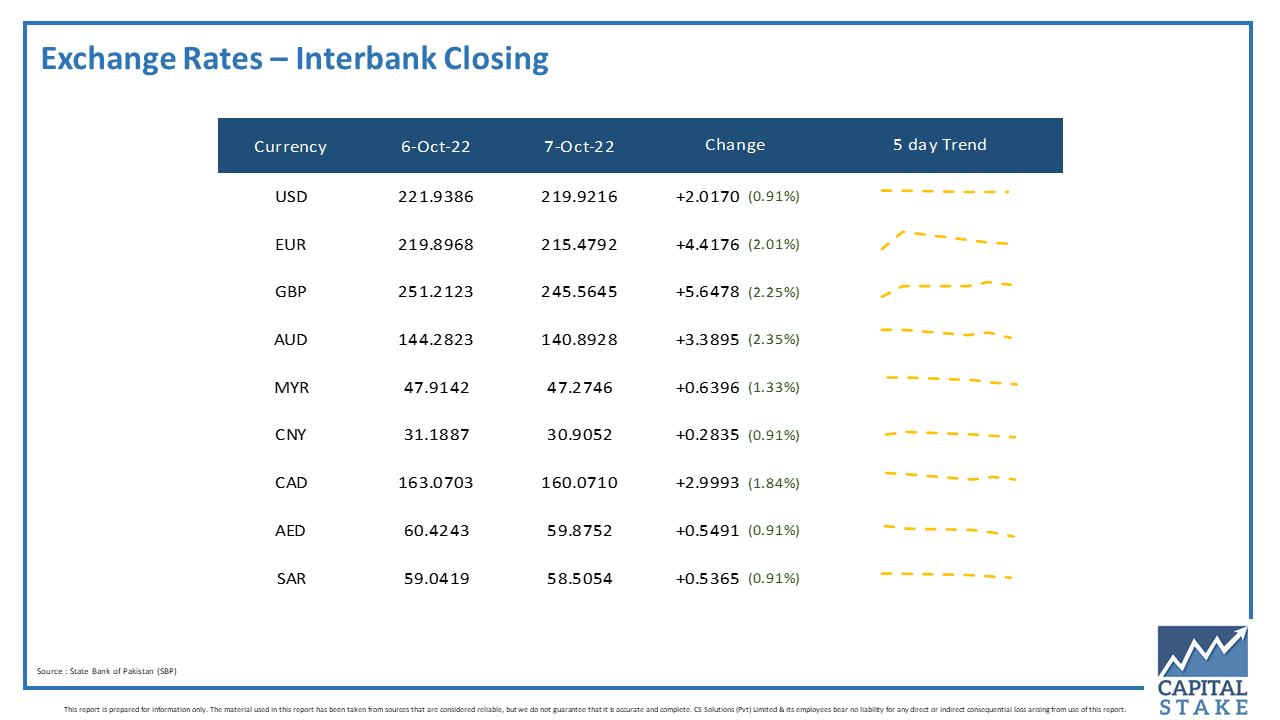

The PKR gained higher against the other major currencies in the interbank market today. It gained 53 paisas against the Saudi Riyal (SAR), 54 paisas against the UAE Dirham (AED), and Rs. 4.41 against the Euro (EUR).

Moreover, it gained Rs. 2.99 against the Canadian Dollar (CAD), Rs. 3.38 against the Australian Dollar (AUD), and Rs. 5.64 against the Pound Sterling (GBP) in today’s interbank currency market.

What about this skyrocket inflation??

It doesn’t make any sense