The world economy is facing severe headwinds amid weak growth prospects, elevated inflation, and heightened uncertainties.

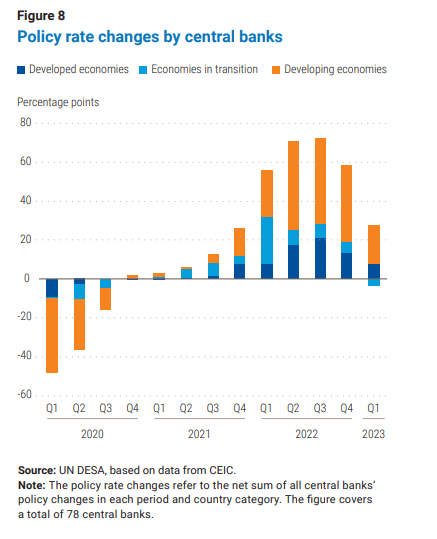

Persistently high inflation has prompted the most aggressive interest rate hikes in decades, causing financial conditions to tighten sharply and exacerbating debt vulnerabilities, particularly in emerging economies like Sri Lanka and Pakistan.

According to the ‘World Economic Situation and Prospects as of mid-2023’ report of the United Nations, inflation rates in Pakistan and Sri Lanka are expected to remain in double digits in the coming months owing to weakening local currencies and supply-side constraints. Domestic food inflation remains elevated due to country-specific factors, challenging food security across the region, particularly in Afghanistan, Bangladesh, and Pakistan.

While economic prospects remain subdued, the slowdown in global growth in 2023 is likely to be less severe than previously expected, mainly due to resilient household spending in developed economies and recovery in China. Global growth is now projected to slow from 3.1 percent in 2022 to 2.3 percent in 2023, an upward revision by 0.4 percentage points from the January forecast.

South Asia

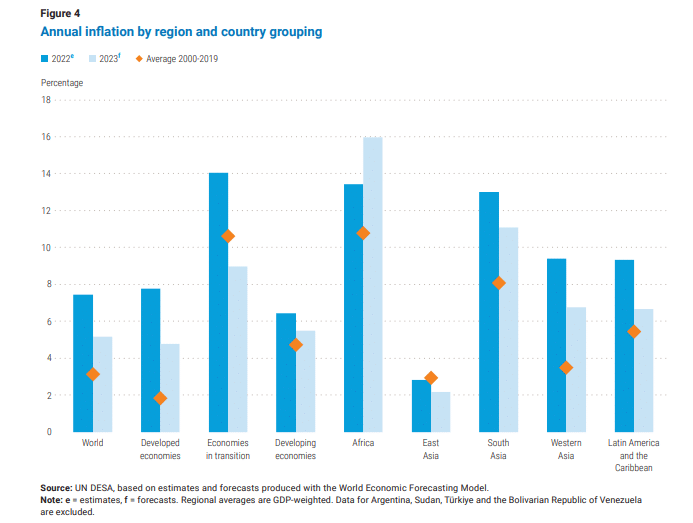

According to the report, annual inflation will remain well above the long-term average, especially in Western Asia, South Asia, and Africa.

Although global food prices have been declining since mid-2022, domestic food inflation has often stayed elevated due to a number of factors, including still-high import costs, local supply disruptions, and market imperfections.

The aggressive tightening of global monetary policy since early 2022 has significantly exacerbated fiscal and debt vulnerabilities and further constrained fiscal space in many countries, especially in sub-Saharan Africa, South Asia, Latin America, and the Caribbean.

Borrowing costs have risen sharply and the strong dollar – despite some softening in recent months – has pushed up the debt-servicing burden of dollar-denominated debt.

World

Global inflation is projected to decline from 7.5 percent in 2022 to 5.2 percent in 2023, mainly due to lower food and energy prices and softening global demand. Amid easing inflationary pressures, the global economy is expected to pick up some momentum in 2024, but at 2.5 percent, growth is projected to remain well below the longer-term (2000-2019) average of 3.1 percent.

Against a backdrop of multiple interconnected crises and heightened macroeconomic uncertainties, monetary and fiscal policy challenges have further intensified. The recent banking sector turmoil in the United States and Europe has illustrated fragilities in the financial system, complicating the trade-off for central banks between fighting inflation and preserving financial stability.

After a decade of loose monetary policy with low-interest rates and quantitative easing in developed countries, which encouraged excessive leverage in the financial sector and generated negative global spillovers, the prospect of high-interest rates and quantitative tightening now poses a massive challenge for developing countries.

Lack of access to affordable finance limits the ability of many governments to invest in education, health, sustainable infrastructure and the energy transition while threatening to push a growing number of countries into debt default.

Overall, prospects for a robust global economic recovery remain dim. The UN survey sees a prolonged period of low growth globally. Global inflation is expected to average 5.2 percent in 2023, while the same metric in many countries is expected to remain well above central banks’ targets.