Pakistan’s benchmark KSE-100 index witnessed an increase after four quarters, with the index up by 4% on a QoQ basis. It also rose 3% in USD terms in 2Q2023.

According to Topline Securities, despite economic and political challenges during the quarter, the market experienced growth due to expectations of conclusion of IMF 9th review.

However KSE 100 index remains unchanged YoY in FY23 as against decline of 12% in FY22.

As per Bloomberg data, Pakistan was not amongst the top or worst performers during this period. Switzerland (+45%), Zambia (+30%), and Polish (+24%) were the top performing markets during the quarter, whereas Nigeria (-33%), Laos (-14%), and Turkey (-12%) were the top worst markets. These are total returns in USD terms.

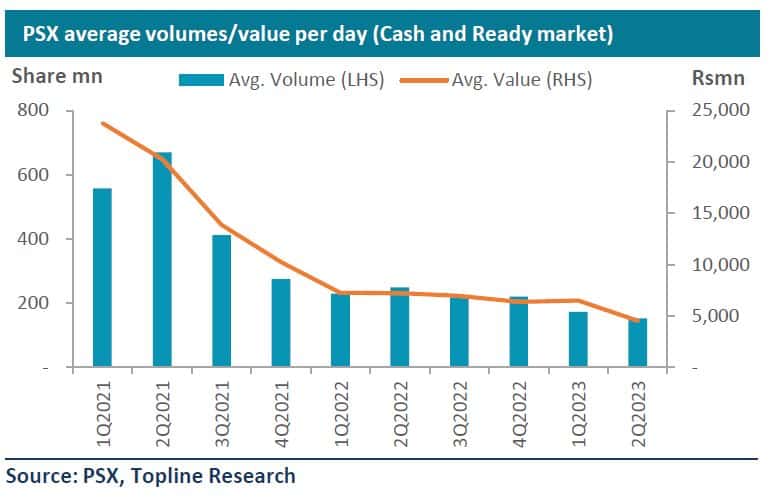

In 2Q2023, average traded volumes in the Cash and Ready market declined by 39% YoY and 12% QoQ to 153mn shares/day. The average traded value also deteriorated by 37% YoY and 30% QoQ to Rs4.5bn/day during 2Q2023.

The average volumes in the Futures market also declined by 35% YoY and 5% QoQ to 69mn shares/day. The average traded value of the same declined by 25% YoY and 26% QoQ to Rs2.5bn/day.

Foreign Corporates turned key seller in the market during 2Q2023 with net selling of US$10mn during the quarter. To note, In last 7-years (2016-2022), foreign corporates have sold shares worth of US$2.5bn at PSX.

On local side, Mutual Funds were top sellers during the quarter with net selling of US$31mn followed by Insurance with net selling of US$17mn. On other hand, Individuals, Companies, and Banks were amongst major buyers with net buying of US$27mn, US$15mn, and US$13mn, respectively.

Key sectors that outperformed market during the quarter included Synthetic & Rayon, Chemical and Leasing sectors. However, sectors that underperformed were Transport, Modarabas and Technology.