The Pakistani rupee closed the week with losses against the US Dollar during intraday trade today after opening trade at 277 in the interbank market.

At 11 AM, it was initially bullish, rising to 276.5 after gaining 59 paisas against the greenback.

Later, it dropped to the 277-278 level between 12:30 PM and 3:15 PM with the interbank rate tipped by traders earlier today to close below yesterday’s close.

Open market rates across multiple currency counters surged to the 282-287 range.

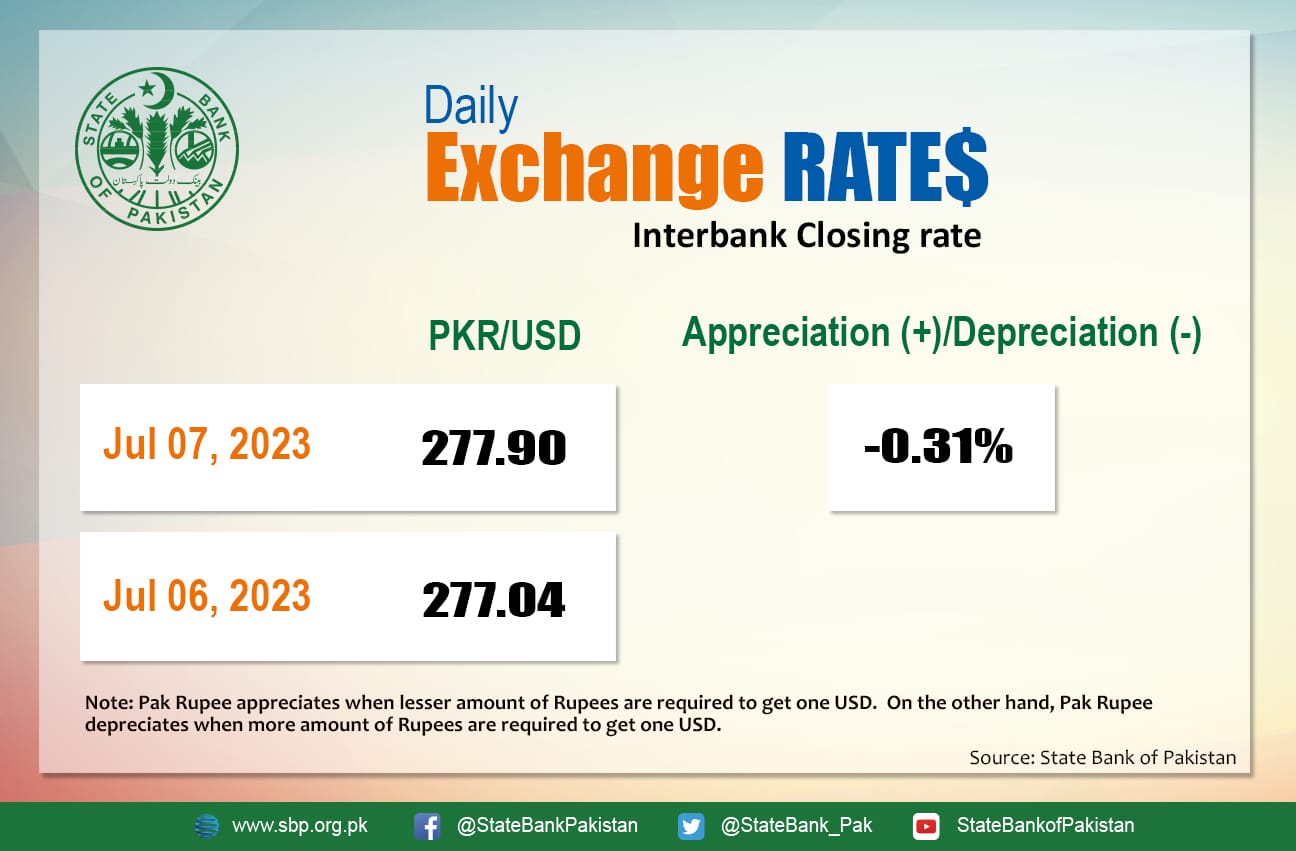

At close, the PKR depreciated by 0.31 percent to close at 277.9 after losing 86 paisas against the dollar today.

The informal exchange rate had recovered massively and at 11:30 AM rose to the 278 level, before falling to 284.

Today’s cash rate per dollar in Hundi stayed between 286 and 292, while many channels (undocumented) reported rates as high as 298.

Today’s losses come with new speculation that the PKR could drop to 293.52 against the US Dollar by the end of September 2023 to as low as 317-340 by June 2024.

Analyst expectations at Trading Economics see the PKR falling to 293.52 against the greenback to as low as 317.29 by June next year. Meanwhile, Pakistan’s Ministry of Energy (Power Division) projects the PKR to touch 325 against the USD by the end of this fiscal year.

Adding more fuel to the fire, Bank of America (BoFA) Securities said in a report on Wednesday that debt, high inflation, and an ever-increasing central bank policy rate could push the rupee to as low as 340 against the dollar by June 2024.

One trader told ProPakistani that this week’s volatility with bleak expectations for next week’s meeting of the IMF Executive Board drove the PKR into the corner.

“SBP reserves have been on a good 2-week winning streak but the broader expectation of IMF’s $1.1 billion disbursal coupled with political developments and uncertainty on upcoming electoral proceedings are significant factors impeding the exchange rate. The fairytale week will end today. Expect similar trends to persist next week onwards,” he added.

Pertinently, Pakistan is experiencing a severe liquidity crunch in external and domestic debt servicing, and traditional strategies to maintain financial stability are becoming constrained. The optimism surrounding IMF’s assistance is a plus for wider markets for the short-term but its implications offer a bleak turnout for months to come.

Overall, the rupee is down nearly Rs. 52 since January 2023. Since April 2022, it is down over Rs. 100 against the greenback. As per the exchange rate movements witnessed today, the PKR has lost 86 paisas against the dollar today.

The PKR was bearish against most of the other major currencies in the interbank market today. It lost 22 paisas against the Saudi Riyal (SAR), 23 paisas against the UAE Dirham (AED), Rs. 1.69 against the Euro (EUR), and Rs. 1.7 against the Pound Sterling (GBP).

Conversely, it gained 45 paisas against the Australian Dollar (AUD) and 61 paisas against the Canadian Dollar (CAD) in today’s interbank currency market.

This is the best time govt given to inverters to buy bucks than sell in September onwards to enjoy leaving common man on verge or inflation.