The Pakistani rupee rebounded against the US Dollar during intraday trade today after opening trade at 286 in the interbank market.

At 12 PM, it was bullish, rising as high as 283 after gaining ~Rs. 3.9 against the greenback.

Later, it dropped to the 287 level between 12:30 PM and 1:15 PM and stayed at that level before rising to 286.

Open market rates (documented) across multiple currency counters rose to the 291-294 range.

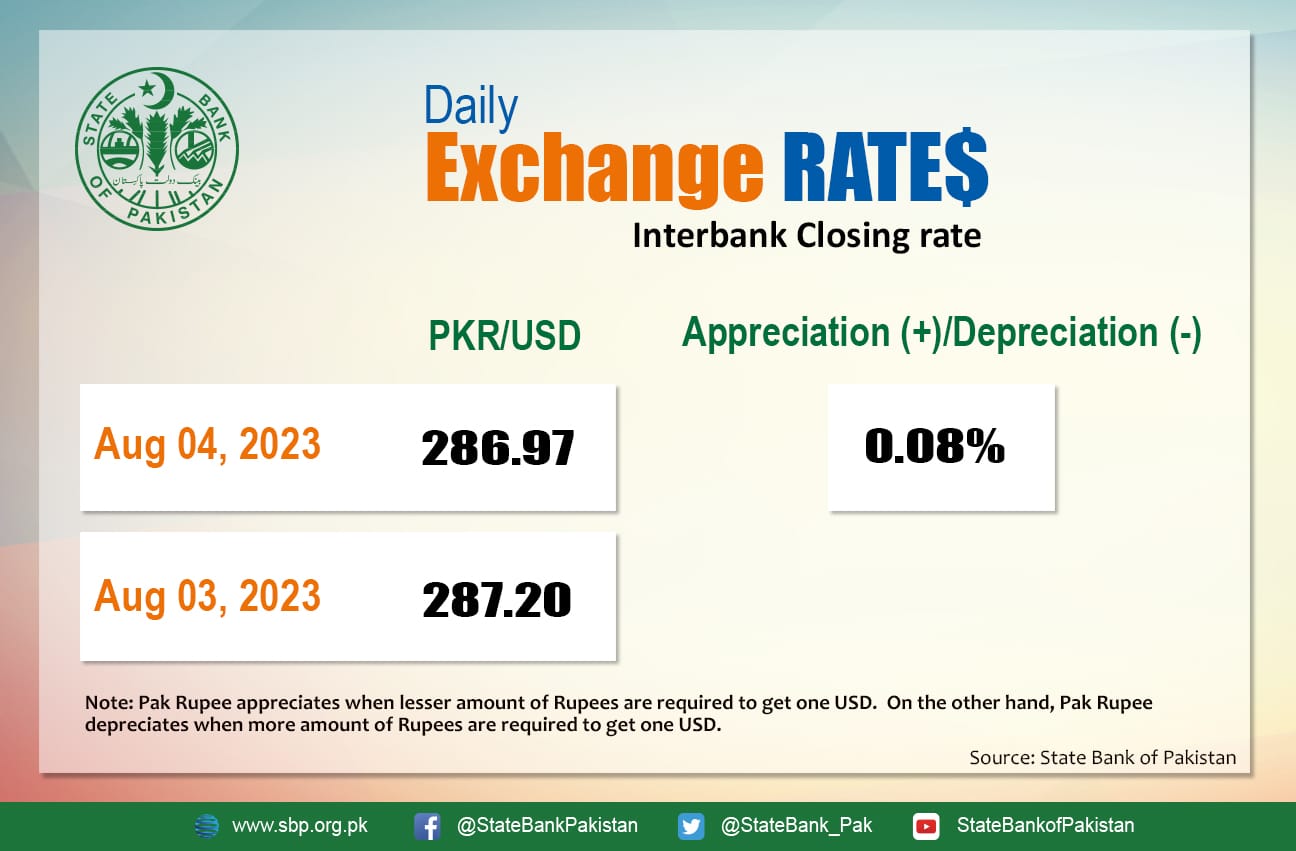

At close, the PKR appreciated by 0.08 percent to close at 286.97 after gaining 23 paisas against the dollar today.

The informal exchange rate initially docked at 296-300.

Today’s cash rate per dollar in Hundi clocked in at the 298-302 band while many channels (undocumented) reported rates as high as 304.

Today’s gains come with little demand for the greenback at exchange counters since Wednesday. A trader said the brief respite was welcomed but the outlook remains the same; the PKR will maintain a seesaw trend in the weeks to come. “300 is the target, 295 is resistance,” one of them added.

The foreign exchange reserves held by the central bank declined marginally on a weekly basis, according to data released by the State Bank of Pakistan (SBP) on Thursday.

On July 27, the foreign currency reserves held by the SBP were recorded at $8.153 billion, down $32 million compared to $8.186 billion on July 21. In a statement, the central bank said that the decrease was on account of debt repayments.

Overall, the rupee is down nearly Rs. 63 since January 2023. Since April 2022, it is down over Rs. 113 against the greenback. As per the exchange rate movements witnessed today, the PKR has gained 23 paisas against the dollar today.

Global

The US dollar lost some ground on Thursday, but it managed to rebound today globally. The USD Index, which measures the value of the US dollar against a basket of six major currencies, rose above 102.80 in the European session on Thursday before falling back to around 102.50.

Market players will be closely watching the July US jobs report ahead of the weekend. Nonfarm payrolls are expected to increase by 200,000. The unemployment rate is predicted to remain at 3.6 percent, while annual wage inflation is expected to fall to 4.2 percent from 4.4 percent in June. Because of the potential impact on the Federal Reserve’s policy outlook, the USD’s valuation could be influenced by the labor market report in the American session.