Cotton market prices have finally started to recover after weeks of downward turn as the quality issues remain a critical issue in local procurement.

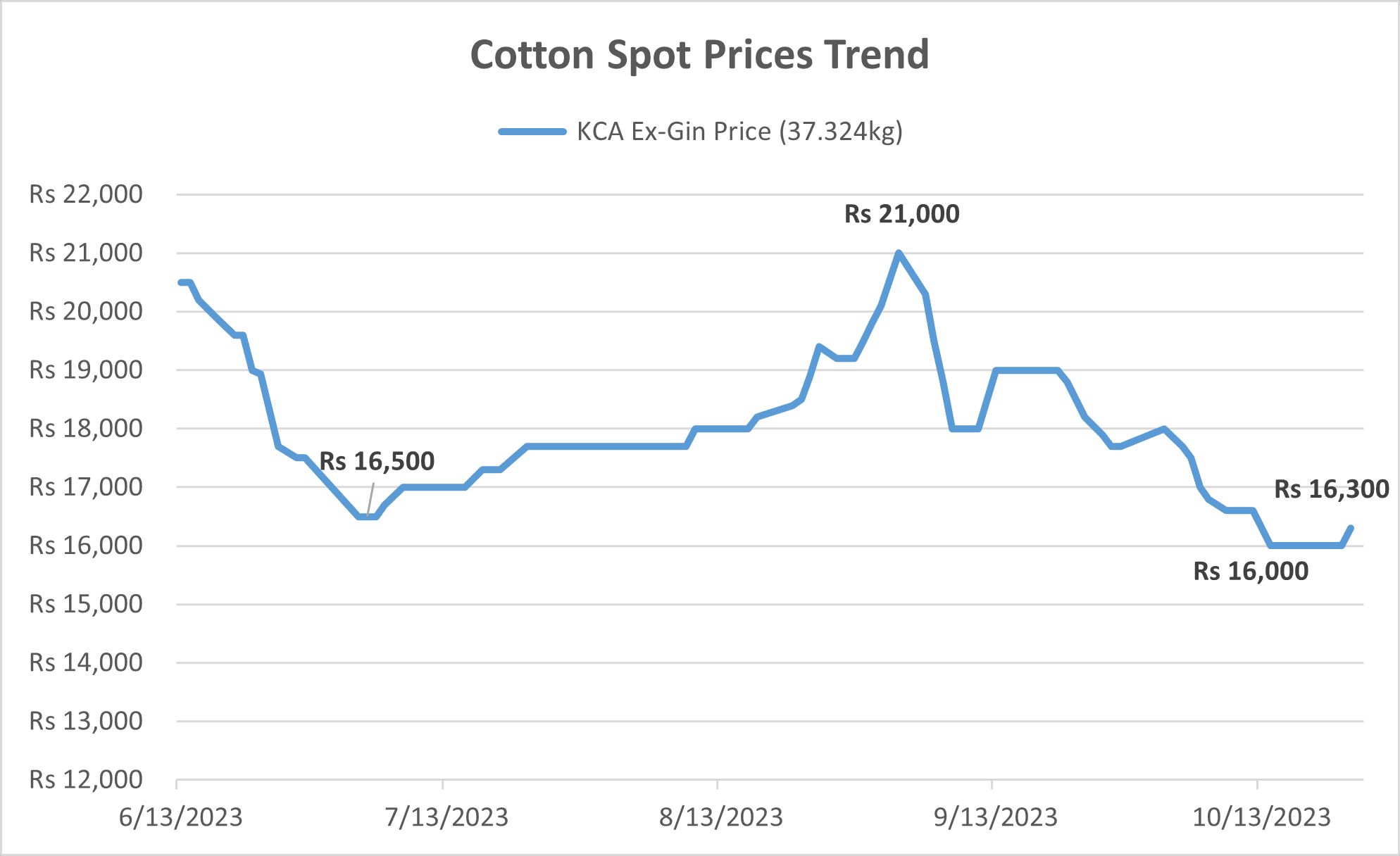

Karachi Cotton Association today raised the spot prices by Rs. 300 per maund, posting a first increase after a decline of Rs. 5,000 per maund from Rs. 21,000 since the start of September to Rs. 16,000 per maunch during last week.

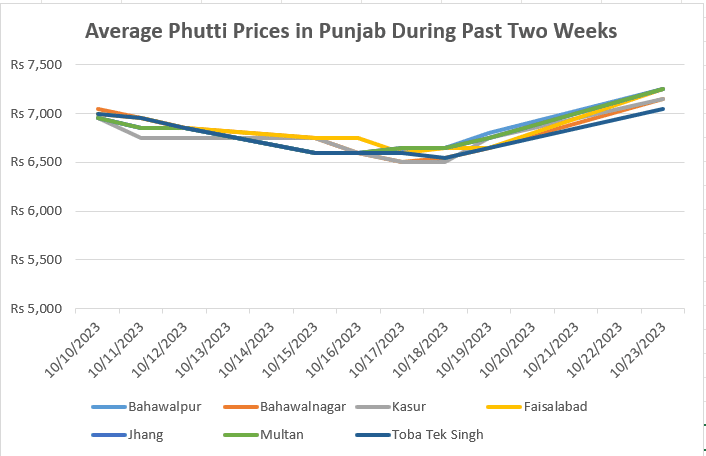

Phutti prices across major markets in Punjab i.e. Bahawalnagar, Bahawalpur, Jhang, Multan, Faisalabad and Toba Tek Singh have recovered by up to Rs. 600 per maund to more than Rs. 7,200 per maund after touching as low as Rs. 6,600 per maund.

The primary contributor behind the previous decline was the dollar’s steep fall from Rs. 307 to below Rs. 280, an increase in arrivals and expectations of bumper crop production of over 12 million bales and an administrative crackdown over hoarding essential commodities that scared away traditional ‘investors’ in the market.

But as per our conversation with market analysts, the bumper crop estimates have fallen in the wake of whitefly attacks that annually cost 1.5 million bales to the country, quality Cotton is in low supply and textile millers have heavily traded fiber in the past week resulting a demand resurgence in the Cotton market and Dollar’s continuous fall against rupee has also come to an end.

“Pakistan local Cotton prices are at 70 cents per lb compared to 85 cents per lb internationally due to the low quality caused by monsoon rains and pest attacks and imports have also lowered as the industry was expecting a bumper production. If the arrivals decline and the quality improves since October has seen lower rainfall compared to September, prices are expected to improve further”, commented Javed Hassan, Cotton Advisor at All Pakistan Textile Mills Association (APTMA) while talking to ProPakistani.

On the other hand, Pakistan Kissan Ittehad reportedly alleged that some elements in the federal government are overestimating the Cotton output to keep the prices low. The Federal Committee on Agriculture (FCA) in a recent meeting put its Cotton production estimate at 11.7 million bales, higher than expected by market analysts. After years of destruction due to monsoon and pest attacks, Cotton sowing has moved to as early as September over the year which means that arrivals may have already peaked in September.

“Practically the production of 11.7 million bales doesn’t seem possible looking at per hectare yield and planted area that is 2.7 million hectares @ 650 kg/hectare average. The harvested area can max reach 85% of the planted area i.e 2.2 million hectares which will result in the production of approximately 9.5 million bales of 170kg” explained Talha Qureshi, Procurement Manager at Siddiqsons Group talking to ProPakistani

It should also be noted that farmers may not wait for third and fourth pickings if the prices remain low just to delay Wheat sowing which offers ensured returns due to the government support price. Last week, the prime minister ordered a crackdown against Cotton buying below the official support price of Rs. 8,500 per maund in coordination with provincial governments. The government announced support price for Cotton was a major cause for the increase in acreage but so far the authorities have failed to enforce the support price.

“It was not an overestimation but environmental circumstances and pest attacks have affected the Cotton output significantly in Punjab. If per acre yield in Punjab was also as high as it has been in Sindh, production could have been a lot higher. Late Wheat harvesting hampers the early Cotton cultivation for which we need to support yielding Wheat hybrids so some of its acreage can be shifted to oilseed crops which will eventually enable early Cotton cultivation”, added Hassan.

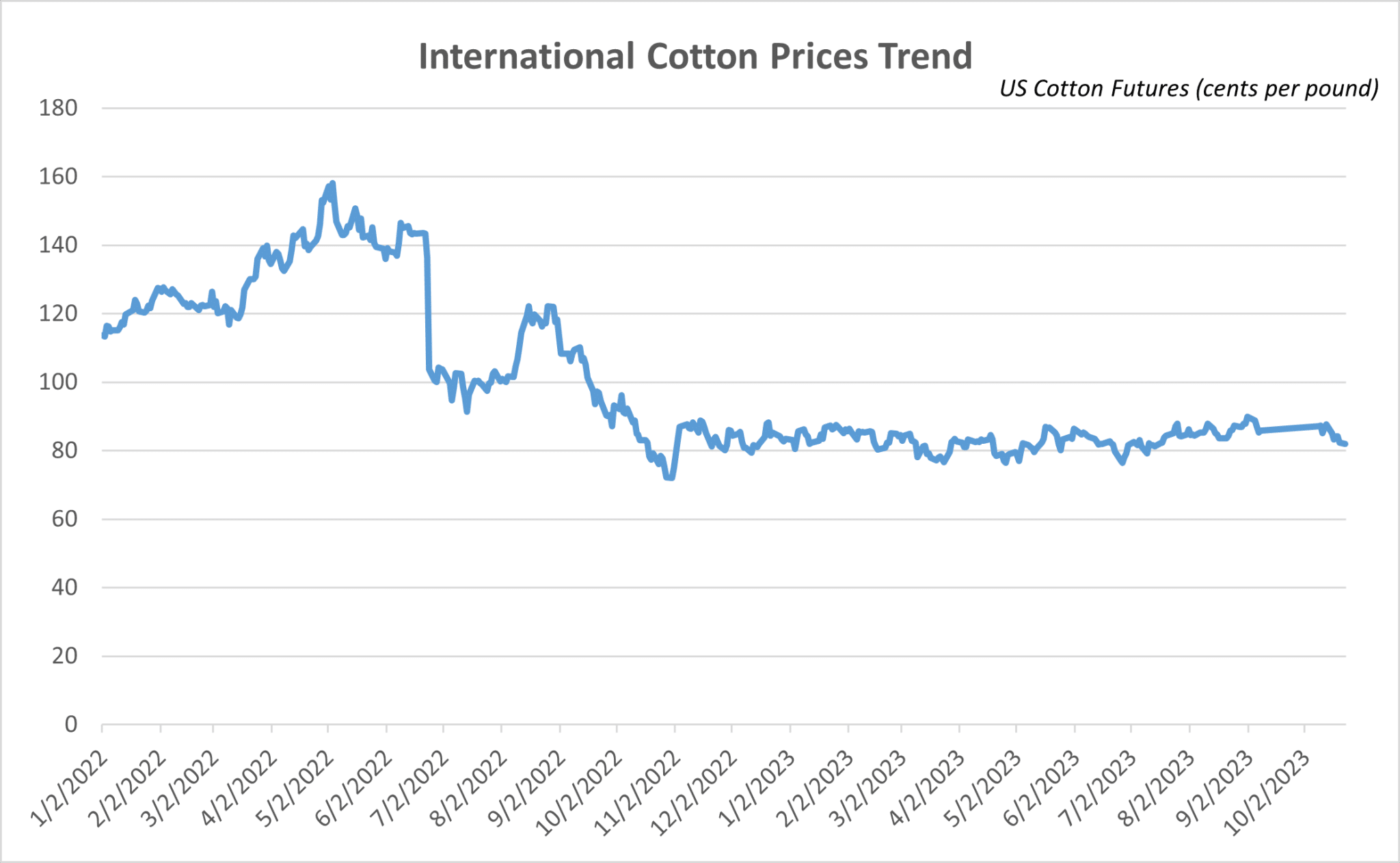

On the other hand, International Cotton prices have remained overall stable in 2023 after dropping to 72 cents per pound in December 2022 from a historical peak of 158 cents per pound in May 2022.

The decline was driven by waning demand in China and post post-pandemic commodity shock ended but the prices have improved in recent months as reductions for the United States, India, the African Franc Zone, Greece, and Mexico more than offset an increase for Brazil according to the USDA September outlook while the consumption has also declined on yearly basis.