When deciding to buy a new car, many people get slightly torn between the financing options. The two most commonly preferred options are of course, buying the new or used car with the capital that you have. And the other one is car leasing, which allows you to get the car of your choice without paying a large amount of capital in one go. The latter is relatively much easier. Which is why, this article shall be all about how to get approved for a car lease. Read the entire article to know about the procedure of car leasing of different Pakistani banks.

How to Get Approved for Car Lease | Pakistani Banks

Leasing a car can be a good option for individuals who don’t have enough funds buy a car. It gives individuals the option to own the car by making low monthly installments for a period of up to 7 years. In Pakistan, different banks offer the facility of car leasing for both new and used cars. This leasing facility from the banks has made it easier for the majority to afford the car.

Also Read: How to pay your bills online

So, without further ado, let’s look at some of the banks that provide this facility to the customers.

Meezan Bank | How to Get Approved for Car Lease

Meezan Bank with its Car ijarah facility gives customers the chance to get interested in free financing for acquiring a car. In this car ijarah agreement, the bank purchases the car and rents it out to the customer for a period of 1 to 7 years. Upon the completion of agreement the vehicle will be sold at a token amount or will be gifted to the customer.

Eligibility Criteria for Car ijarah

Meezan Bank has set eligibility criteria for customers in order for them to get car financing from Meezan. To know about the terms and conditions of car financing, you can refer to the image given below. It is for both salaried and business persons.

Required Documents

You must have the set of following documents with you when you’re applying for the car leasing facility.

- Application form duly filled and signed by the applicant

- Copy of recent payslip (for salaried individuals)

- Business proof such as business association letter, NTN, or Tax returns (For business individuals)

- Bank statement of the last six months

- One recent photograph

- Specimen signature card preferably on bank prescribed format

How to apply for Meezan bank car ijarah service? Just read the following instructions

Procedure

- Go to any nearest Meezan Bank branch.

- Fill out the application form.

- Attach the required documents and submit your application.

- The bank will let you know in 7 to 10 working days about car financing approval.

Note: You can also calculate different payment plans for different cars on Meezan Bank official website.

HBL | How to Get Approved for Car Lease

HBL is another major bank that allows the customer to get hassle-free and flexible car leasing. They have some set of features for car financing which are as follows.

- The bank gives financing limit between PKR 200,000 to PKR 5,000,000

- The amount must be repaid within 7 years (5 years for used car financing).

- The bank provides the option to choose between fixed and floating rate

- The bank offers dedicated after-sales service

Eligibility Criteria

See the eligibility criteria given below if you want to approve car leasing from HBL.

Salaried Individuals

- Must be a Pakistani citizen

- Applicant has to be 22 years or more at the time of application and 60 years or less at the time of maturity.

- Must have a minimum monthly income of PKR 20,000

Self-employed/business persons

- Must be a Pakistani citizen

- Applicant has to be 22 years or more at the time of application and 70 years or less at the time of maturity

- Applicant must have a minimum monthly income of PKR 25,000

Required Documents

The applicant must have the following documents to apply for car leasing.

Salaried Individuals

- Original CNIC along with a verified copy of CNIC

- Two recent passport size photographs

- Latest original salary slip and personal bank statement of last three months

Self-employed/business persons

- Original CNIC along with a verified copy of CNIC

- Two recent passport size photographs

- Bank statement for last 6 months and bank letter confirming details of the account

- Proof of business

If you meet the criteria set by HBL and have the required documents, then you can apply for the car lease by following the instruction given below.

Procedure

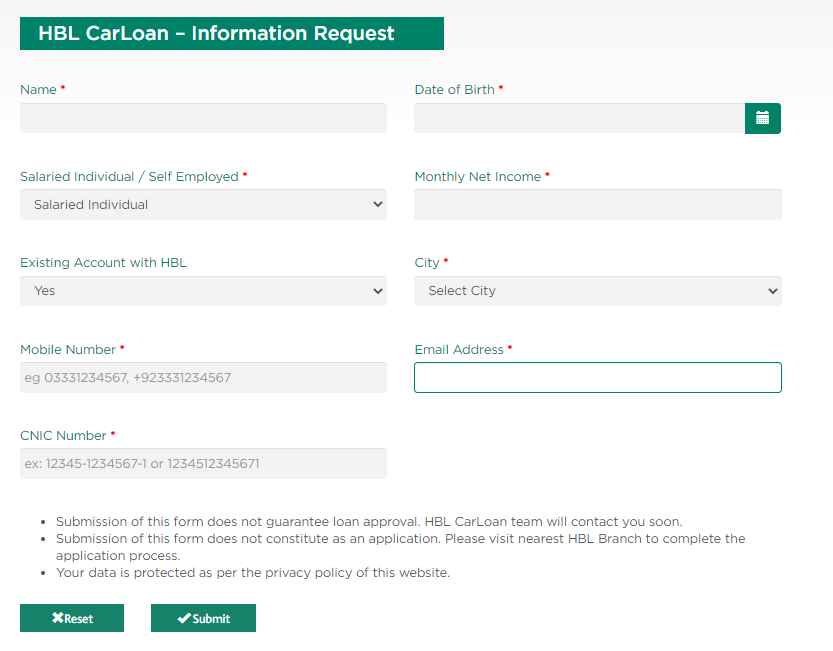

- Access HBL official website.

- On the car loan page, you will see the “I’m interested” option. Click on it.

- A form will appear on your screen, fill the required details and submit it.

Note: The submission of form will not guarantee the approval of car lease. After the form submission, HBL representative will contact you and will tell you to visit the nearest HBL branch for further process.

How to Get Approved for Car Lease | Bank Alfalah

Just like other banks, bank Alfalah also provide the facility of easy car financing. The customers can avail the facility if they meet certain requirements and have the required documents. Read the following instructions to know all about Bank Alfalah car leasing.

Eligibility Criteria

Following is the eligibility criteria for salary and business individuals.

Salaried Individuals

- Must be a Pakistani National Identity Card Holder

- Minimum Salary PKR 30,000/- (Salaried individuals)

- Minimum 21 Years to 65 Years at the time of loan maturity for Private Sector Employees and 60 Years for Government Sector Employees

Business/ Self-employed Individuals

- Must be a Pakistani National Identity Card Holder

- Minimum Income: PKR 50,000/- per month (Assessed on Bank Statement or Documentary Evidence)

- Minimum 1 year in the current business and minimum 21 to 70 years at the time of loan maturity.

For required documents, refer to the image given below.

How to apply for a car lease? Simply

- Open bank Alfalah website.

- Go to the Auto loan page.

- At the bottom of the page, you will see the “Apply now” option. Click on it.

- Provide all the required information and submit the application.

Note: You have to visit the branch to complete the car lease process.

Askari Bank | Car Lease

Askari Bank is another major bank that offers the facility of car lease to the consumers. Just like other banks, Askari bank offers car financing for new, used and imported cars. For your convenience, we have attached a link to provide all the details about eligibility criteria, markup rates and tenure of the lease. Click here.

Required Documents

- Application Form duly filled in all respects

- Copy of valid CNIC

- Salary Slip / Proof of Income

- Bank Statement

- Copy of the latest utility bill with no overdue in the current month

- 2 Passport size photographs

- Biometric Verification

Following is the procedure of applying for car lease from Askari Bank.

Procedure

- Access the Askari bank website.

- Drag your cursor to the personal tab, you will see the “Ask4car” option. Click on it.

- Now click on “how to apply”.

- After that, fill the form and submit it.

Note: The bank representative will contact for further details and will ask you to visit the branch as well.

To get the approval of car lease from Pakistani banks, you must have all the documents and must meet the requirements set by the banks. All the aforementioned points will help you to get approval from these banks. Tell us what you think about this article in the comments section.