- Open FBR IRIS portal, click on registration for an unregistered person and give all relevant information

- Open the IRIS portal again and click on e-enrolment from the different options.

- Enter all the details such as you CNIC, mobile number etc to complete registration process.

- Login in to your account and enter all your income details in the form. Congrats you are tax filer now.

- Type ATL (space) 13 digit CNIC number and send SMS to 9966, to check whether you are on active taxpayer list or not.

Learn How to Become a Filer by Reading the guide below!

Pakistan is one of the countries in the world with the lowest tax-to-GDP ratios. The tax-to GDP ratio tells about country development in a year. With higher Gross Domestic Product (GDP) of a country, more the revenue of a country will be. Therefore, the government will try to increase the tax base. This is what the government of Pakistan is trying to do.

According to a statistic from the Federal Board of Revenue (FBR) Pakistan, only 1% of the total population are active taxpayers. It’s embarrassing for a country of 220 million population. However, the Government of Pakistan is trying to address this area. With changes being made in the Federal Board of Revenue (FBR), we can expect an increase in the percentage of the active taxpayers.

Categorization of Citizens for Tax

Without boring you more with tax and GDP information, we will get straight to the point which is how to become a filer. The Government of Pakistan categorize its citizen in two groups, one is filer and other is non-filer. A filer is a person that is on the FBR active taxpayer list. On the other hand, non-filer is a person who is not on an active taxpayer list.

What is an active taxpayer list? FBR manage a detailed list of the taxpayer which is called Active Taxpayer List (ATL). The list is updated on the first day of every week. You can download the list to check whether you are on it or not. However, we will discuss how to check ATL status later in the article. But first, we will discuss the perks of being a tax filer.

Perks of being a Tax Filer

The Government of Pakistan gives many incentives to tax filers so that more people get encouraged to become a tax filer.

- The tax filers have to pay less vehicle token tax as compared to non-filers. For instance, if the vehicle token tax for non-filer is 20,000 then for filer it will be 10,000.

- If you are a filer then you have to pay 0.3% withholding tax on every transaction of more than 50,000. In contrast, the non-filers have to pay 0.4% withholding tax.

- When a tax filer buys an immovable property then he or she has to pay 50% less tax as compared to non-filers.

These are some of the perks which tax filers get from the Federal Government. Now the question is how much income in a year is taxable? There are different tax slabs created by FBR. If your income is more than 6 lacs per year then you have to pay the income tax. If it is less than 6 lacs per year then you are not liable to pay income tax. However, you have to file a return to declare your income without paying any taxes.

To Become a Filer

Now the thing is, if you want to become a filer then you must have to get a National Tax Number (NTN) from FBR. How to get NTN? Just read the article related to NTN on our website. You will be able to gather all information related to it.

How to become a filer? Simple just go to FBR website and create an account on it.

The first step in becoming a filer is to get NTN from FBR. Check out our article about NTN for a detailed guide. However, for your convenience, we will tell you again the complete procedure of it.

Getting NTN from FBR

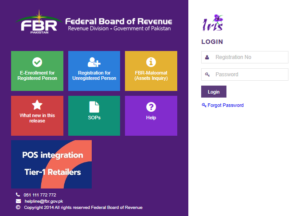

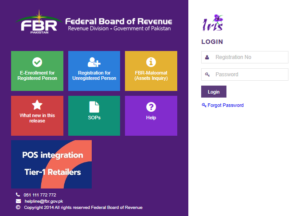

- Firstly, you have to open the FBR IRIS portal using the link below.

https://iris.fbr.gov.pk/public/txplogin.xhtml

- After that, click on registration for an unregistered person.

- Enter all details in the form which are asked from you such as CNIC number, name, address etc.

- You will receive two codes from FBR through SMS or email.

- After that, you have to enter the codes in the relevant field.

- Click on submit button and your account will be created.

- Now you have to log in to your account. FBR will send you the username and password sent to you via email or SMS. Use the username and password to log in to your account.

- After that, click on draft and you will see a 181 application form.

- You need to click on the edit button, to enter your details for NTN.

- Now just enter all the information in the form and attach all the relevant documents.

- Congratulations you will get an NTN from FBR in few hours.

Documents Required for NTN

- Copy of valid CNIC.

- Copy of recently paid electricity bill of the house (not older than 3 months).

- Latest payslip.

- Contact Numbers (Mobile & Landline) and valid Email address.

- National Tax Number (NTN) of Employer, Office Address, and valid Email address.

- For business NTN, you need to tell about the nature of the business, have to attach business letterhead and property or rental papers.

After you get NTN from FBR, you have to go back to the IRIS portal and have to follow the steps given below.

How to become a filer | Enrollment of a Registered Person

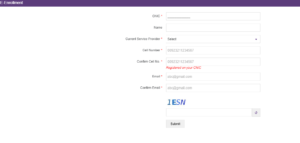

- When you are done with registering yourself in the FBR system then you have to open the IRIS portal again with the following link.

https://iris.fbr.gov.pk/public/txplogin.xhtml

- After that, click on e-enrolment for registered person.

- A form will appear on your screen.

- Fill out all the information like CNIC number, name, cell number and valid email address etc.

- After that click on submit button.

- When you complete this e-enrolment registration, you will receive a password from FBR via SMS or email.

- Now enter the CNIC number in Registration No field and enter the password you received via SMS from FBR. Click on login.

- You will see the same draft option in it. You have to edit the form.

- Enter the relevant information in the Personal Tab, Business Tab, Property Tab, Link Tab and Bank Account tab. Attach the relevant documents in it as well.

- The information should be correct and should be of the current fiscal

- Click on submit button and you are done with this long process.

- After that, you will receive a confirmation email from FBR.

You can also check the Active Taxpayer list whether you are added in the list or not. How to check active taxpayer list (ATL). To find out follow the steps given below.

How To Check Active Taxpayer Status

There are different ways to check whether you are on the active taxpayer list or not. There is a complete income tax ATL available on FBR official website. You have to download the list and find your name in it.

- Open the FBR official website.

- Click on “ATL income tax“. After that, you will see an active taxpayer list for income tax which you can download into your computer.

- Download the list and check your name in it.

There is another way to check the ATL status. You can check the status via SMS. How to do it? Don’t worry we will tell you.

Checking ATL status via SMS

To check the status via SMS, you have to follow the steps given below.

- Open your mobile phone message app

- Type ATL (space) 13 digits CNIC number and send it to 9966

- In case of checking ATL status of AOP or company, you have to type ATL (space) 7 digits NTN and send it to 9966.

Checking ATL status via Online Portal

To check the status via an online portal, you have to follow the steps given below.

- Open the following link in your web browser

https://e.fbr.gov.pk/esbn/Service.aspx?PID=Dbue2kxCaiyqHHkwEvtwFA==

- You will see two blank fields of Registration No and date respectively.

- After that, enter your CNIC or NTN in the Registration No field.

- You have to type the date as well.

- There is a captcha code given below the blank field. Write the code as it is and click on verify.

- After that, you will see ATL status.

These are some of the ways to check the ATL status. You can also become tax filer with FBR offline system. However, you have to hire a tax advisor to do your work. He or she will take all your documents to the regional office of FBR and will complete the procedure for you. But we suggest you use the online FBR system. It is easy and convenient as well. Yes, it will take some time to become a filer. However, if you want to enjoy perks of being a filer then taking out a few hours from your day is nothing. Therefore, to remain a non-filer in Pakistan is no brainer.