Bank Alfalah is the 5th largest private Bank in Pakistan with a network of over 600 branches in more than 200 cities across the country. Bank Alfalah opens up a world of benefits and gives its customers financial freedom that allows them to enjoy their life as they want to. With Bank Alfalfa’s credit card, you can enjoy supreme services and amazing discounts whenever you travel, shop or dine out. If you are a Bank Alfalah account holder and want to get a credit card, you ought to know the following steps:

Method -1 Call Bank Alfalah Helpline

You would have a few choices of credit cards that you can choose. To get more details, call 111-225-111. The customer care representative will provide you all the relevant information regarding the whole process.

After that, the bank representative will visit you at your given address and will give you a form to fill. When you’re done with the form, the sales representative will tell you to wait for further instructions from the bank. The bank will call at your workplace to confirm all the details. After completion of the verification process, you will get your credit card within a month.

Method – 2 Apply Online

Bank Alfalah gives this online option to its customers. With that said, it is best for you to apply online if you’re a customer. With this online service, you can get all the details about different Bank Alfalah credit cards. On the bank website, you get to calculate your eligibility for different credit cards. “How to check that” we hear you ask? Just follow the instructions given below.

- Go to the link https://www.bankalfalah.com/eligibility-calculator-for-credit-cards/.

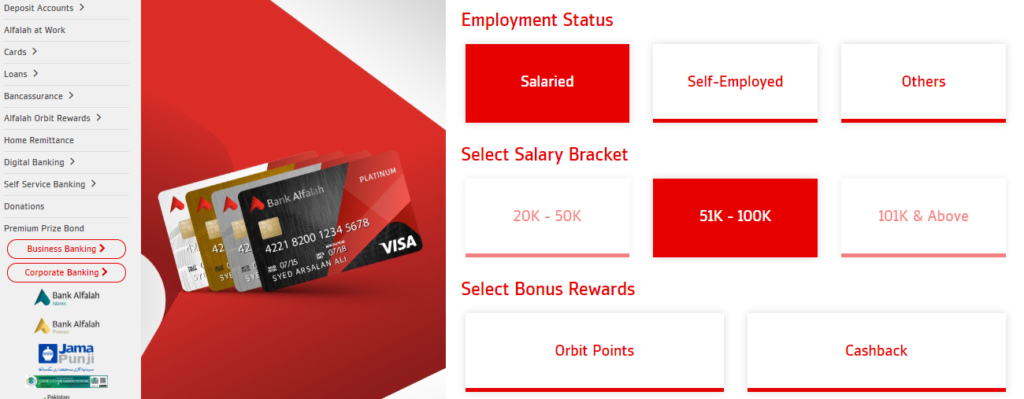

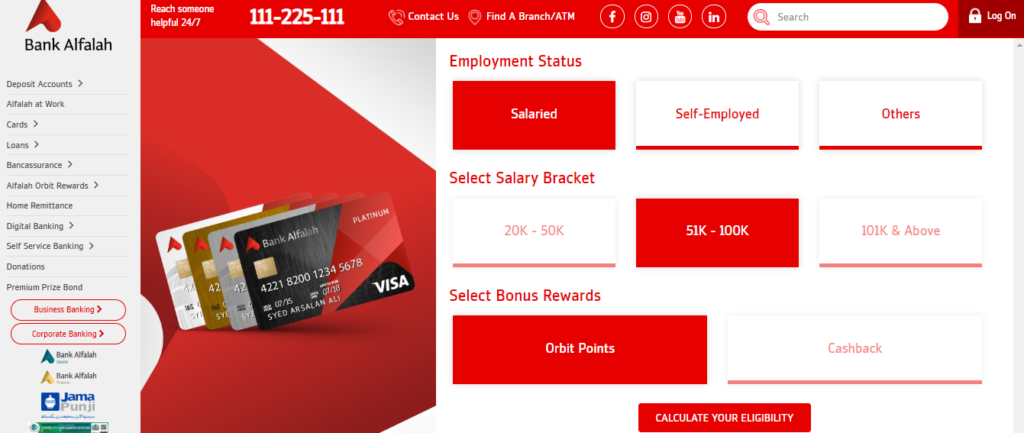

- After that, you will be given three option that include “salaried”, “self-employed” and “others”.

- After selecting the employment status, you have to select the salary bracket.

- Again two options will be given to you regarding the bonus rewards. You can choose either “orbit points” or “Cashback”.

- Next up, click on ‘calculate eligibility’.

- On the screen you will see the credit cards for which you are eligible. Among the available options, select the card you want and click on ‘Apply Now’.

- A form will appear on the screen. Fill all details such as your name, CNIC number, City etc.

- Finally, click on “Submit”.

The bank representative will contact you and ask some questions. The further process is similar to the one mentioned in method 1. If you want to know more about the eligibility criteria of different Alfalah credit cards, then keep reading the article.

Alfalah VISA Platinum Credit Card Eligibility

Salaried Person

- Minimum salary requirement: Rs 100,000

- Age Limit: 21 – 60 years

- Documents required: CNIC, Salary slips, Bank statement, Letter from employer

Self-Employed / Businessmen

- Minimum income: Rs 150,000

- Age Limit: 21 – 70 years

- Documents required: CNIC, NTN, Proof of business, Bank statement

Alfalah Titanium MasterCard Eligibility

Salaried Person

- Minimum salary requirement: Rs 50,000

- Age Limit: 21 – 60 years

- Documents required: CNIC, Salary slips, Bank statement, Letter from employer

Self-Employed / Businessmen

- Minimum income: Rs 60,000

- Age Limit: 21 – 70 years

- Documents required: CNIC, NTN, Proof of business, Bank statement

Alfalah VISA Gold Credit Card Eligibility

Salaried Person

- Minimum salary requirement: Rs 50,000

- Age Limit: 21 – 60 years

- Documents required: CNIC, Salary slips, Bank statement, Letter from employer

Self-Employed / Businessmen

- Minimum income: Rs 50,000

- Age Limit: 21 – 70 years

- Documents required: CNIC, NTN, Proof of business, Bank statement

Alfalah VISA Classic Credit Card Eligibility

Salaried Person

- Minimum salary requirement: Rs 20,000

- Age Limit: 21 – 60 years

- Documents required: CNIC, Salary slips, Bank statement, Letter from employer

Self-Employed / Businessmen

- Minimum income: Rs 50,000

- Age Limit: 21 – 70 years

- Documents required: CNIC, NTN, Proof of business, Bank statement

Alfalah Ultra Cashback Credit Card Eligibility

Salaried Person

- Minimum salary requirement: Rs 20,000

- Age Limit: 21 – 60 years

- Documents required: CNIC, Salary slips, Bank statement, Letter from employer

Self-Employed / Businessmen

- Minimum income: Rs 50,000

- Age Limit: 21 – 70 years

- Documents required: CNIC, NTN, Proof of business, Bank statement

These are the requirements set by Bank Alfalah for different credit cards. After reading this article, we hope that you can be more confident and sure about your choice of credit card and have familiarized yourself to the process a well. Let us know in the comments if you have any questions.