In Simple Laymen Terms – Getting Your Hands On A Standard Chartered Credit Card

- Are you a Standard Chartered Bank account holder? Then this article might just be for you.

- Are you looking to get a credit card? Awesome.

- Age criteria for salaried customers is 21-60 years.

- Age criteria for self-employed customers is 25-65 years.

- Minimum monthly income for salaried customers: Rs 40,000.

- Minimum monthly income for self-employed customers: Rs 70,000.

- You must have a valid proof of income

- All personal data must match info synced with NADRA

Let’s make this short and simple for everyone; having an account at Standard Chartered Bank is not a common thing you hear about. In Pakistan – as it turns out – you need substantial money in your pocket to open a bank account at Standard Chartered in the first place.

Here’s a little long-story-short for you – I’m skipping the storyline; you don’t need that.

When applying for credit cards – through Standard Chartered – the banking system has a pre-defined set of rules and criteria. Your profile is judged based on provided info and of course, your credit history is also scrutinized to prevent any problems in the future.

Do You Qualify?

According to Standard Chartered’s official website, the eligibility criteria mainly consists of two things:

- Age should be 21-60 years for salaried and 25-65 years for self-employed customers.

- Minimum Monthly income should be PKR 40,000 for salaried & PKR 70,000 for self-employed customers.

For details regarding proof of income, the bank expects the following:

- For salaried customers: Latest salary slip / certificate.

- For self-employed customers: 6-month bank statements.

If you visit this site, there’s a form in place with dedicated options. Fill it according to your personal data and click on Submit to begin application process. Here-on-out, your personal data will be transferred by means of this form over the internet, in a secure way. Keep one thing in mind though: Approval of Credit Card facility is subject to credit checks, as per the Bank’s policies and regulatory requirements.

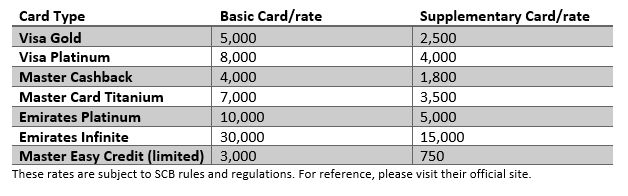

For your information, there is no joining fee, however, annual fee for all cards – except Easy Credit, Emirates Standard Chartered Platinum and Infinite – will be waived for the first year only. In case of a non-employee banking relationship, or being a business man, the bank may require additional documentation, including other bank statements and credit card numbers from other banks. Here below are credit card types offered by Standard Chartered Bank:

After confirming your application and matching up with the bank’s due-diligence, play the waiting game.

Typically, it takes around 3 weeks for you to receive your credit card. During this time, the bank conducts standard checks and background activity – related to credit history – and you might receive phone calls related to all that. For special circumstances, the banking institution encourages customers to either email their customer care department, or to call on their helpline 111-002-002 for further assistance.

When you get your credit card, expect the following benefits:

I picked this up from their website, so here you go.

The truth is, there isn’t much paperwork involved with this bank. Almost everything is done via online secure portals and customer care is strongly adhered to. So, you don’t have to worry about anything in particular – besides your credit history and salary limit. If everything looks clean and positive, you’ll get your credit card in no time.

This article was all about How To Get A Standard Chartered Credit Card. Was this helpful? Drop us a comment and let us know what you think.

Good luck!