Figures including Kyivstar are as follows:

- Stable organic revenue development

- EBITDA margin of 34%

- Cash flow margin of 22%

- Earnings per share of NOK 0.98

Telenor maintained its outlook for a small rise in organic revenues this year after reporting modest growth in the first quarter. The company posted quarterly revenues of NOK 21.12 billion up to NOK 26.29 billion a year earlier, helped by the weaker Norwegian krone, subscriber growth in Asia and acquisitions in the Nordic region.

Adjusted EBITDA improved slightly, to NOK 9.27 billion from NOK 9.23 billion, while the margin dipped to 34.2 percent from 35.1. The results are pro forma for the consolidation of Kyivstar, which is normally treated as an associate.

Net profit tumbled to NOK 1.62 billion from NOK 4.57 billion, hurt by forex losses at Vimpelcom in Russia and a gain from selling the stake in Golden Telecom a year ago. Telenor said it started to see some impacts upon the telecom sector from the economic slowdown, particularly for international calls and in Ukraine at its associate Kyivstar.

Overall volumes remained stable and its home market Norway and Bangladesh were performing well, the operator said. Given the expected continued economic weakness, the main focus will be on cost and capex control to ensure solid cash flow. Cash flow in Q1 improved to NOK 5.98 billion from NOK 4.14 billion a year ago, while capex dropped to NOK 3.29 billion from NOK 5.89 billion.

For the full year, Telenor reiterated its outlook for stable organic revenues, an adjusted EBITDA margin of around 34 percent and capex at 15-17 percent of sales. That excludes its investment in India’s Unitech Wireless, which is expected to launch services in H2. India will contribue an estimated EBITDA loss of NOK 2.0-2.5 billion, additional capex of NOK 5.5-6.5 billion and a margin increase increase in revenues.

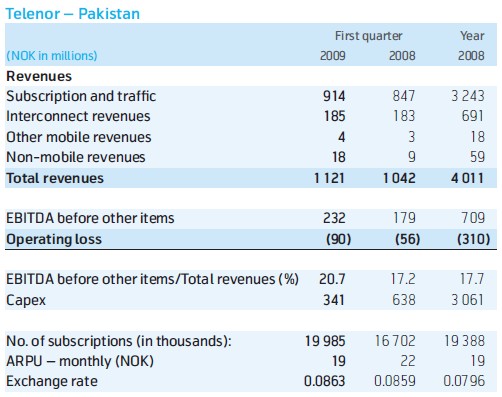

- The number of subscriptions in Pakistan increased by 597,000 during the quarter, resulting in a subscription market share of 22%.

- Subscription growth slowed down compared to the previous quarter and was affected by a new subscription registration procedure implemented by the regulator.

- ARPU in local currency decreased by 15% as both average usage and prices declined due to intense competition and general economic slowdown in Pakistan.

- Total revenues in local currency is increased by 7% as a result of a subscription growth of close to 3.3 million, partially offset by lower ARPU.

- EBITDA is increased by 29% in local currency mainly due to higher revenues.

- Capital expenditure in local currency is decreased as a result of adjusting network investments to the growth in number of subscriptions and traffic volumes.