Participants of a survey conducted by a brokerage house are split on whether the State Bank of Pakistan (SBP) will cut rates or maintain the status quo in the upcoming Monetary Policy Committee (MPC) meeting, to be held on April 29.

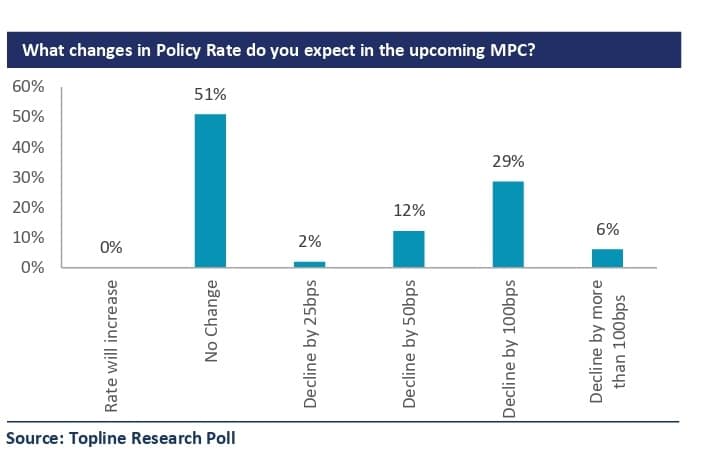

According to a survey conducted by Topline Securities, 51 percent of participants expect the policy rate to remain unchanged at 22 percent, while the remaining 49 percent anticipate a policy rate cut. No participants expect an increase in interest rates.

Among those expecting a cut, 2 percent foresee a reduction of 25bps, 12 percent expect a cut of 50bps, 29 percent anticipate a cut of 100bps, and 6 percent of participants expect it to decrease by more than 100bps. In the last monetary policy survey conducted on Mar 13, 2024, 55 percent of participants expect the policy rate to remain unchanged at 22 percent, while the remaining 45 percent anticipate a policy rate cut.

Among those expecting a cut, 2 percent foresee a reduction of 25bps, 10 percent expect a cut of 50bps, 24 percent anticipate a cut of 100bps, and 9 percent of participants expect it to decrease by more than 100bps. In response to our second question regarding the timing of the first rate cut in case of no change this time, 71 percent of participants expect the first cut to occur in June 2024, while 18 percent anticipate it in 3Q2024, and 11 percent expect the first cut to be in 4Q2024.

In the latest MPC meeting held on March 18, 2024, SBP decided to keep the policy rate unchanged. While arriving at the decision, MPC noted that inflation, in line with earlier expectations, has begun to decline noticeably from 2HFY24.

However, MPC observed that despite the sharp deceleration in February, the level of inflation remains high and its outlook is susceptible to risks amidst elevated inflation expectations. This warrants a cautious approach and requires continuity of the current monetary stance to bring inflation down to the target range of 5- 7 percent by Sep-2025. The committee reiterated that this assessment is also contingent upon continued targeted fiscal consolidation and timely realization of planned external inflows.

In response to the question about the expected Policy Rate in Dec-2024, 41 percent of the participants anticipate the rate to be in the range of 16-18 percent, and 51 percent of participants anticipate the policy rate to be in the range of 18-20 percent.

Additionally, 4 percent expect the rate to be in the range of 14-16 percent, and another 4 percent expect the rate to be in the range of 20-22 percent. On the other hand, no one expects it to be below 14 percent or above 22 percent.

Since the last MPC meeting, new developments have taken place which will likely be considered by the central bank committee in the upcoming meeting. These include: (1) a fall in CPI inflation from 23.1 percent in February 2024 to 20.7 percent in March 2024, (2) SBP FX Reserves at $8 billion despite a $1 billion Eurobond payment, (3) Pakistan posting a Current Account Surplus of $128 million in February 2024 compared to a Current Account Deficit of $303 million in January 2024, (4) 2.5 percent increase in international oil prices and average 3 percent increase in local fuel prices, (5) the rupee largely remaining stable against the US dollar, (6) escalation in tension between Iran and Israel.

Furthermore, in the recent T-Bill auction held on April 17, we saw mixed participation in 3-month and 12-month bonds, where the cut-off yield remained unchanged at 21.66 percent and 20.89 percent respectively.

Topline’s view

The brokerage house said it expects that the SBP will maintain a cautious approach despite the above encouraging trends and adopt a ‘watch and see’ approach until the inflation trend maintains its fall.

It said that key risks to the inflation trajectory include an increase in international prices, delay in the release of IMF funds, IMF demanding additional tax measures to meet revenue targets in case of any shortfall, and pressure on the dollar against the rupee mainly due to delay in getting dollar inflows.