The new income tax slabs for the salaried class under the federal budget 2024-25 revealed that a higher rate of income tax would now be applicable from July 1, 2024, where annual taxable income exceeds Rs. 600,000, high-level sources informed ProPakistani.

In the new federal budget 2024-25, where taxable income is between Rs. 600,000 but does not exceed Rs. 1,200,000, the rate of tax would be Rs. 2,500, or 5 percent, doubling the existing tax of Rs. 1,250.

For individuals earning up to Rs. 600,000, there is no change as this bracket remains tax-free. This exemption ensures that the lower-income segment is not burdened with additional taxes.

In the income range of Rs. 1,200,000 to Rs. 2,200,000, the tax rate has been increased to Rs. 30,000 + 15 percent of the amount exceeding Rs. 1,200,000.

| Sr # | Taxable Income | Rate of Tax |

| 1. | Where taxable income does not exceed

Rs. 600,000 |

0% |

| 2. | Where taxable income exceeds Rs. 600,000

But does not exceed Rs. 1,200,000 |

5% of the amount

Exceeding Rs. 600,000 |

| 3. | Where taxable income exceeds Rs. 1,200,000

But does not exceed Rs. 2,200,000 |

Rs. 30,000 + 15% of

the amount exceeding Rs. 1,200,000 |

| 4. | Where taxable income exceeds Rs. 2,200,000

But does not exceed Rs. 3,200,000 |

Rs. 180,000 + 25% of

the amount exceeding Rs. 2,200,000 |

| 5. | Where taxable income exceeds Rs. 3,200,000

But does not exceed Rs. 4,100,000 |

Rs. 430,000 + 30% of

the amount exceeding Rs. 3,200,000 |

| 6. | Where taxable income exceeds Rs. 4,100,000 | Rs. 700,000 + 35% of

the amount exceeding Rs. 4,100,000 |

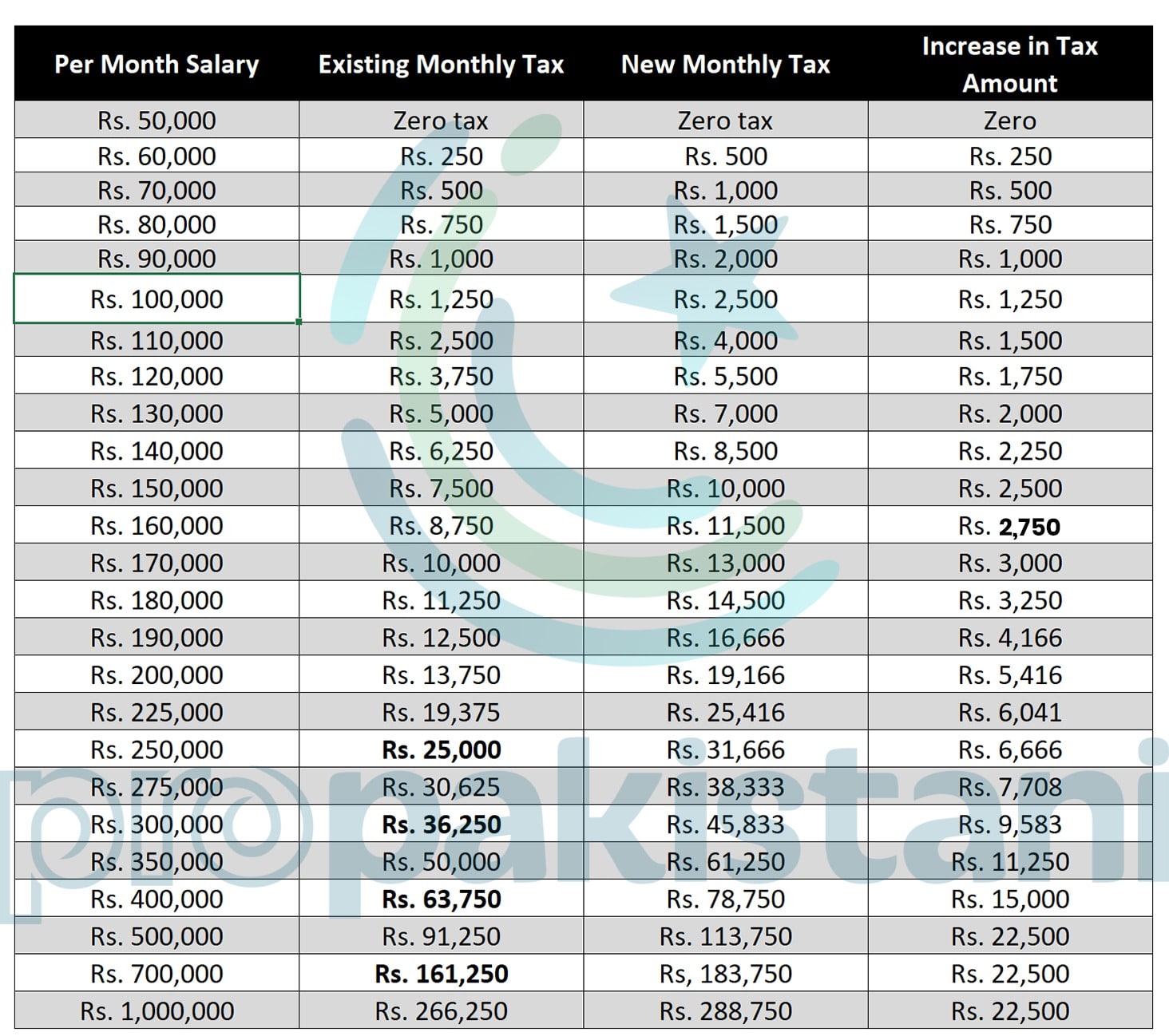

The following table gives a detailed breakdown of the impact of the rate of income tax on salaried class from July 1, 2024:

For live updates on everything about the Federal Budget, visit this link.

lanat he in par. salary class par phr buldozer chala dia he.

Bhai ap ko farak nahi parhna pehle 40k plus ke salary dhunden.

Pathetic policy and leaders along with their makers, what else could we expect from these losers

Pathetic policy

Fluff these Beggars in suits

Papa will buy new weapons, so salaried sons will pay for papa’s toys…

Shame on this policies, 35 percent taxes on salary, 28 percent GST everything, private school, university, and hospital for you and childrens, worst condition of roads, personal security guard, no quality drinking water,

Bastards. This will happen every year

Everyone is equal to IDF from Pindi to Islamabad, they have sold the souls of 225 millions Pakistanis. IDF is brutally crushing Innocent Palestinian people and they are crushing Innocent Pakistanis.

Zaleel tareen government

Salary tax

Gross Salary 160626

Salary meh tax , ke k bill meh tax , rashan meh tax , gas bill meh tax , dawai lo us meh tax , kahin galti se bahar kha lo us meh tax , peenay k pani meh tax matlb yar middle class ko essa he zehar de kr mardo yar … Khuda ki kasam yar ku khud khushi krwana cha rhe ho hum se

Fail to understand why the retailers arent being aggressively added to tax net instead of having salaried class bear the burden. Highly unfair.

It was all because of “You asked for it”

With increase in Inflation, private entities not increasing salary due to inflation and on top of that increase in taxes???? That’s just plain ignorance

Busniess Class se Tax kyu nahi lete.. Specially Jo cash me Dealings krte hain.. Sb Boorai Salry class ke lye hain. Phr pouchte hain Talented log Pakistan chor kr kyu ja rhy hain.. Aap Pakistan ma kaam krne ka mauqa hi nahi de rhy talented logo ko. Judges , Politician, Bu recrate ne aaj Tak kitna tax dya.. Unko

Free Electricity, Gas & Water supply hota ha.. Sari burrai Middle class Parhe Likhe tabqe ke lye ha

Govts just only focused on salary person taxation,

The only people who was paying taxes from their salaries, now have to pay more in terms of taxes. Business community will enjoy more profits whereas salaried class got a decrease in their salaries and increase in inflation. Thank you Govt.

Heart broken

Go to a high-end restaurant cough **mandi house** cough and they say ‘We only take cash, pathetic rich morons and their pathetic politicians servants.

lanat ho policy makers per

Screw these thugs and those who brought them. Feels like we’re working to fill their pockets so they can buy luxury lives abroad.

Business man especially retailers/shop keepers are not included, although they are earning more than salaried persons. Why they are being relaxed?

They are charging almost taxes equivalent to tax structure of foreign countries where they also provide free schooling, medical and hospitalization, security, infrastructure, basic utilities. Whereas with same level of taxes, Pakistani’s are not getting these benefits. Unfortunate

In the coming years, taxes on the salaried class are expected to double. It’s wise to start your own business now to avoid these taxes. Form a traders’ union to pressure the government and benefit from tax avoidance. Alternatively, consider moving abroad, as this country is increasingly unfavorable for honest Pakistanis. Instead of addressing issues like smuggling, narcotics, and government corruption, all tax burdens are placed on the salaried class.

They have no alternate plans just breaking loyal supporters by using all possible negative ways.

We will love to pay taxes if we get something in return, unfortunately we are not getting benefits. But businesses class and elite class is getting benefits on behalf of our taxes.

Allah ka khuaf karo govt k logon jana usi qabar mai hain usi mitti mai jana hy rehem karo