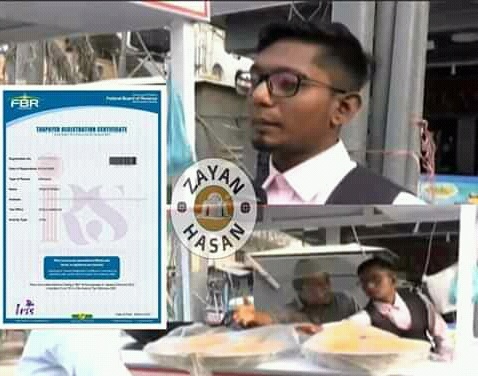

In a country where most small-scale businesses operate without registering with the Federal Board of Revenue (FBR), a vendor from Karachi has become an example for everyone after it came to light that his street-side business is registered with the FBR.

According to details, Shahid Babel sells fried fish in the streets of Karachi and regularly files his income tax. Not just this, he has also displayed the NTN on his kiosk to encourage others to file their tax returns.

ALSO READ

MoITT Starts Evaluating Internet Voting Mechanisms for Overseas Pakistanis

While speaking with a media outlet, Shahid said that it makes him proud that his small business is contributing to the national economy in a positive way.

Sadly, the tax compliance rate in Pakistan, by and large, remains a non-existent affair to date.

In September, FBR revealed in its official tax report that only 2.63 million individuals had submitted their tax returns during FY 2017-18. Of those, 1.23 million were salaried and 1.4 million were non-salaried individuals.

ALSO READ

SBP Orders Banks to Relax Conditions Of Verifying Sources of Income For Low-Costing Housing Schemes

In order to foster a culture of tax compliance in the country, FBR, in September, had signed a special Letter of Understanding (LoU) with the Federal Directorate of Education (FDE).

Under the LoU, students in the FDE administered schools and colleges will be imparted lessons regarding tax compliant culture to increase tax awareness in the younger generation from an early age.

LOL Jab FBR Notice Behji Gi Return File Na karne Ka tab Pata Chelga,

Already we have paid taxes on each purchases

Kuch Better Karo NTN Banwana Koi bARI BAT NAHI

Ignorance at its finest!

Firstly, agar ap FBR se register karte ho tau file return karna ap ki responsibility hai. There’s no point in registering with FBR and not filing tax returns. If you’re doing something legit, there’s nothing to fear about.

Secondly, yes, we pay taxes on each purchases, but it has nothing to do with filing tax returns. It’s a constitutional obligation of every citizen. On top of that, you can ask for tax refund if you think you’re paying more taxes, including your cell phone bills, advance taxes, etc.

KINDLY DON’T SPREAD MISCONCEPTIONS AROUND. Wohi baat karein jis ka ap ko pta ho.

very stupidity to cooperate with our country governments. what we pay in taxes never get return to us

Then get out of this country.

In any country it never gets returned to you. What you don’t get is if tax compliance is non existent due to mentality like yours there is nothing to return as there isn’t enough for billions of population if only 2.6 million are filing. Change yourself please before expecting a change.

Tum jese jaahil logon ki waja se to tax paying ratio kam h…

ooh jahil kisko bol rahay ho he is right haar chez ka tax deye rahay marnay ka bhe kaabar bhe muft nahe is mulk aur chor politician khoon choos liya aap kya chaye sub eik say bar eik hai is mulk mein

Really glad to know the thoughts of a kiosk owner. No doubt that every individual is contributing in country’s economy.

Literate gentry will be proud of it and illiterates are inconsiderable, awareness through reforms in education system will help them for sure.

Pakistan Zindabad.

Don’t think u r giving tax to FBR or govt, think u r supporting ur nation and ur Motherland piyara Pakistan

Very good attempt, now fbr and govt must co-operative such people and take practical steps so that corrupt fbr staff stay away from his kiosk.

Great! Very positive approach, sign of being patriot. We all should support business who are registered with FBR. This the only way to put things in order. If each individual fix themselves and play their part, our system will automatically fix it self in a right direction.

You become filer in Pakistan not for Pakistan but for International Forces who want to monitor every source and wealth pressnt in Pakistan.

Rana saab puri duniya mai log tax return dety hai tum Pakistani kya anokhey ho jahil

That’s an example for all others.

instead of tax govt must compliance with zakat . our success certainly when we follow our prophet Mohammad Saw.

اس نوجوان کا جزبہ قابل قدر ہے۔ ذمہ دار پاکستانی ہونا بہت اچھی بات ہے۔ لیکن کچھ سوالات جس کا جواب کوئ نہیں دیتا۔ وطن عزیز میں آپ پانچ روپے کی شیمپو کی پڑیا بھی خریدیں تو اسکی قیمت میں بھی + ٹیکس ضرور لکھا ہوتا ہے۔ دوکان کا بجلی کا میٹر کمرشل ہے اس پر ایڈوانس انکم ٹیکس اور سیلز ٹیکس۔ پٹرول کے ہر لیٹر پے ٹیکس۔ گیس پے ٹیکس۔ چینی گھی پتی دودھ ہر چیز کی قیمت میں ٹیکس شامل۔کپڑےکی قیمت میں ٹیکس شامل موبائل فون کارڈز پے علیحدہ ٹیکس اور کالز پے علیحدہ ٹیکس۔ سڑکوں پےسفر کریں تو ٹال ٹیکس۔ بینک کے چیکوں پے ٹیکس۔ پچاس ہزار کی یکمشت خریداری پر مزید ٹیکس۔ سرکاری و پرائیویٹ اداروں کے ملازمین کی تنخواہوں پے ٹیکس۔ کھاد پے ٹیکس۔ حد یہ ہے کہ بچوں کی کتابوں اور تعلیمی اداروں پر بھی ٹیکس عائد ہے۔ غور کر کے دیکھیں تو آپ کو ضروریات زندگی کی ہر چیز پے ٹیکس نظر آۓ گا۔ اسکے باوجود حکمران اس قوم کو ٹیکس چور کہتے ہیں جبکہ میں سمجھتا ہوں کہ دنیا میں سب سے ذیادہ پیسہ ٹیکس کی مد میں پاکستانیوں سے ہتھیا لیا جاتا ہے۔ جو سارے کا سارا ان سیاستدانوں کے پیٹ بھرنے پے خرچ ہو جاتا ہے۔ چار صوبائ اور ایک قومی اسمبلی کے خرچے پر کسی دن غور کیجئے گا۔ اور ایک اکیلا وزیر کتنے میں پڑتا ہے اس پے بھی غور کیجئے گا۔ رہی بات اس مچھلی بیچنے والے کی۔۔۔تو مجھے اس سے ہمدردی ہے۔ کیونکہ اب

سردیوں میں اسکو نوٹس آیا کریں گے۔ بھئی ٹیکس آفیسرز کے بچوں کا بھی مچھلی کھانے کا دل کرتا ہی ہو گا۔

Sir, you seriously need to read more about the world. Pakistanis are one of the lowest taxpayers in the world. The taxes you mentioned, these are not uncommon and have been around for thousands of years (yes thousands). Just because the sellers mention the tax on the item does not mean you are the one being taxed. The sales tax is meant for manufacturers, who are making billions in profits but all they do is simply charge the tax amount to the buyer.

I tried to make online NTN but failed to make in the last 7 years. Also I wanted to check my record with FBR. They said submit 500 rupee in any e sahulat franchise. I failed to find any. They said you can submit 500 through Alfalah bank credit card. Only Alfalah. I could not submit. Actually FBR do not want to simplify things which will remove power from their hands and their corruption will stop

1 bhai sahb keh rahe Han pakistan main sab se kam tex collection hoti he to phir hum gu namk se le k Dunia ki hr cheez pe tex dete Han wo jata kidr is ke bawajod hum hum her cheez government se khareed rahe Han taleem sehat insaf her cheez main government ke hum gahak Han or serkar aik dokan to phir hum ko is tex k badle mill Kia raha he

FBR should make new regulations which makes it illegal to perform any commercial activity if not registered with in first year of operation. This is standard practice in most of the developed countries. Only “Danda” can move this nation, so must be utilized.

Good Job … all small business should do the same, and help Pakistan.