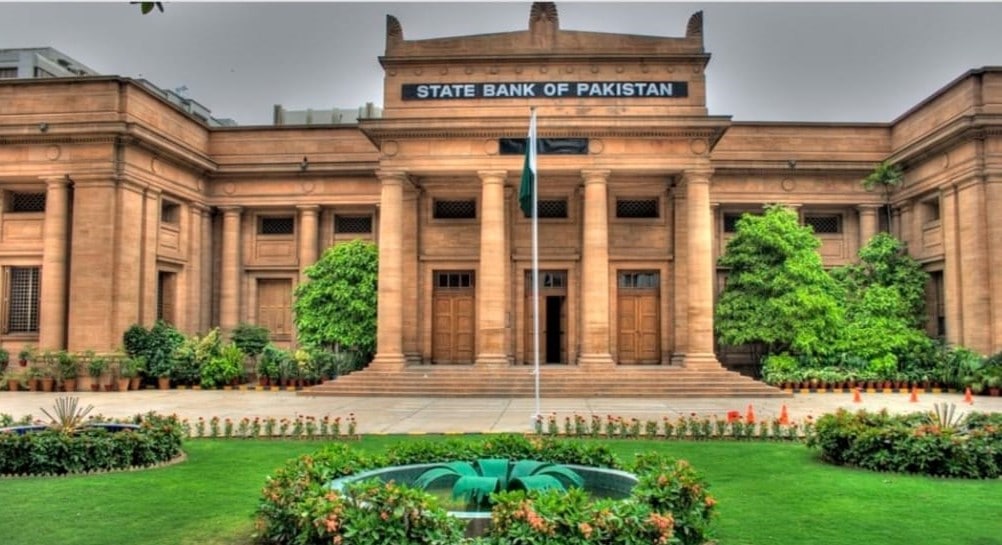

Under the temporary regulatory measures of the State Bank of Pakistan (SBP), banks have deferred Rs. 659 billion of clients’ payment of principal on loan obligations for one year. This was highlighted by the International Monetary Fund (IMF) in its report, “Policy Actions Taken by Countries.” The report reviewed various steps Pakistan has taken since March to deal with the COVID-19 crisis.

This move has been made to strengthen the banking system and sustain economic activity, said the IMF report.

Starting in mid-November, the daily new cases of coronavirus have exceeded the 2,000-mark, and the positivity rate has been on an upward trend, especially in densely populated areas, pointing to the second wave of infections. As a result of COVID-19, the economic activity worsened notably, with preliminary growth estimated at –0.4 percent in the fiscal year 2020. A gradual recovery is expected in the fiscal year 2021.

ALSO READ

External Debt Repayments Dent SBP Reserves by $305 Million

To mitigate the second wave, smart lockdown measures have been re-imposed, along with a general ban on public meetings, rallies, and the closure of educational institutions and venues such as cinemas, theaters, and wedding halls. The government is in discussions with several vaccine manufacturers and has signed up for the United Nation’s (UN) COVAX Facility.

The government has also allocated $150 million for launching a vaccination drive in the second quarter of 2021.

The State Bank of Pakistan (SBP) has expanded the scope of existing refinancing facilities and introduced three new ones to support hospitals and medical centers to purchase COVID-19-related equipment (41 hospitals, Rs. 7.99 billion, to date), stimulate investment in new manufacturing plants and machinery, as well as modernization and expansion of existing projects (269 new projects, Rs. 211 billion, to date), and incentivize businesses to prevent laying off of workers during the pandemic (2,958 firms, Rs. 238 billion, to date). These facilities have been extended beyond their original deadline of June 2020 to December 2020.

The SBP introduced temporary regulatory measures to maintain the banking system and sustain economic activity. These include reducing the capital conservation buffer by 100 basis points to 1.5 percent, increasing the regulatory limit on the extension of credit to small and medium enterprises (SMEs) by 44 percent to Rs. 180 million, relaxing the debt burden ratio for consumer loans from 50 percent to 60 percent, allowing banks to defer clients’ payment of principal on loan obligations by one year (Rs. 659 billion being deferred to date), relaxing regulatory criteria for restructured loans for borrowers who require relief beyond the extension of principal repayment for one year, and suspending bank dividends for the first two quarters of 2020 to shore up capital.

ALSO READ

SBP Directs Banks to Facilitate Customers with Disabilities

The SBP has also introduced mandatory targets for banks to ensure loans for construction activities account for at least 5 percent of the private sector portfolios by December 2021. The central bank has introduced further regulatory measures to facilitate the import of COVID-19 related medical equipment and medicine.

These include lifting the limit on import advance payments and import on open account and allowing banks to approve an Electronic Import Form (EIF) for the import of equipment donated by international donor agencies and foreign governments.

SBP has also relaxed the condition of 100 percent cash margin requirement on import of certain raw materials to support the manufacturing and industrial sectors.