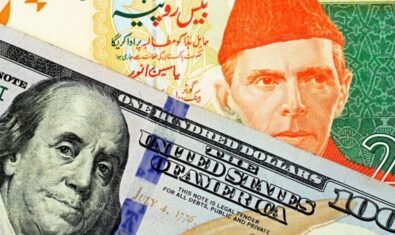

The Federal Board of Revenue (FBR) collected Rs. 20 billion as income tax arrears and tax demands during July-December (2021-22), compared to Rs. 38 billion in the same period in the last fiscal year, reflecting a major decrease of 47.3 percent.

An FBR report revealed an extraordinary poor performance of the tax machinery through the creation of tax demands against the taxpayers and recovery of income tax arrears during 2021-22. There is a massive decrease of 47.3 percent in collections through income tax demands during the period under review.

The FBR has conducted an analysis of Components of Income Tax Collection on Demand (CoD) and Advance Tax/Payments with Returns. The collection on demand as a whole and its both components witness decline during the first half of 2021-22. This was primarily because of the FBR policy of providing maximum facilitation to the business community and furnishing a conducive business environment for greater economic growth. The collection from current demand declined by 62.5 percent and arrear demand by 31.9 percent.

A major part of income tax comes from withholding taxes, whereas CoD shares around two percent. The second component is the voluntary payments which have shown good progress with 18.1 percent growth during July-December (2021-22). The payment with returns has recorded a very healthy growth of around 48 percent and advance tax by 11.7 percent. This is reflective of the greater confidence shown by the business community in the FBR’s facilitation initiatives.

In the past, during FY 2020-21, the overall collection from CoD stood at Rs. 80.1 billion against Rs. 60.8 billion was collected in PFY, showing a growth of 31.8 percent over the previous year. The recovery from arrear demand has shown substantial growth of around 75 percent, whereas current demand increased by 19.9 percent. To further improve this trend, a thorough desk audit by the field formations can prove beneficial in increasing the share of CoD in overall income tax collection.