The Government of Pakistan is considering removing distortion in the sales tax regime for the pharmaceutical sector in the coming budget (2022-23).

Sources told Propakistani here on Wednesday that one of the proposals under consideration is to reduce the sales tax rate or withdraw the 17 percent general sales tax imposed by the previous government on raw materials consumed in the manufacturing of finished products i.e. medicines. The local supply may continue to be zero-rated.

The industry has proposed to reduce the sales tax from 17 percent to 5 percent on pharma raw materials on a zero-rated basis and the Federal Board of Revenue (FBR) can impose a 5 percent sales tax on finished goods.

“Issues Resolution Committee” of the FBR has agreed to resolve sales tax refunds related issues of pharmaceutical companies during the budget (2022-23) in the light of recommendations made by the Pakistan Pharmaceuticals Manufacturing Association (PPMA).

“Issues Resolution Committee” is headed by Chief Commissioner-IR, LTO, Karachi and comprising of senior officers of the FBR for resolution of issues of pharmaceutical companies.

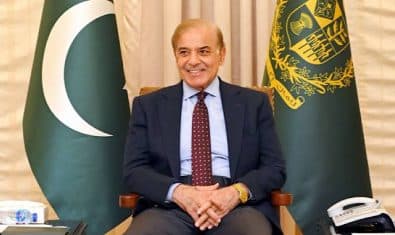

Pakistan Pharmaceutical Manufacturers’ Association (PPMA) has informed Prime Minister Shehbaz Sharif that the decision of the previous government to impose a 17 percent sales tax on raw materials required by the medicine producers had endangered the availability of the essential drugs in the country.

The medicine producers in the country had been agitating on this single point for the past four months but the previous government didn’t show any flexibility and continued with this unjust decision.

The taxation had been hampering the best possible efforts of the PPMA’s members to keep producing essential medicines for the ailing citizens in the country.

The medicine producers in the country expect the government to reciprocate in the same manner and withdraw any unjust tax on the production of drugs. The pharmaceutical industry wanted that either this tax should be withdrawn or it should be refundable on a purchase basis.

There is no chance of misuse of the active pharmaceutical raw materials imported exclusively for the manufacturing of medicines. In case it is not possible to give refunds on a purchase basis, then refund on raw materials and inputs be paid on a purchase basis and the remaining refunds on packaging material be paid on a ‘consumption basis’.

Terms of Reference (TOR) of the Complaint Resolution Committee included a review of the nature of the issue possible solutions and taking immediate action for its resolution.

The committee would follow up with concerned field formations till the issue is resolved and also maintain a complete record of issues, the mechanism adopted for resolution and post-resolution action required if any.

Under the TORs notified by the FBR, the committee would share data with Board on monthly basis indicating issues received, issues resolved and issues pending for resolution and reasons for pendency.