The Pakistani Rupee (PKR) rose further against the US Dollar (USD) and posted gains during intraday trade today.

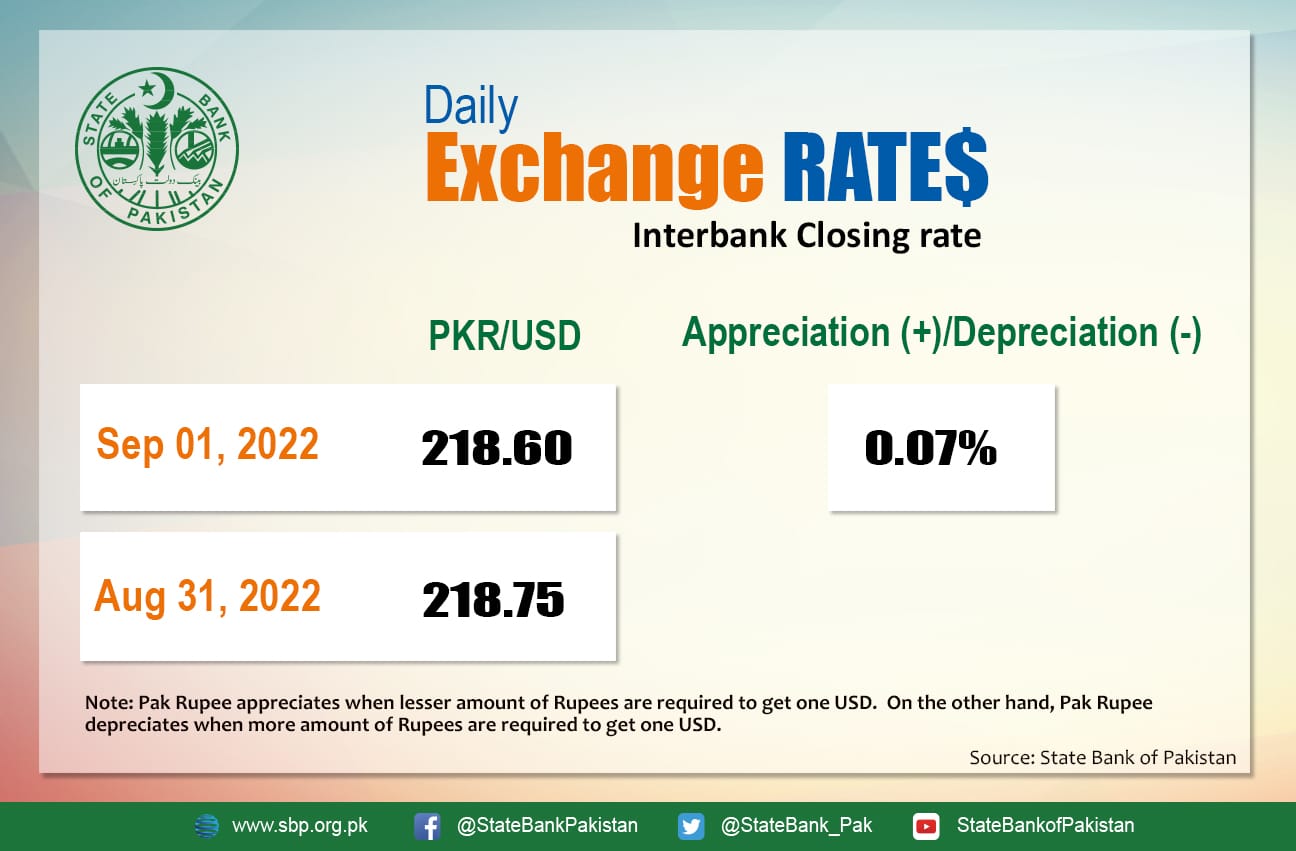

It appreciated by 0.07 percent against the USD and closed at Rs. 218.75 after gaining 15 paisas in the interbank market today. The local unit quoted an intra-day low of Rs. 219 against the USD during today’s open market session.

The local unit was stable in the morning against the greenback and traded on the 216-217 level in the open market at 11:10 AM. By midday, the greenback went as low as 218.725 against the rupee. After 2 PM, the local unit continued to trade at the same level against the top foreign currency before leveling up at the interbank close.

The rupee closed in green against the US dollar third day in a row after the State Bank of Pakistan (SBP) on Wednesday received proceeds of $1.16 (equivalent to SDR 894 million) from the International Monetary Fund (IMF). The development came after the IMF Executive Board completed the combined seventh and eighth reviews under the Extended Fund Facility (EFF) for Pakistan.

The economic impact of floods has yet to be realized in the money markets.

While the PKR continues to recover, Pakistan’s Consumer Price Index-based inflation (CPI) increased by 27.3 percent on a year-on-year basis in August 2022 as compared to an increase of 24.9 in the previous month and 8.4 percent in August 2021, says the Pakistan Bureau of Statistics (PBS). The average inflation in the first two months of the current fiscal year 2023 is 26.1 percent compared to 8.36 percent in 2022. According to economists, this is the highest monthly inflation since October 1973.

In terms of commodity trends that could impact the PKR movement, the Government of Pakistan defied market expectations and increased the prices of petroleum products despite a decrease in oil prices in the international market.

Globally, oil prices continued to fall on Thursday, as new COVID-19 lockdown protocols in China added to fears that high inflation and interest rate hikes are damaging fuel demand.

Brent crude was down by 2.40 percent at $93.34 per barrel, while the US West Texas Intermediate (WTI) stayed below $90 and went down by 2.38 percent to settle at $87.42 per barrel.

Asia’s factory activity fell in August as China’s zero-COVID rules and cost pressures continued to hurt businesses, dimming the outlook for the region’s fragile recovery. Recent volatility in the oil market has coincided with concerns about insufficient supply in the months since Russia sent military forces into Ukraine and as OPEC struggles to increase output.

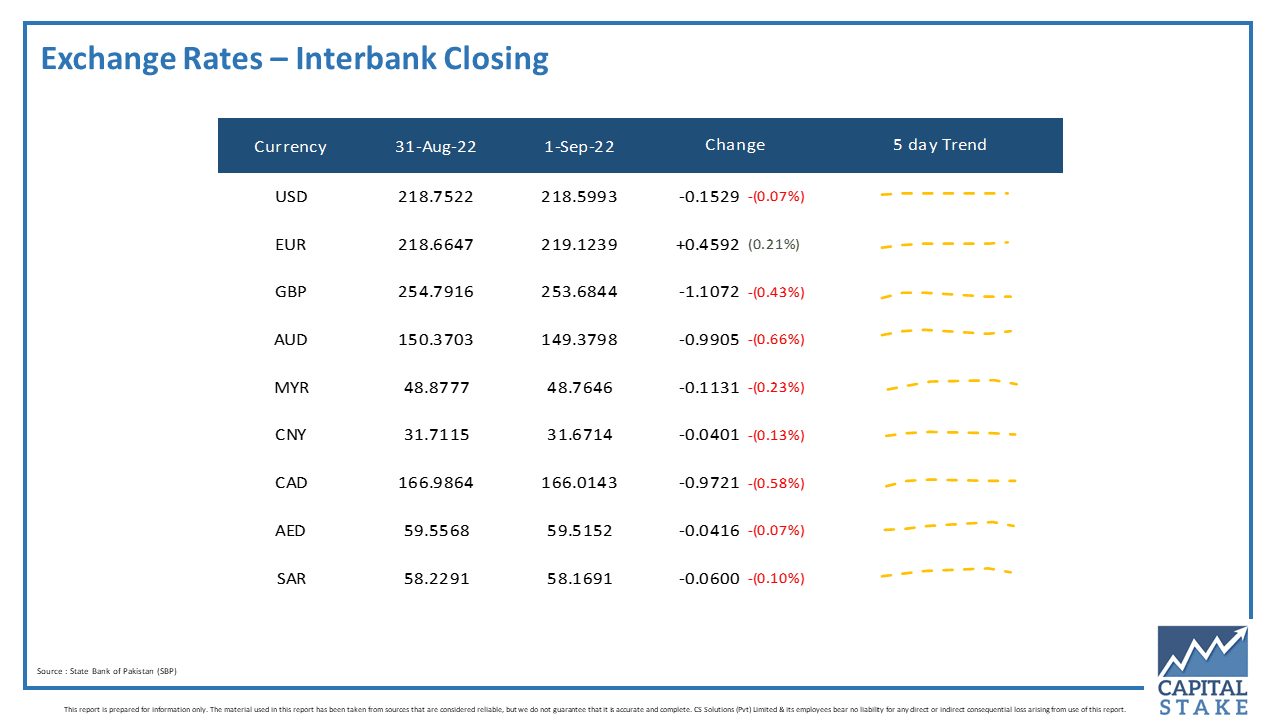

The PKR soared against most of the other major currencies in the interbank market today. It gained four paisas against the UAE Dirham (AED), six paisas against the Saudi Riyal (SAR), 97 paisas against the Canadian Dollar (CAD), 99 paisas against the Australian Dollar (AUD), and Rs. 1.10 against the Pound Sterling (GBP).

Conversely, it lost 45 paisas against the Euro (EUR) in today’s interbank currency market.