The Pakistani Rupee (PKR) crashed further against the US Dollar (USD) and posted big losses during intraday trade today.

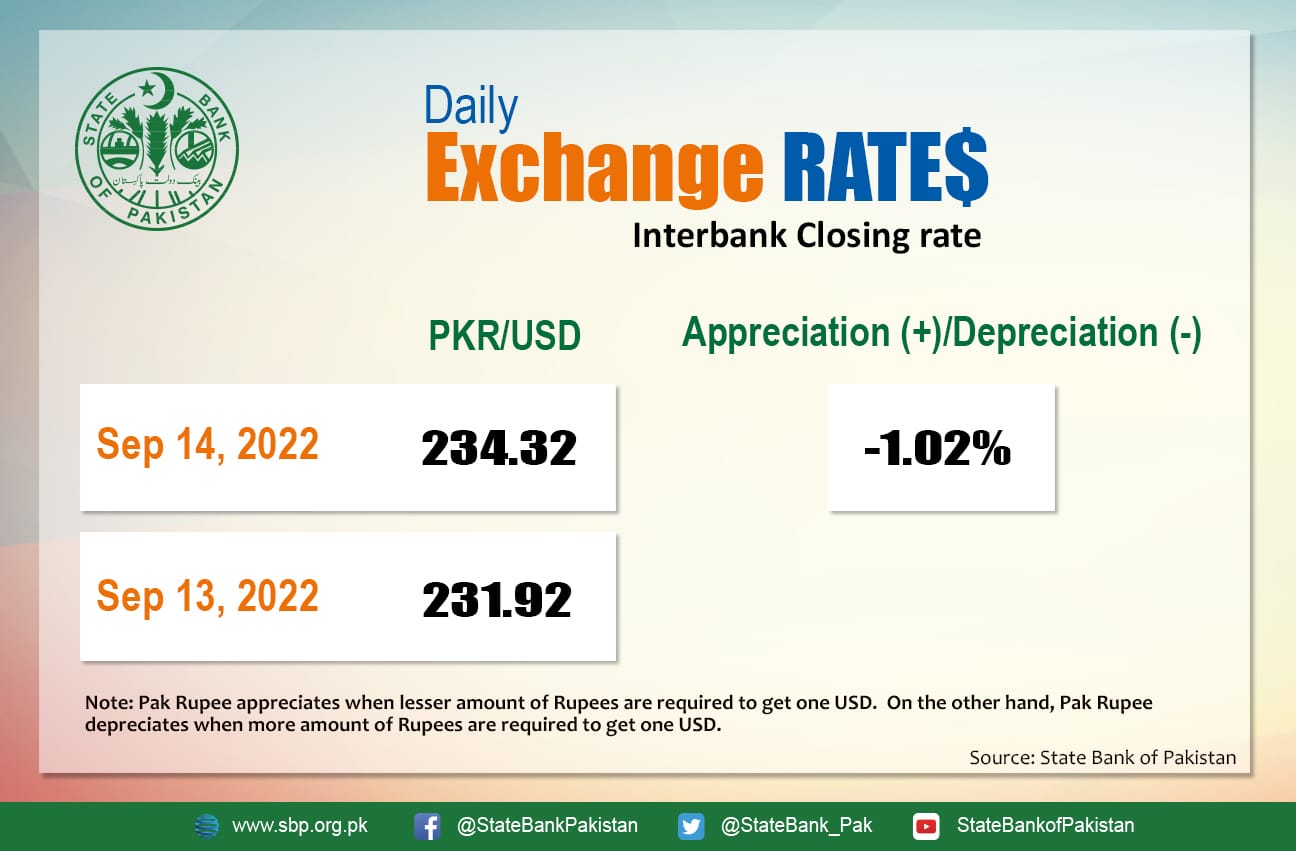

It depreciated by 1.02 percent against the USD and closed at Rs. 234.32 after losing Rs. 2.40 in the interbank market today. The local unit quoted an intra-day low of Rs. 234.30 against the USD during today’s open market session.

The local unit opened at 233.60 at 10:16 AM. By midday, the greenback went as low as 234.10 against the rupee. After 2 PM, the local unit stayed in the 233-235 level against the top foreign currency before the interbank close.

The rupee closed in red against the dollar for the ninth day in a row today amid rising political and economic uncertainty ailing the dollar-strapped South Asian nation. This has been a sharp reversal after the local currency index had rallied two weeks prior on the International Monetary Fund’s (IMF) loan disbursement to Pakistan.

International money markets suggest the dollar index rose on Tuesday, while the S&P 500 fell 4 percent after data showed that US consumer prices rose faster than expected in August, fueling speculation about more aggressive Federal Reserve rate hikes.

Inflation must be moderated if equity prices are to rise, and inflation is currently high. This implies that volatility will be the norm rather than moderation through the end of the year.

Globally, oil prices stabilized on Wednesday after tumbling by more than $1 during the early hours of trade, following signs of significant demand according to the International Energy Agency (IEA) report.

Brent crude was up by 0.43 percent at $93.57 per barrel, while the US West Texas Intermediate (WTI) went up by 0.39 percent to settle at $87.65 per barrel.

The IEA anticipates a large-scale shift from gas to oil, with an estimated 700,000 barrels per day average from October 2022 to March 2023, more than doubling the level of a year ago. According to the IEA, global observed inventories fell by 25.6 million barrels in July.

This comes on the heels of the OPEC’s forecast for global oil demand growth in 2022 and 2023, which cited signs that major economies were performing better than expected despite challenges such as rising inflation.

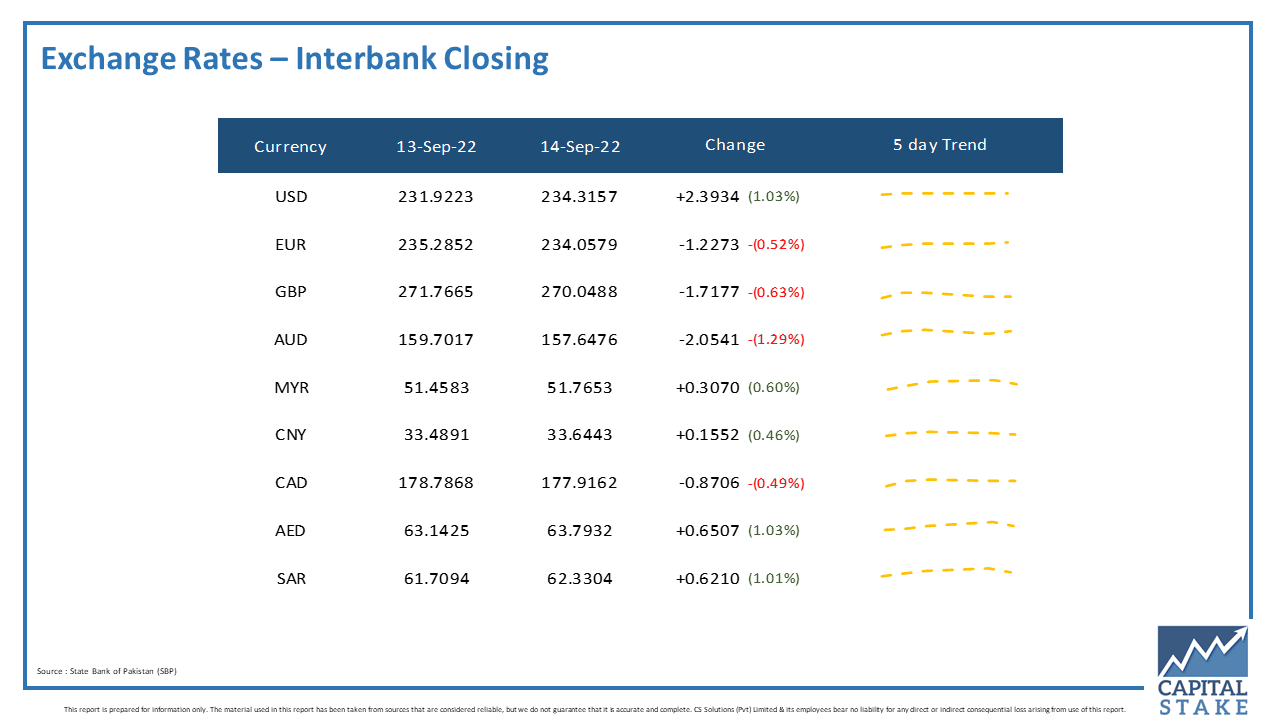

The PKR reversed losses against the other major currencies in the interbank market today. It gained 87 paisas against the Canadian Dollar (CAD), Rs. 1.22 against the Euro (EUR), Rs. 1.71 against the Pound Sterling (GBP), and Rs. 2.05 against the Australian Dollar (AUD).

Conversely, it lost 62 paisas against the Saudi Riyal (SAR), 65 paisas against the UAE Dirham (AED) in today’s interbank currency market.