Pakistan’s US Dollar denominated Eurobonds are falling as the country’s ongoing problems are compounded by recent floods estimated to cost around $30 billion in damages, or 10 percent of GDP.

According to Bloomberg data, the yield on 2024 bonds has clocked in at 80 percent, the highest ever seen for a supposedly non-defaulting economy.

Moody’s downgraded Pakistan’s credit rating last week, while the World Bank has cut Pakistan’s growth forecast for the coming fiscal year in half to just 2 percent.

Fahad Rauf Iqbal, Head of Research at Ismail Iqbal Securities, told ProPakistani, “Argentina has defaulted numerous times, typically every 4-5 years, and Sri Lanka has recently defaulted. So, if Pakistan is close to these countries, we are in the default class of countries”.

Bonds are performing poorly, and it wasn’t a surprise when Moody’s Investors Service downgraded Pakistan’s sovereign debt ratings to Caa1 from B3. “Rating agencies do rate near when it comes to issuing sovereign bonds, but recent downgrades show that any bond issue is a remote possibility, which is why Ishaq Dar has canceled his foreign trips. He has also ruled out the possibility of issuing new bonds because the rating has fallen too low,” the research chief said.

The analyst recalled that Pakistan was previously invested in junk bonds rather than investment-grade bonds, but now, “our ratings have gone even lower in junk bonds, where the yields are extremely high “.

Investors Running Away From ‘Explosive’ Pakistani Eurobonds

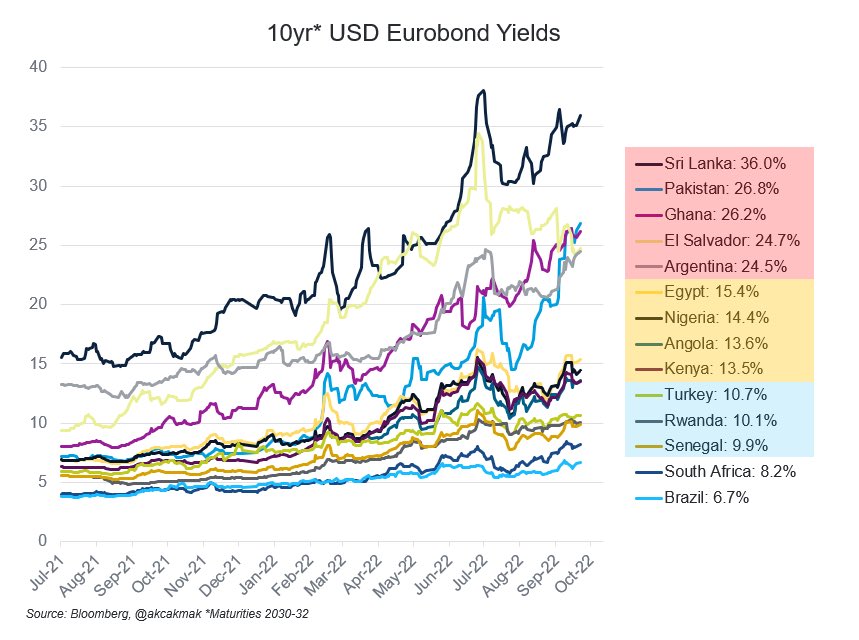

The bond market reaction has heightened fears of a default, causing its international market government debt to plummet. A broad spectrum of debt servicing statistics reveals Pakistan’s Eurobond yields have entered the red zone at 26.8 percent, second only to Sri Lanka whose instruments offer the worst-performing yields at 36.0 percent.

Commenting on Pakistan’s staggering maturity bedlam, Emerging markets investor and researcher Emre Akcakmak said, “Panic and low liquidity sharpen price movements, but still a mad yield”.

He recalled the International Monetary Fund’s (IMF) earlier statement on inflation where the lender projected Pakistan’s inflation rate at 19.9 percent for 2023 against 12.1 percent in 2022. He highlighted that the IMF urged policymakers to take action because “the worst is yet to come”. Most vulnerable emerging markets will soon be unable to raise or even pay off their external debt and Pakistan, Ghana, and Argentina are in the red zone, the researcher noted.

On October 12, Pakistan’s sovereign dollar-denominated bonds fell as much as 130 cents as investors remain reluctant on betting big. The yield to maturity on Pakistan’s bonds has slumped to more than half their face value so far in the past 12 months, with yields on short-term Eurobonds hitting 80 cents on the dollar.

According to Bloomberg data, the bond yield for the 2024-paper is up 80 percent, 51 percent for the 2025-paper, and 27 percent for the 2031 paper.

The 2024 bond is being bid at 40.7 cents on the dollar, while the 2022 bond received bids at 83.1 cents, showcasing the largest drop among shorter-dated issues. Bonds due in 2025 and 2027 fell slightly, while longer-dated maturities received bids in the range below 34 cents on the dollar.

Pakistan requires more than $3 billion in quick cash to meet its debt obligations and avoid default. The country will have to make the first maturity payment of $1 billion against a government-issued Sukuk in December 2022, and another $1.17 billion to Paris Club countries during the current fiscal year.

With multiple debt obligations approaching maturity coupled with unwelcome liquidity bottlenecks, external vulnerability risks, and higher debt sustainability risks, Pakistan is silently edging closer toward economic collapse.

Can Pakistan avoid default? Share your views in the comment section below.