Pakistan’s agriculture sector is understood to be the backbone of the country’s economy, but data suggests small-scale farmers may be at a disadvantage in grabbing their fair share via formal lending channels. The imbalance in credit distribution calls for policy-level measures to ensure increased financial inclusion of small farmers at a time when bigger players appear to have an edge.

The agriculture sector contributes 19.2 percent to the country’s total GDP besides providing raw materials for textile mills and other industries, according to an article published by Pakistan Institute of Development Economics in May. The sector employed roughly 38.5 percent of the workforce during fiscal year 2020-21.

Credit Disbursed in FY22

Credit is a crucial mode that enables farmers to increase the productivity of their lands. The State Bank of Pakistan (SBP) set an agricultural credit target of Rs. 1.7 trillion for the fiscal year 2021-22. However, banks were only able to disburse 83 percent of that amount, i.e. Rs. 1.419 trillion.

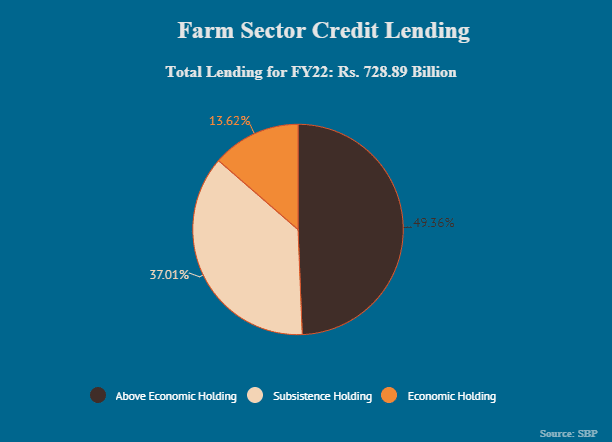

A major chunk — Rs. 728.89 billion — went to the farm sector, which represents agricultural landholdings, machinery and equipment. However, nearly 63 percent of that amount was lent to farmers with bigger fields, while borrowers with relatively smaller land holdings got only about 37 percent.

These subsistence farmers mostly remain unable to buy high-quality seeds, fertilizers, better agricultural equipment owing to a lack of formal financing. The central bank’s categorization of agricultural landholdings in different provinces is as follows:

| Name of Province | Subsistence Holding | Economic Holding | Above Economic Holding |

| Punjab | Up to 12.5 Acres | Above 12.5 to 50 Acres | Above 50 Acres |

| Kyhber Pakhtunkhwa | Up to 12.5 Acres | Above 12.5 to 50 Acres | Above 50 Acres |

| Sindh | Up to 16 Acres | Above 16 to 64 Acres | Above 64 Acres |

| Balochistan | Up to 32 Acres | Above 32 to 64 Acres | Above 64 Acres |

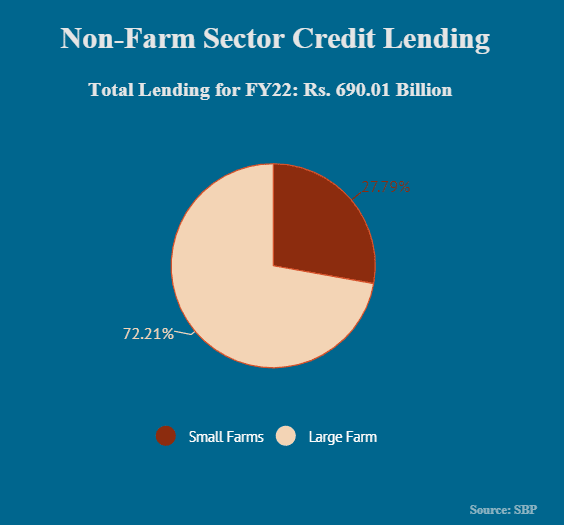

The uneven agri-lending is evident even in the non-farm sector, which comprises livestock, dairy, poultry, fisheries etc. Credit lent to the non-farm sector in FY22 stood at Rs. 690.01 billion, out of which large farms obtained 72.21 percent, with small farms getting just 27.79 percent.

Chairman Agri Forum Pakistan Ibrahim Mughal told ProPakistani:

SBP proclaims to give about Rs. 1.4 trillion in FY22. However, around 50% of that loan was given to institutions, like large poultry sheds, dairy farms etc., which were basically institutional loans but were rather categorized by the banks as agricultural ones.

Mughal said commercial banks prefer auto-financing over agri-financing. He added the SBP sets agri-financing targets for banks and imposes fines if they fall short, but “50% of the banks prefer giving fines instead of the loans.”

The spokesperson of Zarai Taraqiati Bank Limited (ZTBL), the financial institution geared toward the development of agriculture sector in Pakistan, said:

Mainly small farmers are ignored by commercial banks.

Role of Informal Financer

The disparity in agri financing is there because subsistence farmers usually shy away from the formal mode of lending i.e. banks, which demand official documents of land as collateral. On top of that, a large part of land may still be in the name of forefathers or grandparents, rather than the borrower alone, complicating banks’ ability and willingness to lend, according to the PIDE article. This leaves the subsistence farmers at the mercy of a local network of financiers known as arthi.

While addressing that topic, Mughal said:

A subsistence farmer finds (the) banking system quite complex to deal with. He has to go through several difficult stages before obtaining the loan from a bank. So, instead of going through this hassle, he finds it more convenient to obtain (a) loan from arthi.

Arthis are known for charging higher interest rates compared to formal lending institutions, but subsistence farmers prefer arthis because of repayment flexibility and the option of a debt rollover, if needed, the PIDE article showed.

Recommendations

The financing landscape for a subsistence farmer appears grim at the moment. However, SBP has recently taken some steps worth highlighting, including an increase in per acre indicative credit limit for wheat and the launch of an electronic warehouse receipt financing facility that will store farmers’ produce and be used as collateral to avail bank financing.

ZTBL spokesperson said the SBP has enhanced agri credit from 400 billion rupees to 1.5 trillion rupees over the last ten years, but the funding requirement is for 5 trillion rupees. He said:

SBP has to play a vital role in agri credit by forcing private banks to lend farmers up to 40 percent of their financing.

Mughal recommended banks to provide farmers with agricultural machinery at easy terms. In addition, he said:

To financially include the subsistence farmers, SBP should direct commercial banks to open 30% of their branches in the villages. In that scenario, it would be much easier for farmers to obtain bank loans instead of contacting middleman.

Floods and Agri-Financing

Pakistan’s agricultural ecosystem would certainly benefit from a revamp, especially as recent flash floods have caused massive damages to the agricultural sector. The UN Food and Agriculture Organization’s early estimates suggest that more than 4.479 million acres of crop land have been affected by the foods.

For this year, the SBP has set a 1.8 trillion rupee target for agriculture credit. Besides going into the debate of whether that would be enough or not, ensuring farmers are looked after would help them recover from this natural calamity.