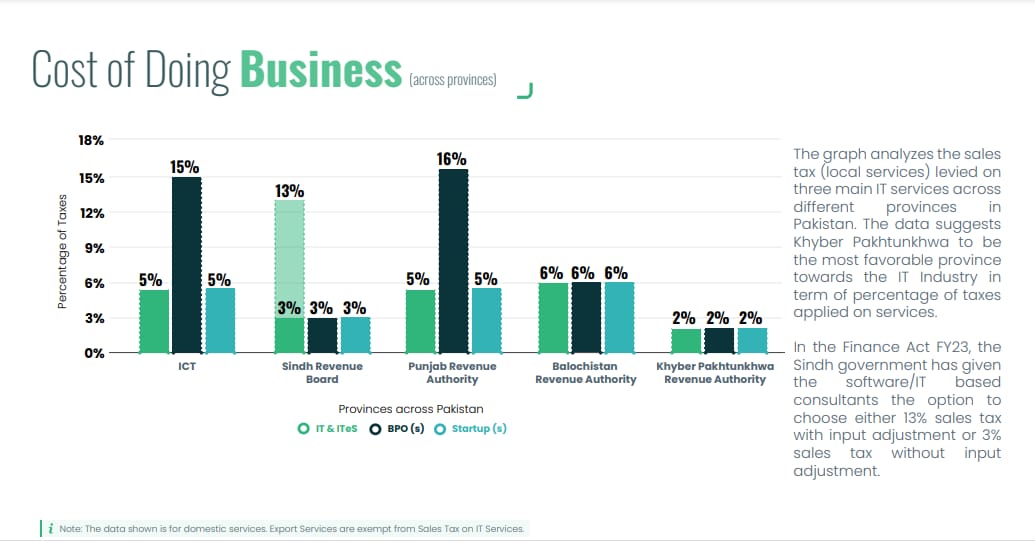

Khyber Pakhtunkhwa is the best province for IT sector incentives because the cost of doing IT business is lowest as compared to other provinces.

According to Pakistan Software Houses Association’s report, Khyber Pakhtunkhwa is the most favorable province towards the IT Industry in terms of the percentage of taxes applied on services. According to the PASHA report, sales tax on three main IT services in Khyber Pakhtunkhwa is the lowest among other provinces.

In Khyber Pakhtunkhwa province there is a 2 percent sales tax on IT & IeTs services and a 2 percent sales tax on BPO(s) services. In the province, only a 2 percent sales tax is levied on startups. According to the PASHA report, a 6 percent sales tax is levied on each of three main IT services (I.e IT & IeTs services, BPO(s) services, and startups) in Balochistan.

In Sindh, there is a 13 percent sales tax on IT and IeTs, a 3 percent sales tax on BPOs, and a 3 percent sales tax on startups. In the Finance Act FY23, the Sindh government has given the software/IT-based consultants the option to choose either 13 percent sales tax with input adjustment or 3 percent sales tax without input adjustment.

In Punjab, the revenue authority levies a 5 percent sales tax on each IT & IeTs service and startup and a 16 percent highest tax on BPOs. Whereas the federal government levies a 5 percent sales tax on IT & IeTs services and startups and a 15 percent sales tax on BPOs.