The Pakistani Rupee (PKR) dipped further against the US Dollar (USD) and posted losses during intraday trade today.

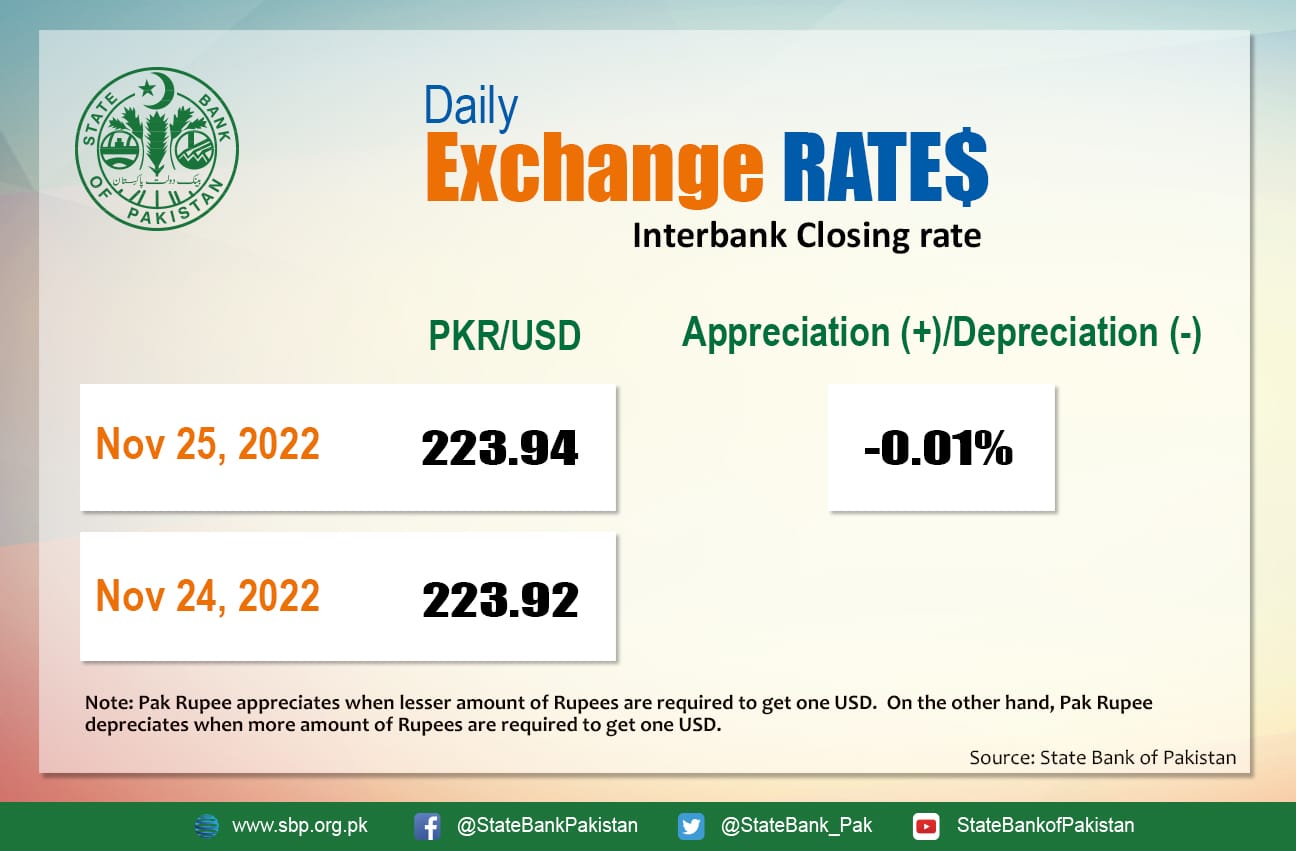

It depreciated by 0.01 percent and closed at Rs. 223.94 after losing two paisas against the greenback. The local unit quoted an intraday low of 224.58 against the greenback.

The local unit was initially bearish in the morning against the greenback and opened trade at 224.2 in the open market. By midday, the greenback moved lower against the rupee. After 1 PM, the local unit was stable and stayed on the 223 level against the top foreign currency before the interbank close.

The rupee reported losses against US Dollar for the third consecutive day today.

Money changers were of the view the rupee fell due to the country’s dwindling forex reserves position. Furthermore, the pressure on the local currency was worsened by a little mix-up between greenback inflows and outflows across domestic markets.

With the appointment of a new army chief, political turmoil appears to have faded away for now, and there are some positive developments that the rupee’s outlook will improve. Earlier this month, China and Saudi Arabia pledged to provide Pakistan with a $13 billion financing package. However, no investments or funding have yet been released.

According to traders, political clarity is critical for pleasing China, Saudi Arabia, and foreign investors.

Globally, oil prices rose on Friday, capping a week marked by concerns about Chinese demand and wrangling over a Western price cap on Russian oil.

At 3:55 PM, Brent crude gained $1.20 or 1.41 percent to reach $86.54 per barrel, while the US West Texas Intermediate (WTI) was significantly up by 2 percent to settle at $79.5 per barrel.

After hitting 10-month lows this week, both contracts were still on track for their third consecutive weekly decline. Brent’s market structure suggests that current demand is weak, with backwardation, defined as front-month prices trading above contracts for later delivery, weakening in recent sessions.

Brent’s structure for the two-month spread even briefly dipped into contango this week, implying oversupply with near-term delivery contracts below later deliveries.

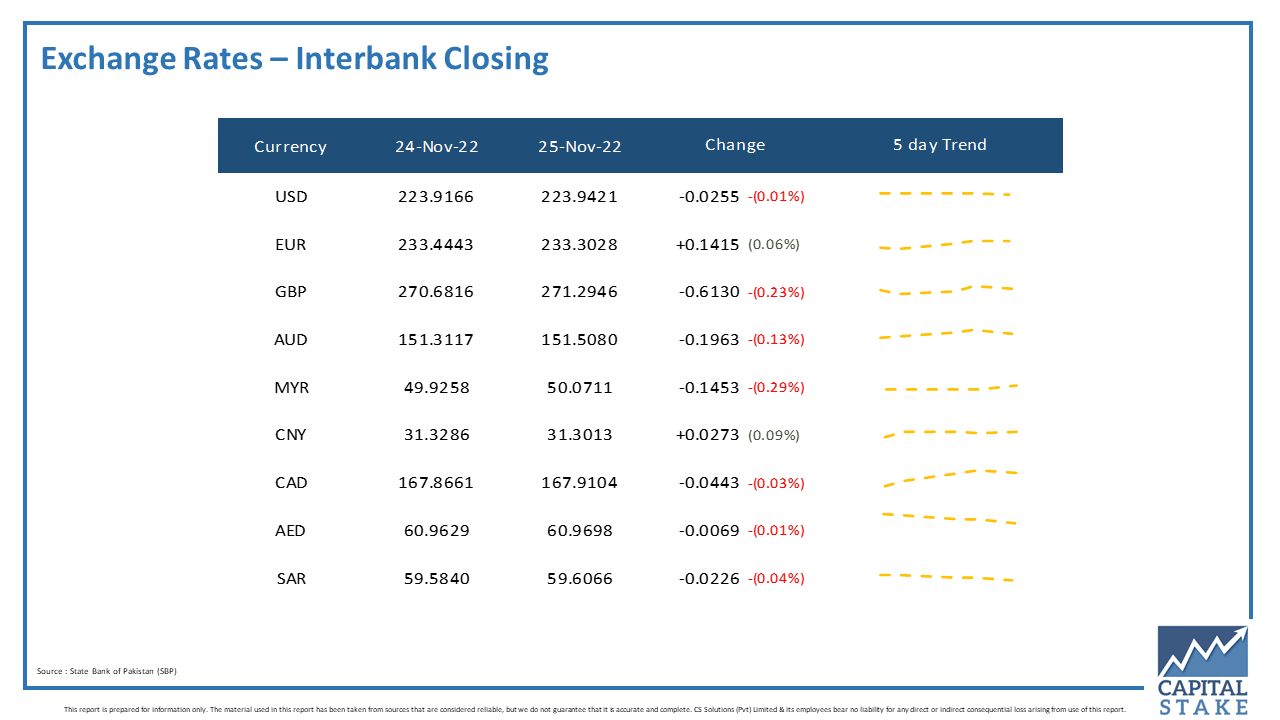

The PKR was bearish against most of the other major currencies in the interbank market today. It held out against the UAE Dirham (AED), lost two paisas against the Saudi Riyal (SAR), four paisas against the Canadian Dollar (CAD), 19 paisas against the Australian Dollar (AUD), and 61 paisas against the Pound Sterling (GBP).

Conversely, it gained 14 paisas against the Euro (EUR) in today’s interbank currency market.