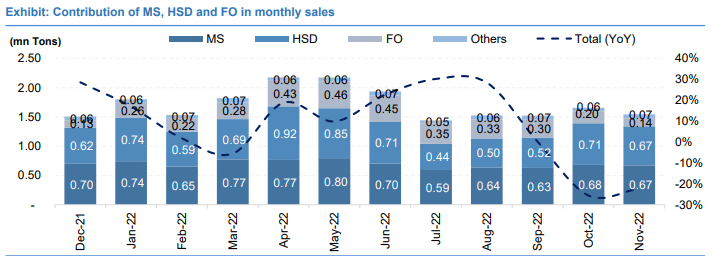

Pakistan’s petroleum sales witnessed a sharp decline of 12 percent on a year-over-year (YoY) basis to stand at 1.55 million tons during November 2022.

According to Arif Habib Limited (AHL), the drop comes due to the overall economic slowdown, higher petroleum prices, and lower furnace oil (FO) based power generation.

MS depicted a fall of 3 percent YoY, to arrive at 670,000 tons in November 2022. Likewise, High-Speed Diesel (HSD) volumes nosedived by 18 percent YoY, to settle at 670,000 tons during the month.

FO sales volumes plunged by 22 percent YoY in November, reaching 140,000 tons. On a month-on-month (MoM) basis, petroleum offtake witnessed a drop of 7 percent during November due to similar reasons mentioned above. Volumes of MS, HSD, and FO registered a fall of 1 percent, 6 percent, and 33 percent MoM, respectively.

During the first five months of the financial year 2022-23, sales of total petroleum products plummeted by 20 percent YoY to 7.70 million tons compared to 9.60 million tons in the same period last year. Product-wise data showed a decline in all categories. The offtake of MS, HSD, and FO settled at 3.21 million tons, 2.84 million tons, and 1.32 million tons, respectively.

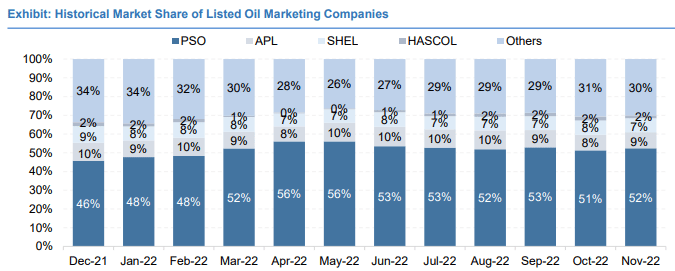

Company-wise analysis shows that Pakistan State Oil’s (PSO) offtake depicted a drop of 2 percent YoY in November 2022 which was majorly contributed by a decrease in sales of FO by 60 percent YoY, while HSD reported a jump of 8 percent YoY.

MS sales of PSO remained stable.

Sales of Attock Petroleum Limited (APL) and Shell Pakistan Limited plunged by 21 percent YoY each due to a fall in sales of MS and HSD. Conversely, HASCOL witnessed a growth of 16 percent YoY amid higher MS and HSD sales.

During 5MFY23, PSO managed to increase its market share by 1.2 percent to 52.2 percent compared to 51 percent in 5MFY22. Meanwhile, the market share of APL and SPL remained stable at 9.2 percent, and 7.4 percent YoY, respectively.

HASCOL’s market share in 5MFY23 improved to 1.8 percent (1.4 percent in SPLY). However, the market share of other OMCs declined to 29.5 percent in 5MFY23 compared to 30.6 percent last year.