The government increased margins on MS petrol for oil marketing companies (OMCs) and also hiked the petroleum development levy (PDL) on high-speed diesel (HSD) in its latest fortnightly revisions of petroleum prices.

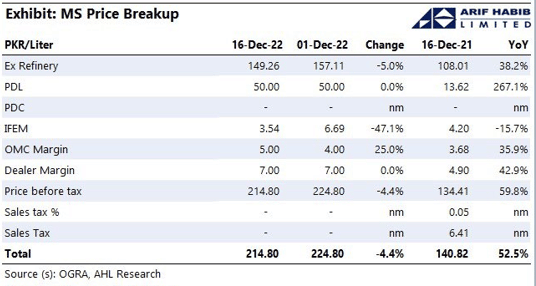

In the latest oil price revision, the government has jacked up OMC margins on MS petrol by 25 percent to Rs. 5 per liter.

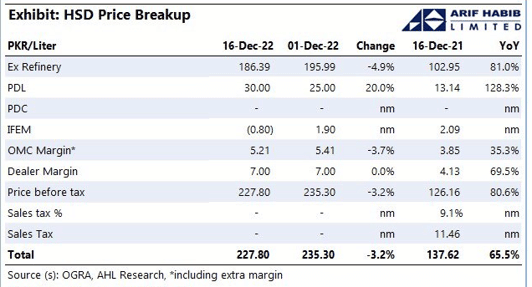

As far as diesel is concerned, the margins were decreased by 20 paisas to Rs. 5.21 per liter, while the PDL was hiked by Rs. 5 to Rs. 30 per liter.

The average platts with incidentals and duty of HSD has decreased by Rs 11.03 per liter from Rs. 193.99 per liter in the 1st fortnightly of December to Rs. 182.95 per liter for the 2nd fortnightly of December. The PSO exchange rate adjustment has increased by Rs. 1.43 per liter from Rs. 2.01 per liter to Rs. 3.44 per liter for the last fortnightly of December.

The IFEM on HSD has also decreased by Rs. 2.70 per liter.

The Inland Freight Equalisation Margin (IFEM) on petrol has been slashed by Rs. 3.15 per liter from Rs. 6.69 per liter to Rs. 3.54 per liter. The dealers’ margin on petrol was kept unchanged at Rs. 7 per liter.

The average platts with incidentals and duty on Petrol has also been decreased by Rs. 9.34 per liter. However, the PSO exchange rate adjustment was increased by Rs. 1.48 per liter. MS Petrol’s ex-refinery price decreased from Rs. 195.99 to Rs. 186.39 per liter. Similarly, the ex-refinery price for HSD was slashed by 5 percent from Rs. 157.11 to Rs. 149.26 in reaction to declining international crude prices in the past three weeks.

Meanwhile, the government announced yesterday to cut POL prices by up to Rs. 10 per liter. Until December 31, 2022, the price of petrol will be Rs. 214.80 per liter, high-speed diesel (HSD) at Rs. 227.80, light diesel oil (LDO) at Rs. 169.0, and kerosene at Rs. 171.83.

The increase in petrol OMC margins will have the greatest impact on their annual recurring earnings. However, the impact may be diminished if an OMC is susceptible to turnover tax after incurring inventory losses due to a decline in oil prices. Diesel earnings may not be as vulnerable.

The increase in OMCs’ margins is positive for the long term, but in the short term, they are exposed to declining oil prices, which pose the risk of significant inventory losses in the ongoing quarter.

This imported government takes every step against the interests of common person