The Pakistani Rupee (PKR) continued its fall against the US Dollar (USD) for the 15th straight day today, with rates out on the streets rising as high as 278 as commercial banks continue to take advantage of the central bank’s reluctance to regulate the open market space.

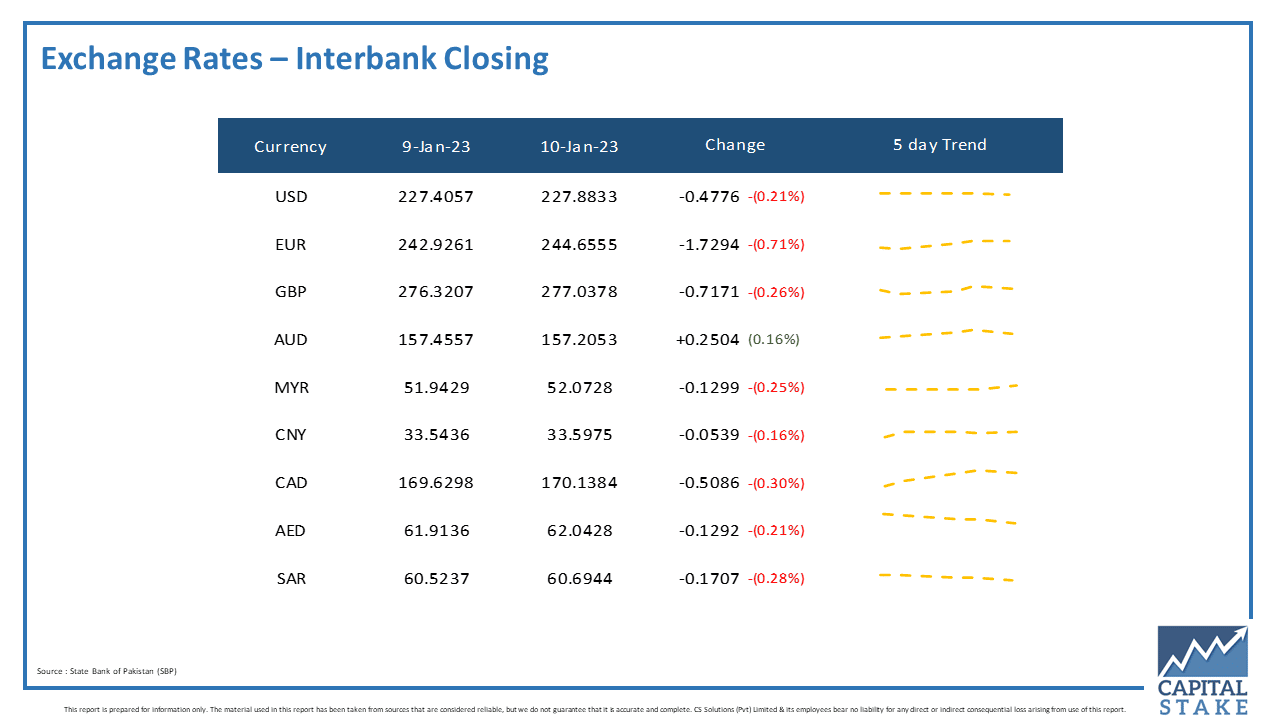

The PKR depreciated by 0.21 percent against the USD and closed at Rs. 227.88 after losing 47 paisas. It quoted an intraday low of 228.575 against the greenback before close.

The local unit was all red against the greenback and opened trade at 227.575 in the open market. By midday, the greenback moved higher against the rupee. After 1 PM, the local unit was still bearish and stayed at the 228 level against the top foreign currency before the interbank close.

The rupee reported losses against the US Dollar today despite news that Pakistan had secured over $10.5 billion in pledges from international creditors for reconstruction in flood-affected areas at the International Conference on Climate Resistant Pakistan held in Geneva.

Money changers told ProPakistani that markets snubbed investment news coming from Geneva as the amounted facility was pertinently just a series of pledges promised for the country over a space of 3 years. With inflows remaining scarce and limited as the economy lays bare against the ruthless demands of the International Monetary Fund (IMF), it is expected that times ahead will be tough for the country.

Debt repayment issues have remained complex and continue to weigh heavily on the volume of dollars in the country. Pakistan is likely to remain default-free for the next 6 months but investor concerns over the country’s debt repayment issues are spelling trouble.

Investors have reservations about the South Asian nation’s large dollar debt repayment maturing in April 2024 but in the short term, there’s still hope that the resumption of the IMF program will help the country survive till June 2022.

Globally, oil fell on Tuesday as investors estimated that further interest rate hikes in the United States, the world’s largest oil consumer, would slow economic growth and limit fuel demand.

Both benchmarks rose 1 percent on Monday after China, the world’s largest oil importer and second-largest consumer, opened its borders for the first time in three years over the weekend.

At 3:25 PM, Brent crude was up by $0.19 or 0.24 percent to reach $79.84 per barrel, while the US West Texas Intermediate (WTI) was also green at $74.98 per barrel.

The reopening of business operations across major Chinese cities is more rapid, and the resumption of China’s demand is something to be excited about. However, because the recovery in crude consumption is still in its early stages, the oil price will most likely remain low and range-bound despite today’s increase.

The PKR was bearish against most of the other major currencies in the interbank market today. It lost 12 paisas against the UAE Dirham (AED), 17 paisas against the Saudi Riyal (SAR), 50 paisas against the Canadian Dollar (CAD), 71 paisas against the Pound Sterling (GBP), and Rs. 1.72 against the Euro (EUR).

Conversely, it gained 25 paisas against the Australian Dollar (AUD) in today’s interbank currency market.

M Naeem 03034913603

M Naeem 03034913603