The long steel sector has been facing a tough situation owing to the continued steep depreciation of PKR versus US$, rising inflation and impediments in raw material imports due to LC restrictions.

While recent profits for Mughal Iron and Steel Ltd (MUGHAL) and Amreli Steels Ltd (ASTL) appeared to improve on higher product prices, companies are expected to continue to face challenges for a prolonged period. In addition, higher finance costs, which were also reported in the outgoing quarter, may continue to pile on to core challenges, according to JS Global.

Steel scrap is the primary raw material and accounts for over 60% of a rebar manufacturer’s costs. The average price of steel scrap during the March quarter remained at US$ 439/ton, an increase of 29 percent from its low of US$ 339/ton in November 2022.

Current prices of scrap have eased off a little as global steel players anticipate mills to increase utilization rates going forward which are still below levels seen in the SPLY. We believe that the decline in scrap prices will likely be limited in the coming months due to the slowed global economy.

In efforts to pass on the rising costs, steel rebar producers significantly raised prices during the first quarter of this calendar year, and increased prices by roughly Rs. 68,000/ton (a net 30 percent increase CYTD).

While higher prices lifted gross level performance during the March quarter, we believe pressure on steel companies’ profitability from 4QFY23 will likely be pronounced with continuing import limitations, reiterating our view of dull demand and lower margins taking time for the sector to find favor. Global exporters of the raw material reportedly have also negated usual discounts to Pakistani importers in recent deals due to the uncertain economic situation of the country.

MUGHAL: 3QFY23 Margins Improved over Better Pricing

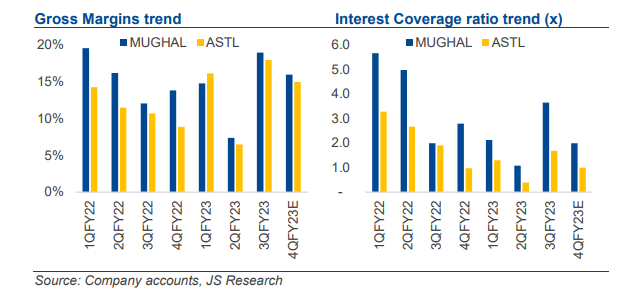

MUGHAL posted 3QFY23 EPS at Rs. 3.9, +56 percent /+177 percent on a YoY/QoQ basis. Gross margins clocked in at 19 percent, +7ppt/+11ppt higher YoY/QoQ over better pricing for both the ferrous and non-ferrous divisions.

Similarly, operating margins clocked in at 17 percent, +7ppt/+11ppt higher YoY/QoQ. The non-Ferrous segment, which acts as a major support for the company, posted higher gross margins during 3QFY23 at 38 percent, a 10ppt YoY increase. Whereas, Mughal’s ferrous division also posted 12 percent gross margins for the quarter, a 6ppt YoY jump, owing to higher retention prices.

Finance cost, however, came in higher (~+31 percent YoY) due to 8ppt YoY rise in KIBOR resulting in erosion of inventory gains. Moreover, the tax charge of Rs. 600 million (effective tax rate: 31 percent) was higher than in previous quarters.

ASTL: 9M EPS Gets in the Green Zone Over a Better 3QFY23

ASTL posted an EPS of Rs. 1.3 for the third quarter, versus an LPS of Rs. 1.3 for 2QFY23 as the company had sold from available inventory at higher rates. Gross margins for the company clocked in at 18 percent (+7ppt/+12ppt YoY/QoQ) due to higher rebar pricing. The company’s performance also improved on a sequential basis at the operating level with operating margins clocking in at 14 percent (up 11ppt QoQ).

The finance cost of the company was higher by 52 percent YoY, on a QoQ basis finance cost was flattish despite the reduction in short-term borrowings as KIBOR rates rose during the period.

Cumulatively, the company’s profit for 9MFY23 added to Rs291mn (EPS: 1.0) compared to a profit of Rs. 1.8 billion (EPS: 6.2) for 9MFY22 mainly due to a weak first half where the company saw plant shutdowns amid low demand in the aftermath of floods.