The Federal Board of Revenue (FBR) has issued a Standard Operating Procedure (SOP) for the tax officials to effectively deal with the cases of Involving Fake / Flying Invoices.

According to the procedure issued on Friday, cases have emerged that establish the huge frequency of use of fake/flying invoices by the registered persons thereby compromising not only the government revenues but also creating legally inadmissible refunds.

Hence, in order to create uniformity in approach and consistency in reporting lines to deter the use of fake and flying invoices, and effectively eliminate such malpractice, the Federal Board of Revenue (FBR) is pleased to formulate and implement, with immediate effect, the Standard Operating Procedure (SOP).

The FBR directed the field officers that the present loose and liberal enforcement regime has emboldened the unscrupulous registered persons to indulge, without the fear of being caught, in the lucrative business of the use of fake and flying invoices.

The edifice of sales tax law is erected on the glorious principle of self-assessment where complete trust is reposed in the taxpayers for submitting true & faithful declarations. To deter the misutilization of such trust, the law also has an in-built penal & prosecution mechanism.

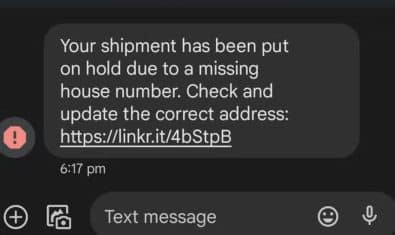

The officers, on having established the case of tax fraud in using fake/flying invoices, shall not stop short of registering an FIR against the perpetrators of such tax fraud under the relevant legal provisions and shall vigorously pursue their cases during the prosecution stage. The officers shall, with the help of automated systems, find out the IP addresses. coordinates. etc. of the perpetrators of such crime and take statutory action accordingly.

It is not possible that so many firms/businesses keep on operating openly and defiantly by issuing false sales tax invoices which are used by a wide range of beneficiaries to cause huge losses of revenue, without the knowledge, active assistance, and connivance of some officials of the department.

The Chief Commissioners and Commissioners IR shall therefore, keep constant vigilance on their RTO staff to detect any such activity and based upon evidence of complicity, to take swift action against the departmental official(s) found involved or in connivance with such persons who are using fake/flying invoices..

Moreover. whenever any widespread fraud is detected in an RTO; responsibility should also be fixed on those officials who neglected to detect such activity and take appropriate legal action at the earliest.

Keeping in view the pervasive use of fake/flying invoices and the sensitive nature of the task, each Chief Commissioner IR shall dedicate at least two senior officers of impeccable integrity, for the purpose of identification of fake/flying invoices and registered bogus/dummy firms in the respective jurisdictions. This function shall primarily be assigned to the Assessment & Processing Cell if already exists in the respective formation.

Uninterrupted and full access to sales tax & FED data available on IRIS, ITMS, CREST, FASTER, and other relevant automated systems shall be given to the said officer(s)/A & P Cell to enable them for an effective data analysis and examination of the whole supply chain through scrutiny of registered persons’ sales tax returns and registrations. For this purpose, the CCIRs shall coordinate with Member IT to get access for the dedicated staff.

The FBR said that the tax officials shall particularly focus, inter alia, on the following characteristics of registered persons’ declarations for the discovery of fraudulent use of fake/flying invoices:

- High volume or value of transactions with little or no net sales tax payment;

- The value of purchases and input tax thereon are equal to or greater than the value of supplies and output tax respectively;

- Consistently huge carry forwards, with unrealistic levels of stocks;

- The meager capital amount declared in wealth statement/company’s accounts vis a vis huge stocks;

- Use of frequent & huge credit notes to avoid payment of due sales tax;

- Recent registration, usually less than 2 years, with high-value purchases or supplies or the sudden start of voluminous transactions after a long dormant period;

- Registered persons’ addresses in low-income, residential, or remote areas;

- Income tax returns are either not filed, or filed with very low income. No withholding tax deductions despite the declaration of huge transactions;

- The nature of supplies is different from purchases (purchases of textile goods but supplies of iron scrap or vice versa etc. etc.);

- Such persons usually operate in networks. When an issuer of fake/flying invoices is identified; scrutiny of the forward and backward transactions i.e. purchases and sales in Annex A and Annex C of their sales tax returns, shall help in uncovering other wrongdoers in the supply chain.

Focus on the cases of commercial importers, dealers/distributors of large companies, and dealers of petroleum products which are generally engaged in issuing flying invoices. In such cases, a diligent comparison of goods imported/purchased with the nature of business of the buyers shall help establish the wrong-doing by the registered person(s), FBR stated.

On identification of the dubious/bogus/dummy registrations or use of fake/flying invoices by the registered persons, their registration, in accordance with the statutory procedure, must be immediately suspended by the concerned Commissioner of Inland Revenue in terms of section 2l of the Sales Tax Act. 1990 read with Rule 12(a) of the Sales Tax Rules, 2006. Such suspension must follow with the prompt statutory action for blacklisting, FBR directed.

Best way to detect and stop sales tax fraud is to post FBR officers in markets and shopping malls…. especially in evening shift