Nearly every year essential commodities are smuggled to Afghanistan, jacking up prices and creating shortages with certain elements profiteering with both hands.

When it happens, the government wakes up and makes few arrests but brings more pain for farmers and consumers as a result of a strike by some associations and more shortages when the black economy fights back.

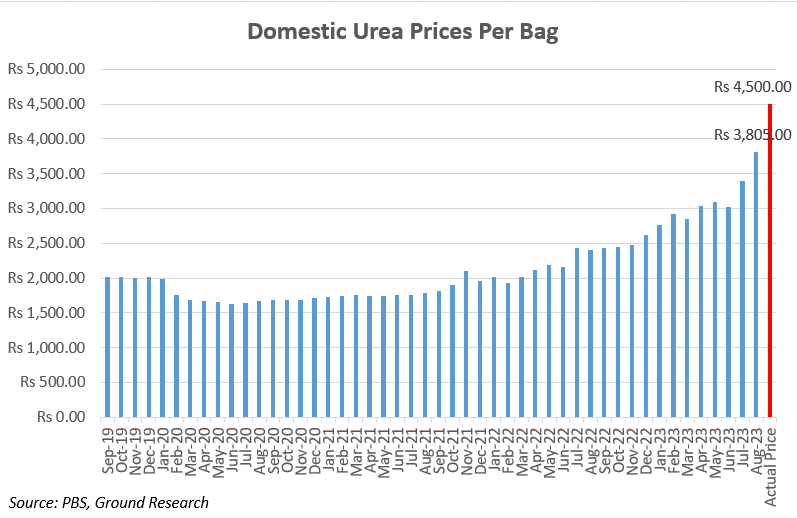

The black market of fertilizers especially Urea has been around for years but the gap between MRP and the actual price charged to farmers has more than doubled over the years. Prices have surged by more than 60 percent during the first 8 months of CY23 and on top of that, there are already reports of Urea shortage from multiple cities though Rabi season has not even started yet.

According to JS Global’s latest report for August 2023, monthly Urea sales clocked in at 650,000 tons posting an 18 percent increase over August 2022 and the compound sales during 8MCY23E stood at 4.38 million tons showing a 3 percent increase YoY.

Two major manufacturers, FFC and Engro, which jointly hold nearly 70 percent market share of Urea offtakes, reported an increase of 6 percent and 13 percent during 8MCY23E while FFBL and Fatima Fertilizer Ltd experienced a decline of 30 percent and 13 percent respectively.

The report also affirms the sector’s unique ability to promptly transfer the impact of duties & taxes, rise in international DAP prices and devaluation to the consumers, positioning it favorably to handle any potential future increases in input costs. But the farmer unfortunately is bearing the burnt of a whole lot of what is not supposed to happen in a country supposedly self-sufficient in Urea production.

Although as per Insight Securities, the decline in Urea production is only 2 percent during the first seven months of CY23 as per the official number but still, there is a not-so-silent Urea crisis unfolding in the remote towns and cities away from power corridors and we doubt anybody has a plan.

| Fertilizer Company | Maximum Retail Price (MRP) for Urea per 50kg bag |

| EFERT | Rs. 3411 |

| FFC | Rs. 2910 |

| FFBL | Rs. 3595 |

| Fatima | 3210 |

Hoarders are not willing to settle for even Rs. 1,200-1,500 into margins per 50 kg bag and are still stocking it so it can be sold in Rabi for Rs. 5,000 or more. The case for DAP is also not so different where the same commodity being sold under invoiced a few months back is being sold at Rs. 2,000 higher than MRP. As reported earlier, one DAP bag was made mandatory for dealers to buy with every 3 bags of Urea which also jacked up Urea prices but now it’s made one DAP for one bag of Urea.

“The black market of fertilizers in Pakistan is complex and primarily caused by 1) The high demand which makes the prices go up and makes it more profitable for traders to sell on the black market 2) The high cost of production, which makes it difficult for fertilizer companies to sell their products at a profit. 3) The lack of government regulation, makes it easy for fertilizer to be smuggled into the country or sold on the black market,” stated Hamza Nizam Kazi, Head of Corporate and Legal Affairs at Jaffer Brothers Ltd while talking to ProPakistani

Urea is used alike in both Rabi and Kharif seasons and its average annual consumption of 6.1 million tons is arguably lower than the production capacity of 6.5 million tons but sometimes the shortfall happens due to local gas shortages and low pressure which used to be supplemented through either imports or supplying 100mmcfd subsidized RLNG to Fatima Fertilizer Ltd (FFCL) and Agritech Ltd plants on Rs. 839 per mmbtu against average import price of Rs. 2,925 per mmbtu.

But the economic downturn of last year and a half caused RLNG shortages due to which the government decided in March 2023 to shift these two plants to indigenous gas through Sui Northern Gas Pipelines Limited (SNGPL) instead of importing Urea to meet domestic demand.

The Fertilizer Review Committee (FRC) meeting held in July 2023 warned of the possible Urea crisis as the production has been hit by lower natural gas supplies with reportedly an estimated shortfall of 0.2-0.6 million tons for the Rabi Season 2023-24.

In light of this, the Ministry of Industries and Production (MoIP) proposed to extend the timeline of these supplies which was approved by the Economic Coordination Council (ECC) last month allowing to run these two plants on indigenous gas till March 31, 2024. But regarding the import of 200,000 tons of Urea, since provinces had made no commitments to lift imported Urea on the off-cost basis, ECC deferred the matter till Oct 2023.

‘It Does Not Absolve the Manufacturers’

Initially, fingers were pointed at gas price obscurity for the Urea price disparity that followed the June gas price hike of 50 percent for the SSGC and SNGPL network while the notification was not issued explicitly for Mari Petroleum from where major gas producers source their gas.

According to Insight Securities June 2023 report, FFBL and EFERT’s Enven Plant were hit by the cost escalation due to gas price hikes by 69 percent and 47 percent for feed and fuel, respectively, on the SNGPL and SSGCL network but the gas price hike is yet to be notified for Mari Petroleum. Initially, FFC and Fatima Fertiliser held their Urea price but eventually followed their industry peers anyway although the matter is still pending and they are getting gas at previous prices.

The argument provided by industry experts over the years to explain all the hoarding and smuggling has been the arbitrage between domestic and international prices caused by the ‘over-regulation’, this argument has been flawed by what’s happened with Corn this year.

The market decided prices have been significantly lower this year amid ample production and while farmers wouldn’t wish anything more, there is no government support price for corn. Now, despite the fact that US Corn prices roughly translate to Rs. 2,255 per 40kg at the moment, nearly equal to the domestic average price of Rs. 2,100, Corn has been smuggled to Afghanistan to artificially jack up the prices to Rs. 2,600 domestically.

Why? Only because a lot of big names are involved in stocking it and to ensure that these people can exit the market profitably. Smuggling happens irrespective of any support price whatsoever, the key is whether the parties involved are benefiting from it or not.

International Urea prices have nosedived by more than 58 percent to $385 per metric ton in August 2023 from the peak of $925 per metric ton during April 2022 though it has recovered by 34 percent in the last two months as the tensions persisted in the Black Sea region.

“Devaluation has neutralized the effect of a decline in international prices and while the arbitrage has shrunk, it still exists and Yes, there is more than one factor that contributes to smuggling in addition to the price difference. Closing this gap in the case of Wheat prices has tamed the prices to some extent but artificial shortage is also created by some elements”, stated Muhammad Shehroz, Sector Analyst at Insight Securities while talking to ProPakistani

The argument of price differential being the only contributor to price disparity also sort of feels like at best, like an attempt at absolving the manufacturers of all the responsibility.

“It’s true that the arbitrage between domestic and international prices caused by the regulation is the main reason for the hoarding and smuggling of fertilizers. However, it does not absolve the manufacturers of all responsibility. The manufacturers can take steps to vertically integrate themselves to reduce their costs”, added Kazi.

He also said that what’s happening with corn suggests that the problem is more than just arbitrage. It is also due to the greed of the traders who are willing to smuggle the corn to Afghanistan even without gaining much, just so they can make a profit eventually.

So the argument is that if only the market is left on its own and whatever so-called regulations are eliminated, prices will equalize and hoarding & smuggling will vanish automatically can’t stand without having a blind spot for the smuggling mafia. But let’s have it their way!

Deregulation Hawks and Their Convictions

Those who argue in favour of deregulation say that it will lead to lower prices for farmers as the current system of price controls is inefficient and leads to shortages and black markets. They also argue that deregulation will lead to more investment in the fertilizer industry, which will lead to increased production and lower prices.

Those who argue against deregulation say that it will lead to higher prices for farmers. They argue that the current system of price controls protects farmers from the volatility of the international market. They also argue that deregulation will lead to the closure of fertilizer plants, which will lead to shortages and higher prices.

The fact that urea has rarely been sold at the notified price suggests that the current system of price controls is not working. However, it is not clear whether deregulation would lead to lower prices for farmers. It is possible that deregulation would lead to higher prices if the fertilizer industry is not able to compete with the international market.

But it’s also been said that when deregulation hawks are approached with the idea that okay let’s deregulate the sector but also issue a blanket approval for Urea imports, nobody agrees and the debate gets shut right there.

Shehroz argued that if we experience cartelization and joint price fixing post-deregulation as it’s alleged in the cement industry, we may not have the foreign reserves to counter that phenomenon.

However allowing imports would lead to lower prices for farmers because imports would bring more supply into the market, which would help to drive down prices. However, it is not clear whether the government would be willing to allow imports, given the current political situation.

“The government needs to weigh the pros and cons of deregulation carefully before making a decision. It is important to consider the impact of deregulation on farmers, the fertilizer industry, and the economy as a whole” added Kazi.

He also agreed that the government should allow imports of urea while deregulating the sector. This would help to bring down prices for farmers and ensure that there is enough supply in the market. The government can also provide subsidies to farmers to help them afford the higher prices.

Track and Trace Failures

The FBR Track and Trace system was supposed to prevent tax evasion and smuggling in multiple sectors including Fertilizers but it has failed miserably in having any significant positive impact on the industry or the consumers.

A recent inquiry committee constituted by the previous government observed multiple technical issues i.e. confusion regarding who is responsible for purchasing applicator machinery, failure of UIM stickers in varied sets of environments, no localization of tax stamps/stickers and no standardization regarding stacks of bags on conveyors causing applicator readability problems.

It has recommended revamping the entire existing process including customization of Unique Identification Marking (UIM) stickers, SMS-based USSD verification to address the limited availability of high-end phones, educating the general public, constituting a permanent oversight committee and much more but while that’s happening, there has been some arguments regarding why these issues could not be foreseen in advance.

It must be noted that FBR’s Rs. 25 billion worth of tender to implement the track and trace across different sectors was challenged in the Sindh High Court when a Swiss firm SICPA questioned the manner in which the contract was awarded saying that FBR did not let them produce samples of UIM markings, the contractor AGCL was not capable of fulfilling its claims and had a conflict of interest due to alleged involvement in the imports of cement, fertilizer, sugar.

It also claimed violations of PPRA rules which had restrained FBR from awarding the contract but withdrew its objections in 24 hours. Though Sindh High Court eventually held up the FBR’s decision to award the contract to AGCL on the basis of lack of jurisdiction.

What Can Be Done?

“If farmers are not benefiting then it’s better to remove the subsidized gas benefits for the fertilizer sector and rather than the government having debt on its balance sheet, it should use that money to provide relief to farmers and food consumers in a more suitable way” opined Mirza Asghar, Research Analyst while talking to ProPakistani.

He suggested that while putting an end to smuggling is nearly impossible, it’s the only way to ensure the availability of Urea at notified prices. But the matter is actually, availability in the first place, regardless of the price because dealers are not satisfied at even Rs. 1200-1500 of margin per bag and still hoarding it.

The failures or rather we should say, the involvement of the district administrations in letting all of this happen on their watch and then sabotaging the subsequent spree of crackdowns is also a primary contributor. In our city, police seized nearly two thousand bags in a single raid but there were only 1100 left to report by the evening. Urea at government price is only provided to farmers who can show some ‘connections’ while the rest are left to hang out dry by the system.

Shehroz also agreed that crackdowns will have no significance or long-term sustainability as long as these administrative loopholes and market forces are not addressed through policy action due to which the benefits of subsidized gas are not reaching downstream to the farmer.

There are a number of reasons why the subsidy has not been effective. One is that the industry is not transparent and efficient. It is difficult to track how much gas is being used by the fertilizer industry and how much of the subsidy is actually going to farmers. There is a lot of waste in the production and distribution of fertilizer which is a drain on the subsidy.

The bottom line is that Wheat sowing will begin in one and a half months from rainfed areas in the north and the government has delayed the matter of Urea imports till October 2023.

An insufficient application of Urea can drastically cut down productivity because farmers may not have any option if it isn’t available or is out of their reach which can cause a Wheat shortage during the next season requiring more imports and the vicious cycle continues.

The picture being portrayed about smuggling to Afghanistan is inaccurate. Indian urea prices are one third of Pakidstan’s yet only our urea gets smuggled

The real culprit is the bundling of DAP with urea.