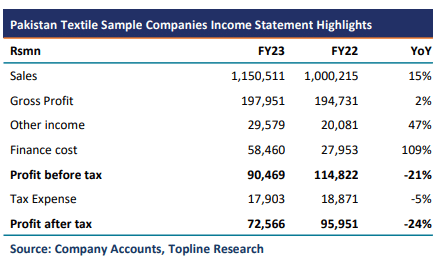

Pakistan’s textile sector’s profitability declined by 24 percent year-on-year (YoY) to Rs. 72.6 billion in the financial year 2022-23 primarily due to an increase in finance costs, high cotton and energy costs, and global slowdown, according to Topline Securities.

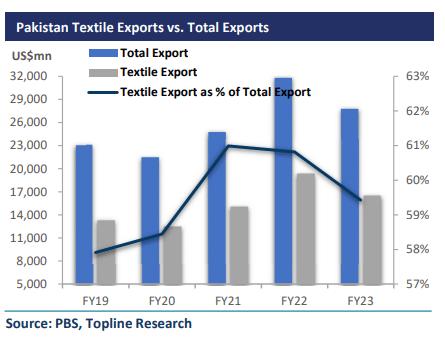

Sales of listed textile firms rose 15 percent YoY to Rs. 1,150 billion in FY23 while in dollar terms it declined by 17 percent YoY mainly due to a decline in textile exports.

In FY23, Pakistan recorded textile exports of $16.5 billion down by 15 percent YoY (+18 percent YoY in PKR terms) primarily led by global slowdown and recession in Europe.

The gross margins of sample companies fell from 19 percent in FY22 to 17 percent in FY23 led by high energy and cotton prices as both costs make up a large part of the cost of textile companies.

To recall, due to IMF conditions, the government discontinued the concessionary energy tariff for the textile sector effective from March 01, 2023, which led to increased cost of production. Moreover, local cotton prices have also increased by 9 percent YoY to an average of Rs. 19,070 per mound during FY23. The increase in cotton prices is due to bad weather conditions which led to heavy rainfall and flooding that destroyed cotton crops last year.

Other Income of sample companies increased by 47 percent YoY mainly due to exchange gains and the rise in interest income. Finance costs also jumped 109 percent YoY during FY23, mainly attributable to higher interest rates and higher borrowings of the sector.

The effective tax rate of the sector clocked in at 20 percent in FY23 versus 16 percent in FY22.

Company-wise performance

Interloop (ILP), Nishat Mills (NML), and Feroze1888 Mills (FML) are the top 3 contributors to the textile composite sector profitability in FY23.

ILP saw a 63 percent YoY increase in profits, reaching Rs. 20.2 billion in FY23, despite a 122 percent YoY finance cost hike. Gross margins were up 5 percent YoY to 33 percent in FY23 amid cost-saving initiatives and better pricing management, which contributed to the notable improvement in margins. ILP contributes 28 percent to the total sector profitability in FY23.

NML’s profits were up 18 percent YoY to Rs. 21.9 billion in FY23, primarily driven by an 83 percent YoY increase in other income amid exchange gains and interest income. NML’s sales rose by 22 percent YoY, attributed to both export and local sales. However, gross margins remained flat YoY. NML contributes 17 percent to the total sector profitability in FY23.

FML’s profits jumped 163 percent YoY to Rs. 8.9 billion in FY23 mainly due to exchange gains. Sales and gross margins also increased by 17 percent YoY and 7 percent YoY respectively. FML contributes 12 percent to the total sector profitability in FY23.

Projections for FY24

The report anticipates an increase in textile exports albeit lower than the government estimate of $25 billion for FY24. To highlight, in 2MFY24 textile exports clocked in at $2.8 billion down 10 percent YoY.

Furthermore, Cotton production is expected to rise as the favorable weather conditions have resulted in a better Cotton crop in Pakistan. As of September 30, 2023, cotton arrival has increased by 71 percent YoY to 5 million bales compared to last year’s 3 million bales. However, elevated energy costs and shortage of gas will continue to remain a challenge to the textile industry.