Nadeem Hussain left three decades of corporate journey behind for a startup at 49 and invested his own $6 million to ramp up financial inclusion in Pakistan.

He built 300 branches of Tameer Microfinance Bank from Karachi to Peshawar and created a role model for the industry that came after it.

Then he built Easypaisa, which revolutionized mobile banking in a country that was not even on the map for it before.

His next stop was investing in startups, across the world. The investment arm, Planet N, now holds the biggest portfolio in Pakistan in terms of the number of companies, with 50+ investments in eight different countries.

Despite all that, he calls himself the Coach. But now he is up to something else.

Fortunate for us, Hussain sat with ProPakistani to discuss his esteemed journey, his ‘Fourth Coming’ with Raqami Islamic Digital Bank, their future plans and the course of the fintech revolution in Pakistan.

Tameer Bank and Easypaisa experience helped a lot in understanding branchless banking networks, and we also got to meet people from the bottom of the pyramid who understood and appreciated Pakistan a lot.

Talking about Planet N, he added that they had simple criteria that revolved around changing the customer journey and ensuring the solution was scalable and the customer was willing to pay for it. It was successful. After seven years and some existence, Planet N is at a stage with thirty-six (36) companies remaining and all give a dividend every quarter.

Raqami Islamic Digital Bank (RIDB) was among the five retail digital banks (RDBs) that were issued NOCs last year after a nearly ten-month-long rigorous process. The primary objective of SBP through these licenses was to raise financial inclusion where conventional banks have shown little or no progress.

Credit is the life and blood of any economic growth, but our conventional banking industry has continuously failed to tap the under-banked segments of society, citing high capex and OpEx costs of expanding brick & mortar and the uncertainty that comes with lending SMEs and Farmers.

From agriculture to women and from students to SMEs, all segments that often drive the innovation and economy in any country are considered too risky by the traditional banks.

Based on findings from the 2019 Asian Development Bank Report, a significant majority, exceeding 70%, of farmers resort to informal credit sources. Financial institutions perceive these investments as fraught with risk, while informal channels tend to exploit farmers by providing lower prices, thereby hindering the long-term socioeconomic development of communities.

According to the 2021 Global Findex Database, only 16% of Pakistan’s adult population had an account in a financial institution, and that percentage dropped to 12% in rural settings.

More than half of those not having an account cited Insufficient funds as the biggest reason, while 32% and 24% stated that financial services were too expensive, or the financial institution was too far away, respectively. Only 13% of women in Pakistan had bank accounts, while they are more than half of the unbanked population. Women were half as likely as men to have a phone, and four out of five unbanked adults say they cannot use accounts at a financial institution without help.

Despite all that, conventional banks are more than happy buying T-bills only and nobody wants to disturb that status quo, not even SBP itself. So it found a way to support the cause of financial inclusion in parallel by introducing a digital licensing regime.

It’s interesting to note that several conventional banking players were also among the applicants for digital banking but were declined for the fact that first, they already had full banking licenses and second, there was skepticism that traditional banks would only use the license to spread their existing portfolio instead of supporting innovation and spreading to other verticals.

Derived from the Urdu word “Raqam” meaning money, Raqami’s equity partners include the Kuwait Investment Authority, one of the world’s largest sovereign wealth funds, and Enertech Holding Co., a Kuwait-based energy sector developer and investor.

Despite the consortium’s considerable financial strength, it lacked direct experience in running financial institutions, which was a primary requirement for approval, but that’s where Nadeem Hussain came in. The financial industry stalwart is considered one of the key reasons for putting RIDB across the finish line of SBP’s approval, due to his long experience in raising financial inclusion through digital & branchless banking.

Unlike most other digital banks & fintech players, RIDB is working on Open Banking via Banking as a Service (BAAS) and will be introducing their API to partners who would be interested in launching their own Shariah-compliant services for lending, payments, savings, investments and takaful. This will lead to the scale-up of embedded finance, making it a killer recipe for financial inclusion.

Despite the apparent rationale of digital banking, it relies on relatively poorer segments of society, which means they got to have a huge customer base for healthy deposits. So RDBs don’t only have to serve underbanked segments, they also have to do it at a pace unseen in the industry before, and RIDB is betting on offering its balance sheet and API as a platform to make it happen.

Leading business enterprises that already have millions of customers can’t wait ten long months for an EMI license if they are looking to offer financial services to their clientele, but open banking will ensure that any business can integrate the respective services they are looking for in a matter of days.

Currently, this integration takes 3–6 months with conventional banks, while our APIs and criteria will be on our website, and we will integrate the service in three days,” added Hussain.

He stated that a company bank account takes thirty days to open, but we will be able to do it in two days with a two-page document and digital signature in one place, so open banking with embedded finance is the solution.

Going through his LinkedIn, one observes that Hussain has been on a partnership spree lately, signing up one after the other, from Finja to Oneload and from Akhuwat to Retail Pay, all of which either have cutting-edge technology or millions of customers or both.

RIDB will be running the pilot with seven partners and post State Bank approval for the next phase, they are looking at 100–150 partners.

“My team often ask me not to publicize the meetings, but I believe that the true power is in execution, and if someone has better execution then more power to them,” added Hussain.

When asked about his earlier opposition to shariah-compliant banking and how his positions changed, Hussain explained that he lacked the full understanding of the model back then and so did the public.

He revealed that they had envisioned turning Tameer Microfinance Bank shariah-compliant, but at that time, market surveys overwhelmingly reported that the public either opposed it or considered it a ruse at that time.

Now more than 80-85% of people prefer shariah-banking over conventional, as per our research. These include businesses, educated students, women, and retail owners as well, which means Pakistan’s culture has shifted towards shariah during last 15–20 years,” added Hussain.

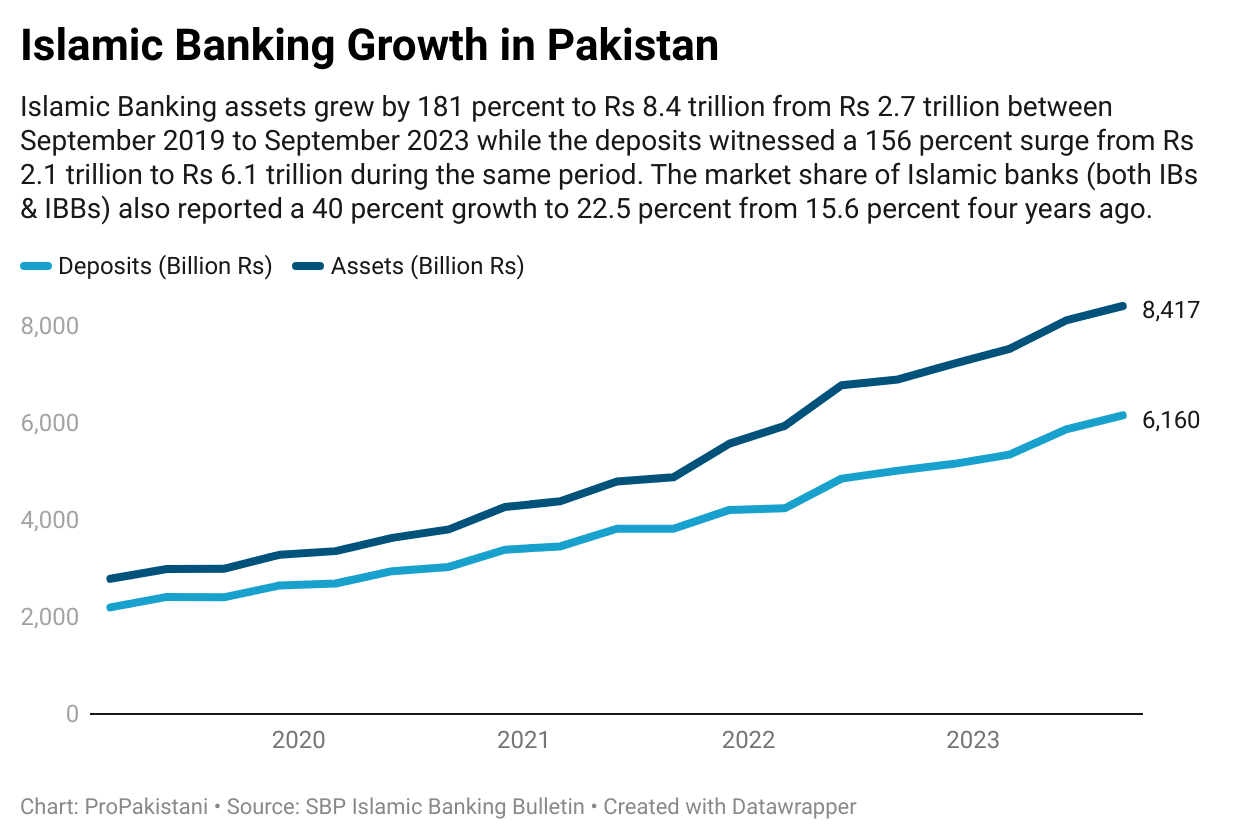

Islamic Banking growth in Pakistan has been phenomenal to say the least, especially during the last few years. According to SBP Islamic Banking Bulletin, Islamic Banking assets grew by 181 percent to Rs 8.4 trillion from Rs 2.7 trillion between September 2019 to September 2023 while the deposits witnessed a 156 percent surge from Rs 2.1 trillion to Rs 6.1 trillion during the same period.

The market share of Islamic banks (both IBs & IBBs) also reported a 40 percent growth to 22.5 percent from 15.6 percent four years ago.

Many people in the country prefer Shariah-compliant financial services due to their religious beliefs, creating a demand for Islamic banking. Islamic banking has contributed significantly to financial inclusion as it attracts individuals who may have avoided traditional banking services due to religious factors, such as the prohibition of interest rates.

The State Bank of Pakistan (SBP) has played a crucial role in supporting this sector, creating a favorable environment. The government’s commitment to implementing Islamic finance also received a boost with a court verdict against interest-based banking, leading to the conversion of more conventional banks into Islamic ones.

This shift is not just about principles, but also about practical advantages. Islamic banking offers low-cost deposits and potential market share growth, making it attractive for banks. Despite challenges like mindset conversion and careful planning, more banks are making this transition.

In December 2023, the SBP finally launched an interoperable Person to Merchant (P2M) service for accepting digital payments at retailers and businesses. It has created much hype for the much-awaited and needed digital payments revolution and end to the shadow economy in Pakistan, with most event comparing it with the Unified Payment Interface (UPI) in India. But Hussain believes that there is much need to do more.

“Raast has established the railroads just like UPI but the success story of later happened in India because of demonetization as it provided a stimulus for the culture change and that still has to happen for Pakistan because we are still a cash-based economy,” added Hussain.

He stated that State Bank has done its work, but now it’s FBR’s job to play its part because the retailers are the biggest use case scenario, and they are afraid of transaction fees and the tax burden that may come with it.

He also proposed that the government should announce a 3-year tax immunity for all retailers because they are not in the tax net already but after three years, if the government gets a million taxpayers, it’ll be worth it.

Additional Input by Jehangir Nasir